GFL Environmental Divests Solid Waste Operations in Two Separate Deals in Colorado, New Mexico, and Tennessee

June 10, 2023

🌧️Trending News

GFL ($NYSE:GFL) Environmental Inc., based in Vaughn, Ontario, is one of North America’s largest diversified environmental services companies providing solid waste management, liquid waste management, and soil remediation services. The company recently announced the divestment of its solid waste operations in Colorado, New Mexico, and Nashville, Tennessee in two separate transactions. The first transaction included the sale of GFL’s solid waste collection operations in Colorado and New Mexico to Veolia North America, a leading provider of resource and energy management solutions. The second transaction included the sale of GFL’s solid waste collection operations in Nashville, Tennessee to Waste Industries, a leading solid waste collection and disposal company in the Southeast. The divestment of these operations allows GFL to focus on emerging opportunities in the environmental services sector and will lead to greater organizational efficiency.

Furthermore, the transactions are expected to generate significant value for shareholders by increasing financial flexibility and providing additional capital for future growth initiatives. GFL will continue to operate its other solid waste collection services in the United States, including its operations in Virginia, Maryland, West Virginia, Kentucky, Ohio, Pennsylvania, Michigan, Indiana, and Illinois. Through these operations, GFL will remain committed to providing quality environmental services to its customers.

Price History

The stock opened for trading at $37.3 and closed at the same price, a decrease of 0.5% from its previous closing price of $37.5. The divestment of solid waste operations is part of GFL ENVIRONMENTAL‘s strategy to focus on core infrastructure activities. GFL ENVIRONMENTAL hopes that with this divestment it can increase its operational efficiency and create value for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gfl Environmental. More…

| Total Revenues | Net Income | Net Margin |

| 7.16k | -558.6 | -4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gfl Environmental. More…

| Operations | Investing | Financing |

| 1.11k | -2.03k | 836.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gfl Environmental. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.83k | 12.87k | 18.8 |

Key Ratios Snapshot

Some of the financial key ratios for Gfl Environmental are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.3% | – | -3.4% |

| FCF Margin | ROE | ROA |

| 3.7% | -2.3% | -0.8% |

Analysis

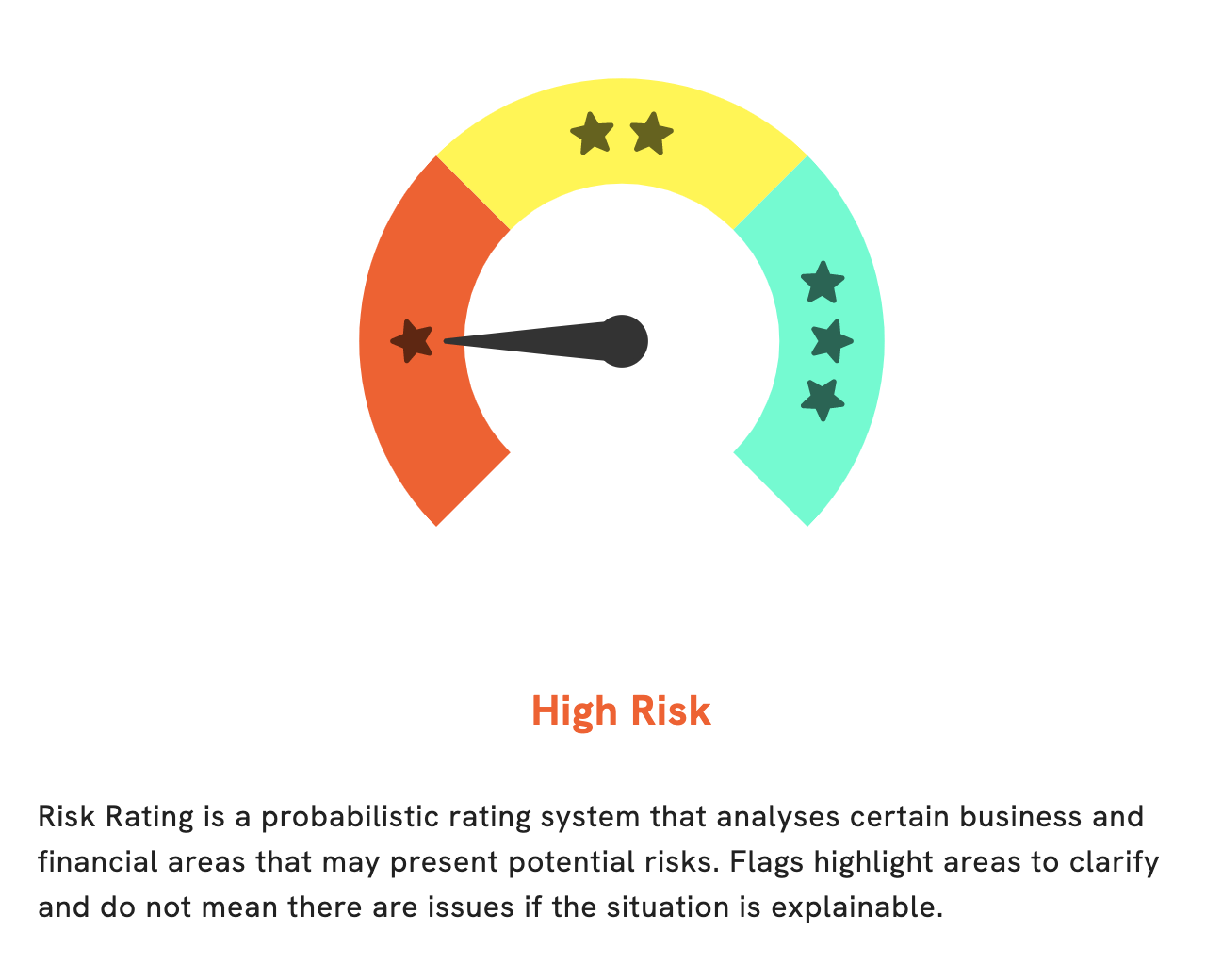

At GoodWhale, we provide investors with an in-depth analysis of GFL ENVIRONMENTAL‘s fundamentals. Based on our Risk Rating, GFL ENVIRONMENTAL is a high risk investment in terms of financial and business aspects. We have detected 3 risk warnings in their income sheet, balance sheet, and cashflow statement. Income sheet analysis reveals that GFL ENVIRONMENTAL’s net income has increased only slightly over the past year, with no significant fluctuations. Balance sheet analysis indicates that GFL ENVIRONMENTAL has a high debt burden and weak liquidity position. Cash flow statement analysis reveals that GFL ENVIRONMENTAL has experienced difficulties in managing cash, which has caused them to take on additional debt in order to fund their operations. At GoodWhale, we believe that investors should be aware of the associated risks and uncertainties when investing in GFL ENVIRONMENTAL. To get more insights, register on goodwhale.com and get access to our comprehensive risk analysis report. More…

Peers

The company offers a full range of services, including waste collection, transfer, disposal, and recycling. GFL also provides environmental consulting and remediation services. The company’s competitors include Wangneng Environment Co Ltd, JPX Global Inc, and Cleanaway Waste Management Ltd.

– Wangneng Environment Co Ltd ($SZSE:002034)

Wangneng Environment Co Ltd is a Chinese company that provides environmental protection services. It has a market cap of 8.49B as of 2022 and a return on equity of 10.9%. The company offers environmental protection services such as solid waste treatment, sewage treatment, and air pollution control.

– JPX Global Inc ($OTCPK:JPEX)

JPX Global Inc is a publicly traded company with a market cap of $42.81 million as of 2022. The company has a return on equity of 9.79%. JPX Global Inc is a provider of transportation and logistics services. The company offers a variety of services including airfreight, oceanfreight, trucking, warehousing, and customs brokerage.

– Cleanaway Waste Management Ltd ($ASX:CWY)

Cleanaway Waste Management Ltd is an Australian-based company that provides waste management services across a range of industries. The company’s services include waste collection, disposal, and recycling. Cleanaway has a market cap of 5.85B as of 2022 and a Return on Equity of 3.57%. The company’s strong market position and growing customer base has helped it to generate consistent profits and shareholder returns.

Summary

GFL Environmental Inc., a Vaughn, Ontario-based company, has recently made investments in the solid waste management market in three US markets: Colorado, New Mexico, and Tennessee. This move is part of a long-term strategic plan to expand its operations and grow its presence in the US market. Analysis of the move shows that GFL Environment may benefit from increased revenue as it acquires more customers and expands its services.

Additionally, this divestment may lead to cost savings for the company by streamlining operations in the three markets. It is expected that the investment will pay off in increased profits, improved customer service, and better efficiency in the long run.

Recent Posts