Adaptimmune Therapeutics Stock Intrinsic Value – ADAPTIMMUNE THERAPEUTICS Reports Q1 Revenue of $47.6M, Exceeding Street Estimate of $4.6M.

June 3, 2023

🌥️Trending News

ADAPTIMMUNE THERAPEUTICS ($NASDAQ:ADAP), a biopharmaceutical company that focuses on developing engineered T-cell therapies, recently reported its Q1 revenue of $47.6 million, greatly surpassing the Street estimate of $4.6 million. This tremendous success is credited to strong sales from its drug Ontak, which is used to treat certain types of peripheral T-cell lymphoma. The company is focused on developing and commercializing engineered T-cell therapies to treat cancer, leveraging its proprietary technology platform to target specific tumor antigens that are expressed in tumors.

This impressive revenue figure is a testament to the efficacy of ADAPTIMMUNE’s innovative products and potential market opportunities in the coming years. These positive developments should be seen as a sign of good things to come for the company as it expands its operations and continues to develop treatments for a variety of conditions.

Earnings

ADAPTIMMUNE THERAPEUTICS recently reported their first quarter earnings for the fiscal year ending March 31, 2023. The company surprised investors by announcing total revenues of 47.6 million USD, exceeding the Street estimate of 4.6 million USD. The company was able to achieve this result despite a 102.1% decrease in net income from the previous year, which stands at 1.04 million USD.

The company’s earnings have seen massive growth over the last three years, as total revenue has increased from 0.43 million USD to 47.6 million USD. This impressive growth has led to increased confidence in the company’s stock price, and has given investors optimism for the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adaptimmune Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 71.17 | -114.16 | -157.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adaptimmune Therapeutics. More…

| Operations | Investing | Financing |

| -124.65 | 142.25 | 13.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adaptimmune Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 288.08 | 204.21 | 0.51 |

Key Ratios Snapshot

Some of the financial key ratios for Adaptimmune Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 235.6% | – | -152.2% |

| FCF Margin | ROE | ROA |

| -210.5% | -81.7% | -23.5% |

Market Price

ADAPTIMMUNE THERAPEUTICS reported a Q1 revenue of $47.6M, exceeding analyst estimate of $4.6M. On Monday, the stock opened at $1.3 and closed the day unchanged, down by 2.3% from previous closing price of 1.3. The company’s strong revenue performance was credited to its recent launch of a new cancer-targeted treatment. With the positive quarter results, investors are becoming increasingly confident that ADAPTIMMUNE THERAPEUTICS will be able to capitalize on their success moving forward. Live Quote…

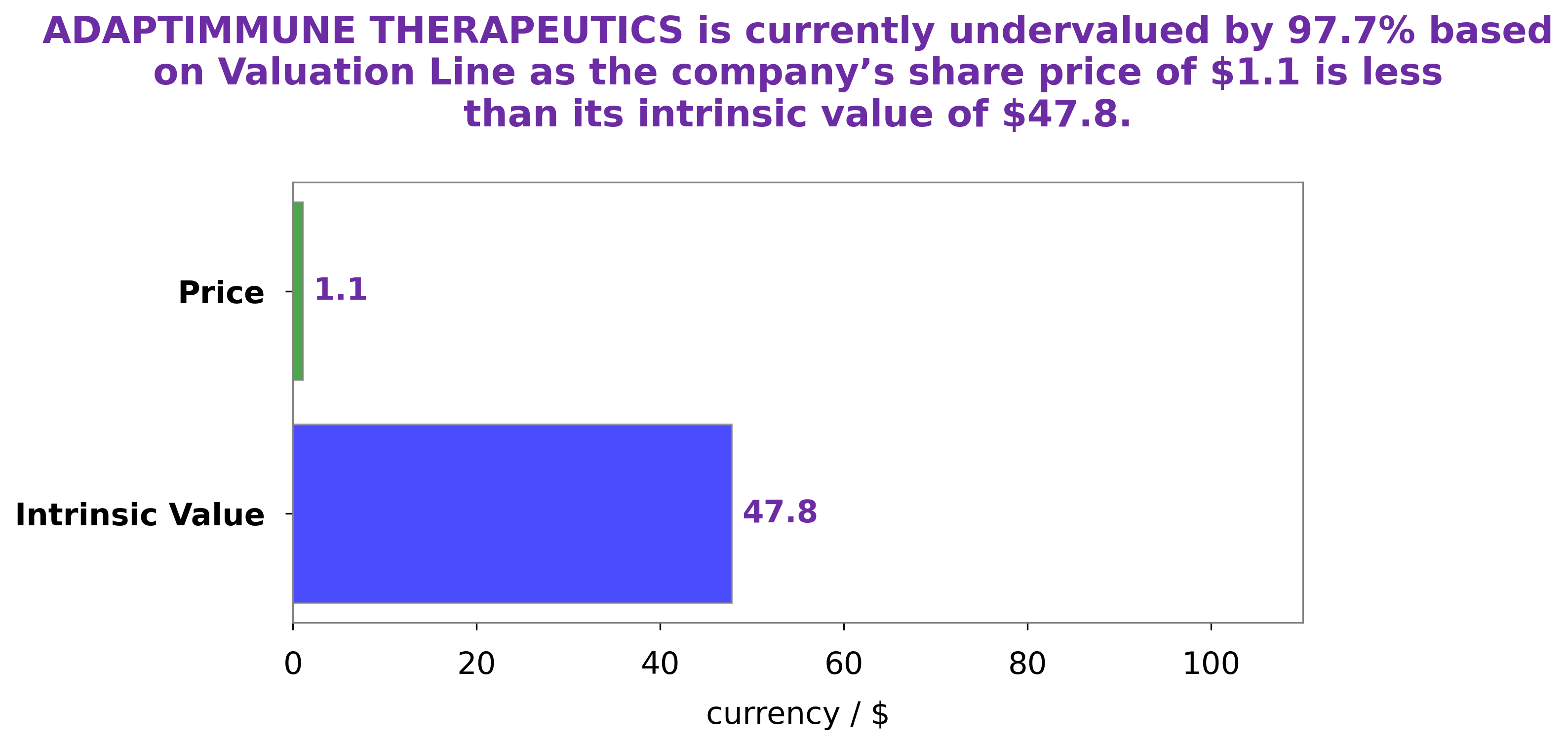

Analysis – Adaptimmune Therapeutics Stock Intrinsic Value

At GoodWhale, we recently conducted an analysis of the wellbeing of ADAPTIMMUNE THERAPEUTICS. Through our proprietary Valuation Line, we arrived at a fair value of $49.5 for ADAPTIMMUNE THERAPEUTICS stock. However, we noticed that the current market price of the stock is only $1.3, which is undervalued by 97.4%. This discrepancy between fair value and market price might present an opportunity for investors looking to purchase ADAPTIMMUNE THERAPEUTICS stock. More…

Peers

The company’s T-cell therapy platform harnesses the body’s own immune system to target and kill cancer cells. Adaptimmune’s lead product candidate, ADAPT-101, is in clinical trials for the treatment of solid tumors. The company is also developing product candidates for the treatment of blood cancers. Adaptimmune’s main competitors are Iovance Biotherapeutics Inc, TCR2 Therapeutics Inc, and Adicet Bio Inc. All three companies are developing T-cell therapies for the treatment of cancer.

– Iovance Biotherapeutics Inc ($NASDAQ:IOVA)

Iovance Biotherapeutics Inc is a biopharmaceutical company that focuses on the development and commercialization of cancer immunotherapy products. The company has a market cap of 1.24B as of 2022 and a Return on Equity of -56.45%. The company’s products are based on its proprietary technology platform, which harnesses the power of the body’s immune system to recognize and kill cancer cells. Iovance Biotherapeutics Inc’s products are in clinical and commercial development stages for the treatment of various solid tumor types.

– TCR2 Therapeutics Inc ($NASDAQ:TCRR)

The company’s market cap is 49.48 million as of 2022, a return on equity of -24.78%. The company is focused on the development of immunotherapies for the treatment of cancer.

– Adicet Bio Inc ($NASDAQ:ACET)

Adicet Bio Inc is a clinical stage biopharmaceutical company focused on developing next-generation cell therapies for cancer and other intractable diseases. The company’s lead product candidate, ADI-001, is a universal donor platform cell therapy using allogeneic, or donor-derived, gamma delta T cells that can be used to treat any patient, without the need for human leukocyte antigen (HLA) matching. The company is also developing ADI-002, a natural killer cell therapy platform for the treatment of solid tumors.

Adicet Bio Inc has a market cap of 836.46M as of 2022, a Return on Equity of -9.85%. Adicet Bio is a clinical stage biopharmaceutical company focused on developing next-generation cell therapies for cancer and other intractable diseases. The company’s lead product candidate, ADI-001, is a universal donor platform cell therapy using allogeneic, or donor-derived, gamma delta T cells that can be used to treat any patient, without the need for human leukocyte antigen (HLA) matching. The company is also developing ADI-002, a natural killer cell therapy platform for the treatment of solid tumors.

Summary

Adaptimmune Therapeutics has released its Q1 revenue figures, coming in at an impressive $47.6 million, compared to analyst estimates of only $4.6 million. This strong performance is likely to drive investor confidence in the company, and may prove to be a strong catalyst for share price appreciation. The company has been focusing on next-generation T cell therapies, which may be a sign that they are making significant progress in the development of these treatments. The company is also actively engaging in strategic collaborations, including deals with Kite Pharma and Glaxo SmithKline.

Investors may be interested in these agreements as potential sources of long-term income. Overall, Adaptimmune Therapeutics appears to be a company with a promising outlook for growth.

Recent Posts