SNCY Stock Fair Value Calculation – SUN COUNTRY AIRLINES Reports 19.2% Increase in Total Revenue for FY2023 Q2

August 21, 2023

☀️Earnings Overview

On June 30 2023, SUN COUNTRY AIRLINES ($NASDAQ:SNCY) reported its FY2023 Q2 earnings results with a total revenue of USD 261.1 million, a 19.2% increase compared to the same period in the prior year. The airline’s net income was USD 20.6 million, a significant improvement from the -3.9 million recorded the previous year.

Analysis – SNCY Stock Fair Value Calculation

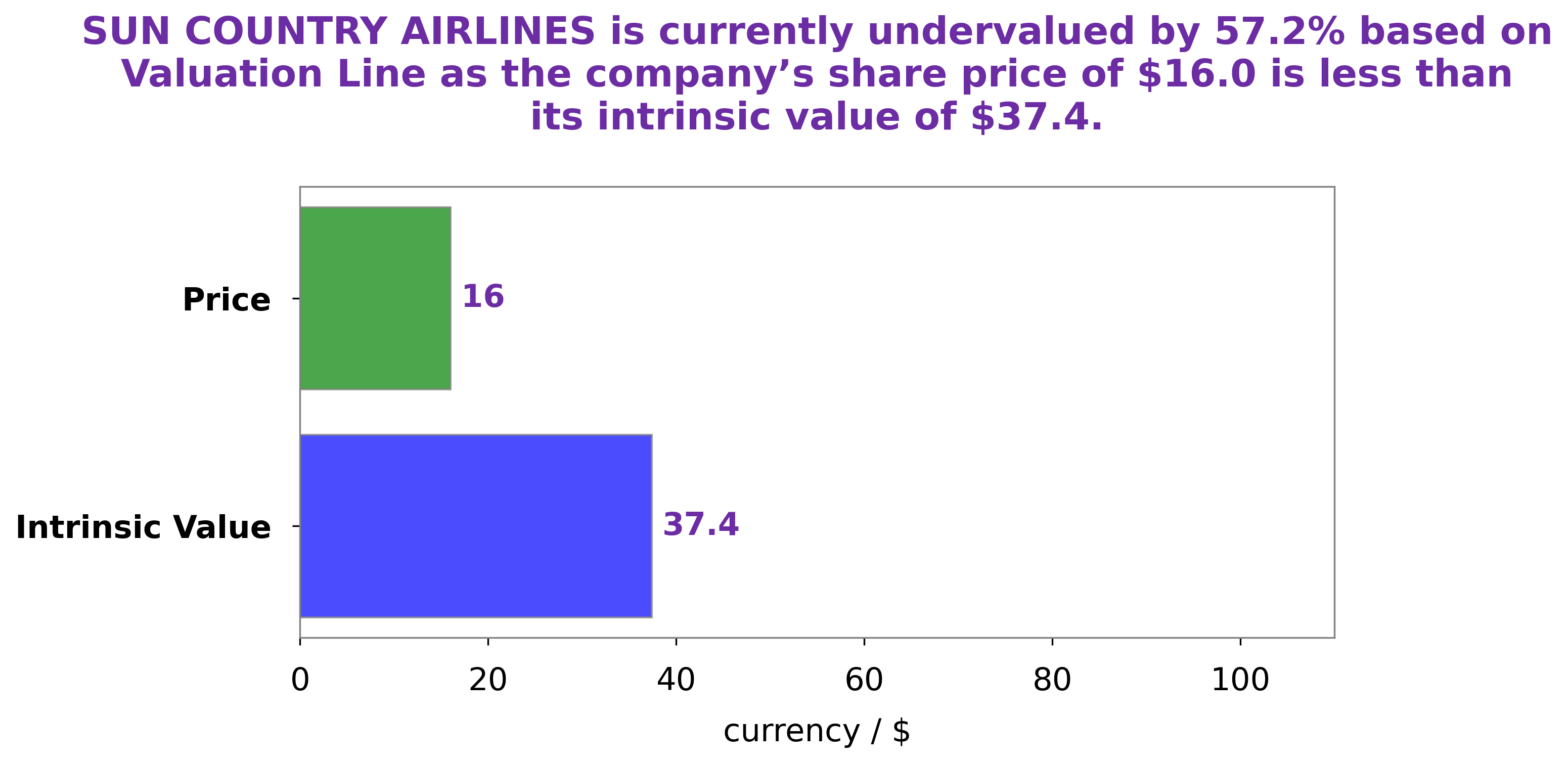

GoodWhale has conducted an analysis of SUN COUNTRY AIRLINES’ fundamentals. According to our proprietary Valuation Line, the intrinsic value of SUN COUNTRY AIRLINES’ share is $38.4. Currently, SUN COUNTRY AIRLINES’ stock is traded at $20.4, meaning that it is undervalued by a whopping 46.8%. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SNCY. More…

| Total Revenues | Net Income | Net Margin |

| 1k | 76.91 | 7.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SNCY. More…

| Operations | Investing | Financing |

| 186.08 | -318.37 | 9.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SNCY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.63k | 1.09k | 9.26 |

Key Ratios Snapshot

Some of the financial key ratios for SNCY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.4% | -10.9% | 13.4% |

| FCF Margin | ROE | ROA |

| -5.6% | 16.1% | 5.1% |

Peers

The competition among Sun Country Airlines Holdings Inc, VietJet Aviation JSC, Enter Air SA, and El AL Israel Airlines Ltd is fierce. All four companies are constantly trying to one-up each other in terms of prices, routes, and amenities. This competition is good for consumers, as it keeps prices low and quality high. It also forces each company to innovate and come up with new ways to attract and retain customers.

– VietJet Aviation JSC ($HOSE:VJC)

Air Enter SA has a market cap of $368.42 million as of 2022 and a return on equity of -1234.95%. The company is a provider of air transportation services. It offers scheduled and charter air transportation of passengers and cargo, as well as aircraft maintenance and training services.

– Enter Air SA ($LTS:0REF)

As of 2022, EL AL Israel Airlines Ltd had a market capitalization of 191.1 million and a return on equity of 24.45%. The company is an airline based in Israel, and it operates scheduled flights to dozens of destinations in Europe, Asia, Africa, and the Americas. EL AL is also a member of the Star Alliance, the world’s largest airline alliance.

Summary

Sun Country Airlines reported a 19.2% increase in total revenue in their second quarter earnings for 2023, coming in at USD 261.1 million. Net income for the quarter was USD 20.6 million, a significant improvement compared to the prior year’s -3.9 million. While the earnings report was positive, investors responded by pushing the stock price down the same day.

Analysts have commented that investors may be wary of the airline’s short-term outlook given the current economic environment. Long-term investors may view the dip in stock as a buying opportunity, however, considering the strong year-over-year growth reported in their latest earnings.

Recent Posts