BURLINGTON STORES Reports 10.7% Increase in Revenue for First Quarter of FY2024

June 1, 2023

☀️Earnings Overview

BURLINGTON STORES ($NYSE:BURL) reported their first quarter of FY2024 earnings on April 30 2023, with a total revenue of USD 2137.0 million, a 10.7% increase from the same period in the previous year. Net income also rose significantly, up 102.5% to reach USD 32.8 million.

Analysis

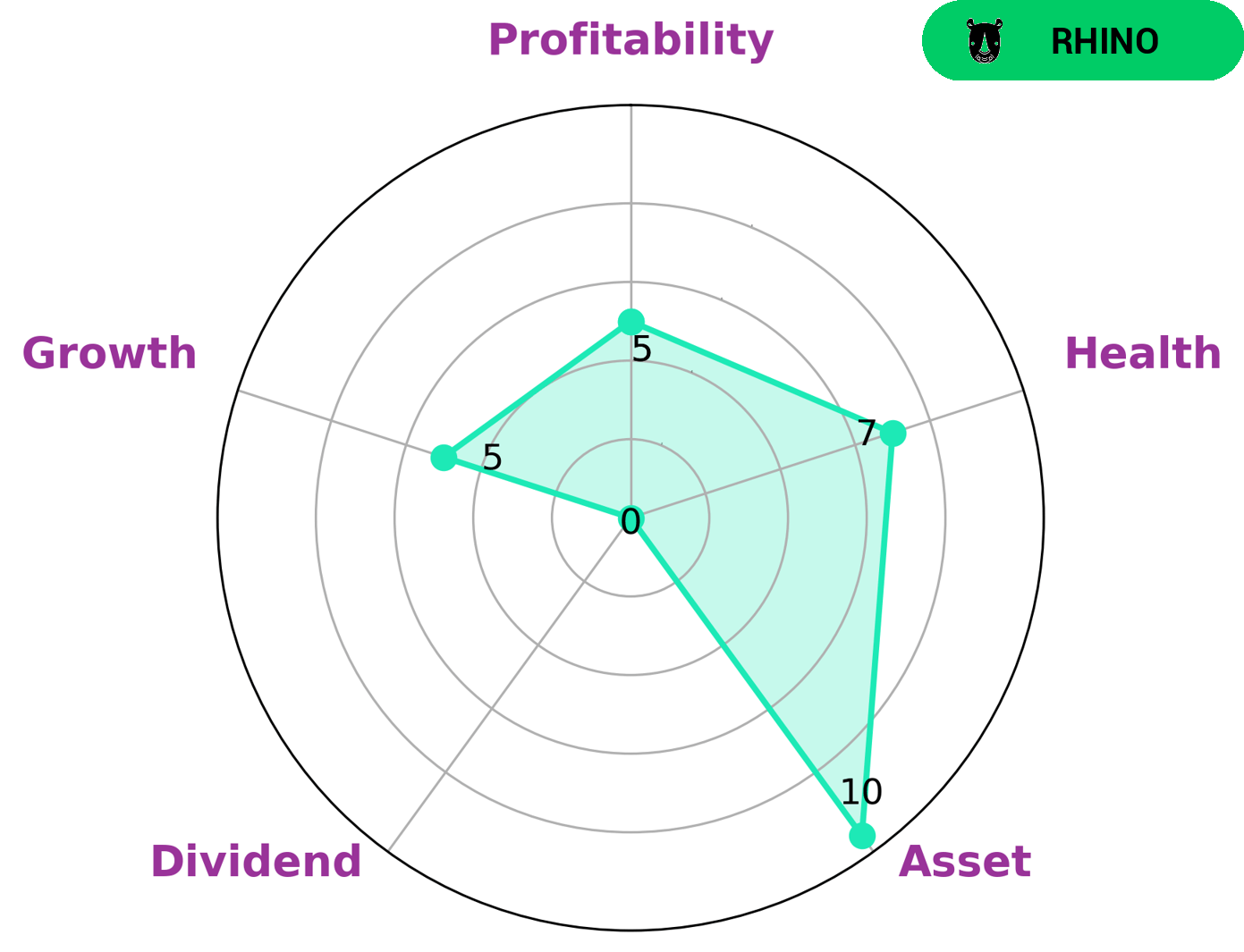

GoodWhale has conducted an analysis of the fundamentals of BURLINGTON STORES and found that the company has a high health score of 7/10. This score indicates that BURLINGTON STORES has strong cashflows and debt, and is capable to pay off debt and fund future operations. Furthermore, GoodWhale has classified BURLINGTON STORES as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given this data, investors looking for stability in the short-term may find BURLINGTON STORES an attractive option. Despite its strength in assets, the company is only medium in growth, profitability and dividend, making it an option that might not yield high profits or high dividends in the medium-term. However, for those seeking stability with moderate returns, BURLINGTON STORES could be a viable option. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Burlington Stores. More…

| Total Revenues | Net Income | Net Margin |

| 8.91k | 246.7 | 3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Burlington Stores. More…

| Operations | Investing | Financing |

| 690.73 | -402.32 | -383.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Burlington Stores. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7k | 6.2k | 12.23 |

Key Ratios Snapshot

Some of the financial key ratios for Burlington Stores are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.3% | -14.8% | 4.5% |

| FCF Margin | ROE | ROA |

| 2.8% | 31.8% | 3.6% |

Peers

The company offers products and services that are in competition with Ross Stores Inc, Chiyoda Co Ltd, Mr Price Group Ltd, and other companies.

– Ross Stores Inc ($NASDAQ:ROST)

Ross Stores Inc is an American chain of off-price department stores headquartered in Dublin, California, with over 1,400 locations in 37 states. The company’s revenues total more than $15 billion as of 2019, making it the second-largest off-price retailer in the United States behind TJX Companies. Ross Stores typically sells brand name clothing, accessories, footwear, and home décor at prices that are 20% to 60% below department and specialty store regular prices.

– Chiyoda Co Ltd ($TSE:8185)

Chiyoda is a Japanese company that provides engineering and construction services. The company has a market cap of 25.87B as of 2022 and a Return on Equity of -2.63%. Chiyoda has been in business for over 70 years and has completed projects in over 80 countries. The company has a strong focus on the oil and gas industry, but also works in the power, chemicals, and other industries.

– Mr Price Group Ltd ($BER:M5M1)

Mr Price Group Ltd is a South African retail chain that was founded in 1985. The company has a market cap of 2.39B as of 2022 and a ROE of 27.7%. Mr Price Group Ltd operates over 1,000 stores across South Africa, Zimbabwe, Mozambique, Lesotho, Botswana, Namibia, and Swaziland. The company offers a wide range of products including clothing, homeware, and cosmetics.

Summary

Burlington Stores has reported impressive first quarter FY2024 earnings results, with total revenue of USD 2137.0 million, up 10.7% from the previous year and net income increasing by 102.5% to USD 32.8 million. Despite these strong financial figures, the company’s stock price declined the same day, suggesting that investors may be expecting even greater returns in the future. Investors should consider Burlington Stores’ strong historical performance and potential for future growth when deciding whether or not to invest.

Recent Posts