Boston Omaha Corp Subsidiary Link Media Holdings Enters Into Definitive Agreement

April 14, 2023

Trending News ☀️

Boston Omaha ($NYSE:BOC) Corporation, a Nebraska corporation, entered into a definitive agreement (the “Agreement”) with ITN, LLC (“ITN”) on April 6, 2023. This agreement resulted in the creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement for Boston Omaha. Link Media Holdings, Inc., a wholly-owned subsidiary of Boston Omaha, agreed to purchase all of the issued and outstanding membership interests of ITN, LLC pursuant to the terms of the Agreement. Boston Omaha Corporation is a publicly-traded, diversified holding company incorporated in Nebraska.

The company focuses on acquiring and growing businesses that hold attractive long-term potential, typically those with business models that are not dependent on macroeconomic trends or driven by market volatility. It currently holds interests in real estate, media, insurance, and other industries. Its mission is to create long term value for its shareholders through focused investments in businesses and assets it believes can generate attractive returns.

Market Price

On Wednesday, Boston Omaha Corp (BOSTON OMAHA) stock opened on the market at $22.9 and closed at $21.9, down by 3.3% from its last closing price of 22.6. The company recently announced that its subsidiary, Link Media Holdings, Inc., has entered into a definitive agreement with a private equity fund. This agreement will allow Link Media to acquire a strategic stake in a media company which specializes in consumer and trade media for the agribusiness sector. The transaction is expected to close within the next few weeks.

The acquisition of the media company is part of Boston Omaha’s plan to expand its presence in digital media and grow its portfolio of investments. As part of this strategy, Boston Omaha has been exploring further opportunities to expand into sectors such as digital media, technology, and healthcare. This move is expected to open up new opportunities for the company and increase its potential for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Boston Omaha. More…

| Total Revenues | Net Income | Net Margin |

| 81.23 | 7.14 | 0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Boston Omaha. More…

| Operations | Investing | Financing |

| -5.17 | 87.86 | -109.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Boston Omaha. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 683.72 | 157.07 | 16.95 |

Key Ratios Snapshot

Some of the financial key ratios for Boston Omaha are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.2% | – | 6.2% |

| FCF Margin | ROE | ROA |

| -55.7% | 0.6% | 0.5% |

Analysis

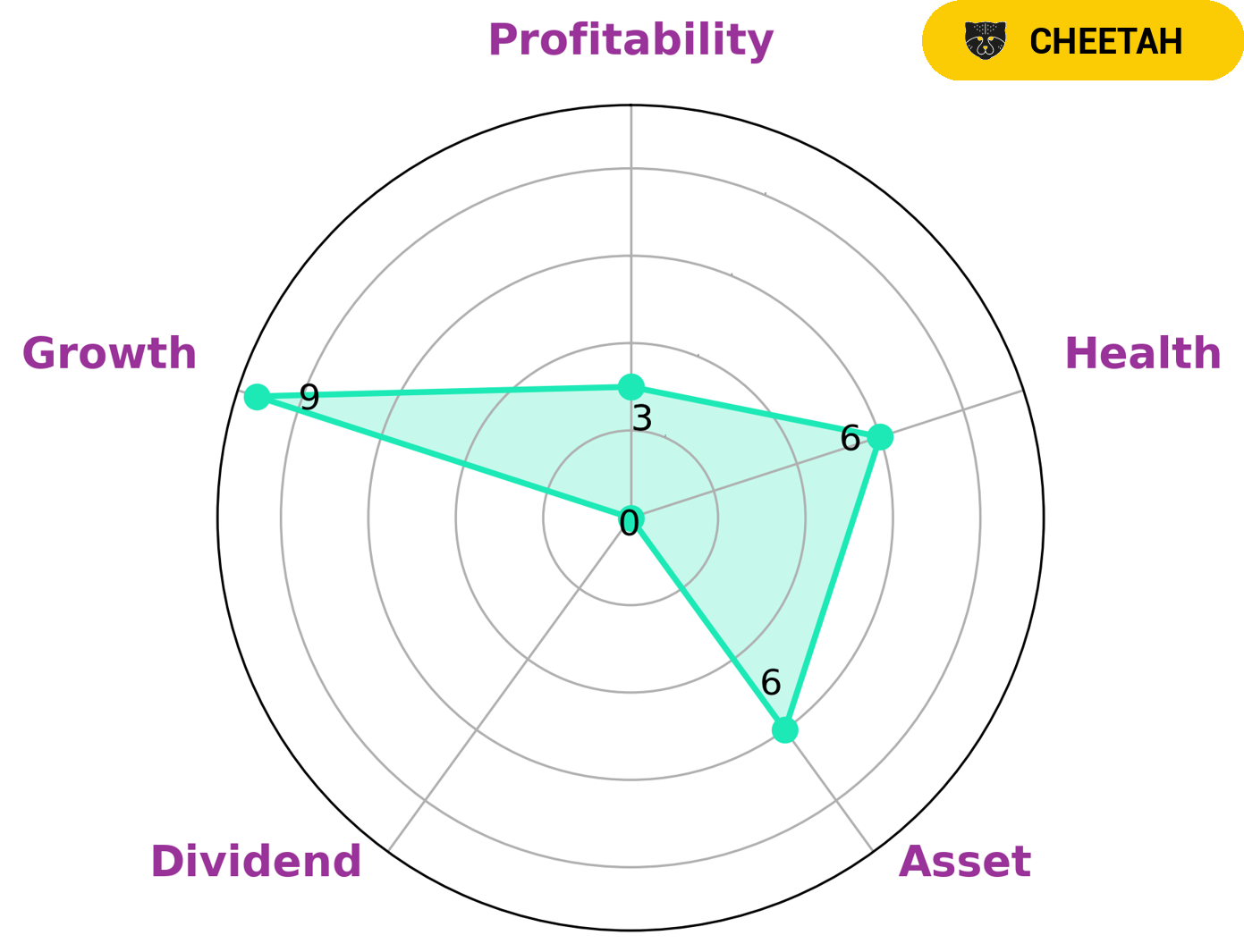

GoodWhale’s analysis of BOSTON OMAHA‘s wellbeing reveals that, based on the Star Chart, it is classified as a ‘cheetah’ type of company. This means that it achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are interested in such a company would likely be looking for a high growth opportunity with some risk. Based on our analysis, BOSTON OMAHA has strong growth potential, medium assets, and weak dividends and profitability. It also has an intermediate health score of 6/10, indicating that it is likely to pay off debt and fund future operations. All these factors make BOSTON OMAHA an attractive prospect for investors looking for a high growth opportunity with some risk. More…

Peers

The competition between Boston Omaha Corp and its competitors is fierce. Each company is vying for a share of the market, and each has its own strengths and weaknesses. Innocean Worldwide Inc is a large company with a strong presence in the market. Domain Holdings Australia Ltd is a small company with a niche market. Nestbuilder.com Corp is a new company with a innovative product.

– Innocean Worldwide Inc ($KOSE:214320)

Innocean Worldwide Inc is a South Korean advertising agency. The company has a market cap of 843B as of 2022 and a Return on Equity of 9.71%. Innocean Worldwide Inc specializes in creating and executing integrated marketing campaigns for its clients. The company has a strong focus on digital marketing and has a team of experienced professionals who are experts in this field. Innocean Worldwide Inc has a wide range of clients, both in Korea and internationally, and has a proven track record of delivering successful campaigns.

– Domain Holdings Australia Ltd ($ASX:DHG)

Domain Holdings Australia Ltd is a digital media and services company. The company focuses on delivering an integrated suite of products and services that enable people to connect with each other and with the places they live, work and visit. Domain Holdings Australia Ltd has a market cap of 1.95B as of 2022, a Return on Equity of 4.18%. The company’s products and services include digital marketing, web design and development, and online advertising.

– Nestbuilder.com Corp ($OTCPK:NBLD)

Nestbuilder.com Corp is a company that provides online real estate services. The company has a market capitalization of 231.44k and a return on equity of -8065.9%. The company offers a variety of services including listings, home buying and selling tips, and mortgage information.

Summary

Investors in Boston Omaha Corporation saw a decline in stock price on April 6, 2023 after the company’s wholly-owned subsidiary, Link Media Holdings, Inc. entered into a definitive material agreement. While the details of the agreement have not been made public, investors will be looking to the company to provide further information and updates on the effects of this agreement on the future of the corporation. Investors should continue to monitor the stock and keep an eye on any further developments.

Recent Posts