TRANSDIGM GROUP Reports Strong Fourth Quarter Financial Results, with Total Revenue Up 22.6% and Net Income Rising 55.6% Year-Over-Year

November 27, 2023

☀️Earnings Overview

TRANSDIGM GROUP ($NYSE:TDG)’s total revenue for the fourth quarter of their fiscal year 2023 increased by 22.6% to USD 1852.0 million, while net income rose 55.6% to USD 414.0 million compared to the same period in the previous year, as reported on September 30 2023.

Analysis

Analyzing the financials of TRANSDIGM GROUP with GoodWhale, it is evident that the company has a high health score of 8/10. This score reflects its ability to pay off debt and fund future operations with its strong cash flows and debt. According to the Star Chart, TRANSDIGM GROUP is strong in growth, profitability, and weak in asset and dividend. The company has been classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. For such a company, investors who are looking for long-term investments with a high return-on-investment may be particularly interested. Furthermore, investors who are seeking a solid growth story and high revenue and earning potential may also be interested in investing in TRANSDIGM GROUP. As the company continues to expand its operations, it will likely attract more investors looking for a strong growth story or yield. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transdigm Group. More…

| Total Revenues | Net Income | Net Margin |

| 6.58k | 1.26k | 19.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transdigm Group. More…

| Operations | Investing | Financing |

| 1.38k | -900 | -16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transdigm Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.97k | 21.95k | -35.87 |

Key Ratios Snapshot

Some of the financial key ratios for Transdigm Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.9% | 17.6% | 43.7% |

| FCF Margin | ROE | ROA |

| 18.8% | -82.2% | 9.0% |

Peers

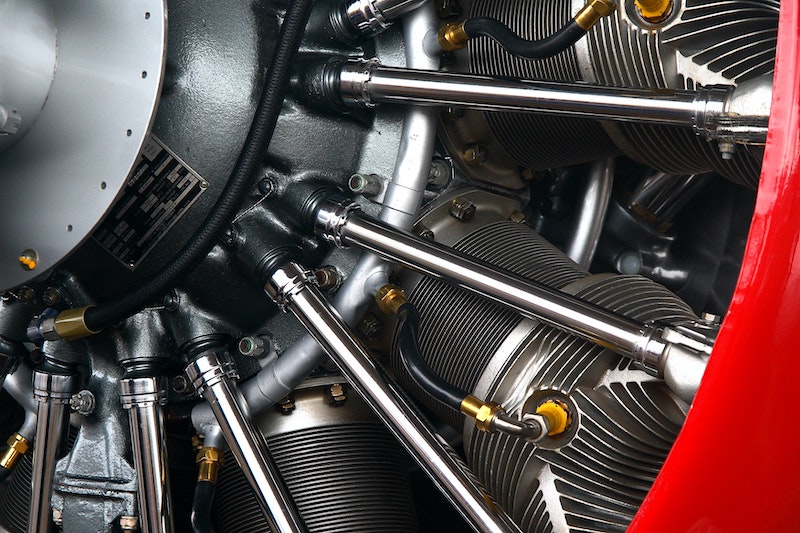

TransDigm Group Inc is a leading designer, producer, and supplier of aircraft components. The company’s main competitors are Chemring Group PLC, Triumph Group Inc, and AECC Aero-Engine Controls Co Ltd.

– Chemring Group PLC ($LSE:CHG)

The company’s market cap is 849.54M as of 2022 and has a ROE of 12.84%. The company is a leading international provider of specialist products, services and solutions for military, homeland security and commercial markets.

– Triumph Group Inc ($NYSE:TGI)

Triumph Group Inc is a global aerospace and defense company that designs, manufactures, repairs and overhauls a wide variety of aircraft components, accessories, subsystems and systems. The company serves the commercial, military, business and general aviation markets, as well as the space and defense markets. Triumph Group has a market cap of 582.13M as of 2022 and a Return on Equity of -8.78%. The company has a long history of providing quality products and services to its customers, and is well-positioned to continue doing so in the future.

– AECC Aero-Engine Controls Co Ltd ($SZSE:000738)

AECC Aero-Engine Controls Co Ltd is a leading manufacturer of aircraft engines and engine controls. The company has a market cap of $37.18 billion and a return on equity of 4.22%. AECC Aero-Engine Controls Co Ltd designs, develops, manufactures, and sells aero-engines and engine controls for use in aviation and power generation applications. The company’s products are used in a variety of aircraft, including commercial jets, business jets, and helicopters. AECC Aero-Engine Controls Co Ltd has over 3,000 employees and is headquartered in Shanghai, China.

Summary

Investors may be encouraged by TRANSDIGM GROUP‘s financial results for the fourth quarter of fiscal year 2023, as total revenue increased by 22.6% to USD 1852.0 million and net income rose 55.6% to USD 414.0 million year over year. This positive performance drove the stock price up on the same day, indicating that investors have confidence in the company’s future prospects. Moving forward, investors should carefully monitor TRANSDIGM GROUP’s progress as the company continues to seek growth opportunities in its industry.

Recent Posts