DULUTH HOLDINGS Reports 57.1% Decrease in Q4 FY2023 Revenue to USD 7.5 Million.

March 26, 2023

Earnings Overview

On March 9, 2023, DULUTH HOLDINGS ($NASDAQ:DLTH) reported their FY2023 Q4 earnings results, with total revenue of USD 7.5 million, a 57.1% decrease from the same quarter the year before. Net income for the quarter was USD 241.8 million, a 10.7% decrease compared to the same period in the previous year.

Transcripts Simplified

With me today is our Chief Financial Officer and Treasurer, Heather Pribyl. Before we begin, I’d like to point out that this call may contain forward-looking information, which involves risks and uncertainties. Please refer to our press release, as well as our SEC filings, for a discussion of the risk factors that could cause our actual results to differ materially from the forward-looking statements discussed tonight. We are pleased with our second quarter results, which exceeded our expectations and reflect the resilience of our business model and the hard work of our associates. This is the ninth consecutive quarter that we have seen double-digit growth in e-commerce. Our gross margin was also impacted by increased freight costs as we shifted more sales to direct-to-consumer channels and our stores. Operating expenses as a percent of net sales were up year-over-year, primarily due to store pre-opening costs and increased advertising spend. In summary, we are very pleased with our performance in the second quarter, which exceeded our expectations and demonstrates the resilience of our business model and the hard work of our associates. We remain focused on executing our strategic initiatives, which include further strengthening our direct-to-consumer business, increasing store profitability and expanding into new categories. Going forward, we are confident in Duluth Holdings‘ ability to deliver profitable growth and create value for our shareholders. With that, I’ll now turn it over to Heather for more details on the financials.

Heather Pribyl – Chief Financial Officer & Treasurer Thank you, David. Good afternoon everyone. I’ll start by providing more detail on the second quarter financials. And that concludes my remarks today. I’ll now turn it back over to David for closing comments. David Loretta – Chief Executive Officer Thank you, Heather. In closing, we are very pleased with our second quarter results and remain focused on executing our strategic initiatives for long-term profitable growth and creating value for our shareholders. I want to thank all of our associates for their hard work during this challenging time and look forward to keeping you updated on our progress going forward. Thank you for joining us today, and we will now open up the call for questions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Duluth Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 653.31 | 2.3 | 0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Duluth Holdings. More…

| Operations | Investing | Financing |

| -5.63 | -22.64 | -3.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Duluth Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 527.45 | 300.26 | 6.64 |

Key Ratios Snapshot

Some of the financial key ratios for Duluth Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | -39.5% | 1.0% |

| FCF Margin | ROE | ROA |

| -4.4% | 1.8% | 0.8% |

Share Price

The stock opened at $6.8 and closed at $6.8, rising by 9.2% from the prior closing price of $6.2. With this, DULUTH HOLDINGS hopes to increase their customer base and drive sales growth in the future. Additionally, they are also exploring new partnerships and investments to further drive their success and recovery. Overall, while the decrease in revenue was substantial, DULUTH HOLDINGS is taking the necessary steps to prepare for a successful recovery and future growth in their business. Live Quote…

Analysis

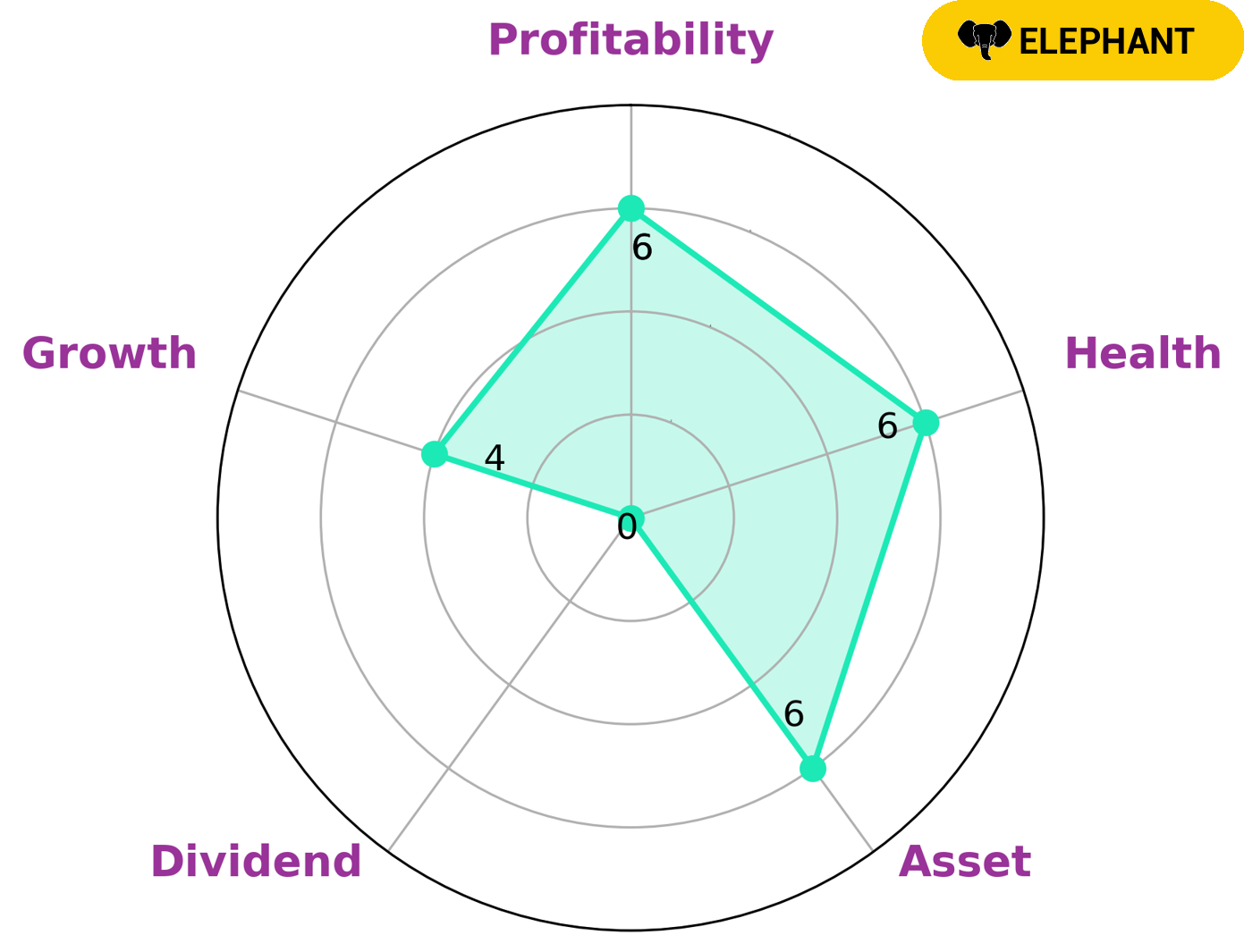

GoodWhale is pleased to analyze DULUTH HOLDINGS‘s financials. Our star chart shows that DULUTH HOLDINGS has an intermediate health score of 6/10, indicating that it may be able to sustain future operations in times of crisis. In terms of its financial performance, DULUTH HOLDINGS is strong in liquidity, medium in asset, growth, profitability and weak in dividend. Analyzing these metrics, we classify DULUTH HOLDINGS as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. For potential investors, DULUTH HOLDINGS may be a good choice. Its strong liquidity and medium growth ensure that it can make up for the lack of dividends by providing returns through other channels. Furthermore, its strong asset base should provide some security. More…

Peers

Duluth Holdings Inc is an online retailer that specializes in providing casual wear, workwear, and outerwear for men and women. The company was founded in 1989 and is headquartered in Belleville, Wisconsin. Duluth Holdings Inc operates under the name Duluth Trading Company. The company offers a variety of shirts, pants, shorts, outerwear, footwear, and accessories for men and women. Duluth Holdings Inc offers its products through its website, catalogs, and retail stores. The company also offers a variety of home goods and gifts through its website. Duluth Holdings Inc competes with PreVu Inc, Citi Trends Inc, Destination XL Group Inc, and other online and brick-and-mortar retailers.

– PreVu Inc ($OTCPK:PRVU)

PreVu Inc is a company that provides market research and analysis services. It has a market cap of 159.57k as of 2022 and a return on equity of 20.12%. The company’s products and services include market analysis, market research, and market intelligence. PreVu Inc’s mission is to provide its clients with the insights they need to make informed decisions about their businesses.

– Citi Trends Inc ($NASDAQ:CTRN)

Citi Trends Inc is a company that focuses on selling affordable fashion apparel and accessories for women, men, and children. As of 2022, the company has a market cap of 175.05 million and a return on equity of 27.52%. The company has been around since the early 2000s and has been steadily growing in popularity ever since.

– Destination XL Group Inc ($NASDAQ:DXLG)

Destination XL Group is a specialty retailer of men’s apparel with over 600 stores across the United States. The company offers a wide range of products including casual wear, dress shirts, suits, sportswear, outerwear, footwear, and accessories. Destination XL Group has a market cap of 428.59M as of 2022 and a Return on Equity of 41.63%. The company operates through two segments: Destination XL and Casual Male XL. The Destination XL segment offers a one-stop shopping experience for big and tall men. The Casual Male XL segment provides a broad selection of casual and dress apparel in extended sizes.

Summary

DULUTH HOLDINGS reported their Q4 FY2023 financial results on March 9, 2023, showing a decrease in revenue of 57.1%, compared to the same quarter of last year. Net income for the quarter also decreased by 10.7%. Despite the decrease in revenue and income, the stock price moved up the same day, indicating positive investor sentiment.

Therefore, the current outlook for investing in DULUTH HOLDINGS appears to be positive. Investors should monitor the company for further developments as it navigates the current market conditions.

Recent Posts