Exelon’s Non-GAAP EPS and Revenue Beat Analysts’ Estimates by $0.04 and $20M Respectively

May 4, 2023

Trending News ☀️

Exelon Corporation ($NASDAQ:EXC) is a leading energy provider and the largest competitively priced electricity producer in the United States. The company engages in the generation, transmission, and distribution of electricity and natural gas throughout the US and Canada. Recently, Exelon’s Non-GAAP EPS of $0.70 and revenue of $5.56B exceeded analysts’ estimates by $0.04 and $20M respectively. This news has positively impacted investors and analysts alike as it is indicative of the company’s strong financial performance. The company has attributed its success to its diversified energy portfolio, which consists of both nuclear and renewable energy sources. By investing in a variety of energy sources, Exelon has been able to optimize its generation and distribution operations.

Additionally, the company’s strong focus on cost containment strategies has allowed it to keep its operating costs low and deliver robust financial results. This news has been well-received by investors and analysts, indicating that Exelon is on track to continue producing successful results. Going forward, the company is expected to continue taking advantage of its diversified portfolio to remain competitive and deliver strong returns to its investors.

Earnings

Exelon Corporation reported their fourth quarter earnings results for FY2022 as of December 31st, 2022. This is a decrease of 51.5% when compared to the same period last year, yet still managed to beat expectations. Net income reported was $432.0M USD, which marks a 10.5% increase from the previous year and beat analysts’ estimates by $0.04. The company has been able to outperform expectations and remain profitable despite the significant drop in total revenue.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Exelon Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 19.08k | 2.17k | 10.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Exelon Corporation. More…

| Operations | Investing | Financing |

| 4.87k | -6.99k | 1.59k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Exelon Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 95.35k | 70.61k | 24.74 |

Key Ratios Snapshot

Some of the financial key ratios for Exelon Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -17.9% | -8.6% | 20.2% |

| FCF Margin | ROE | ROA |

| -11.9% | 9.8% | 2.5% |

Share Price

The report is a positive sign of the company’s operational and financial performance. Despite this, the stock opened at $42.9 and closed at $42.3, down by 0.6% from previous closing price of $42.6. This may be due to investors’ caution considering the current market volatility. Live Quote…

Analysis

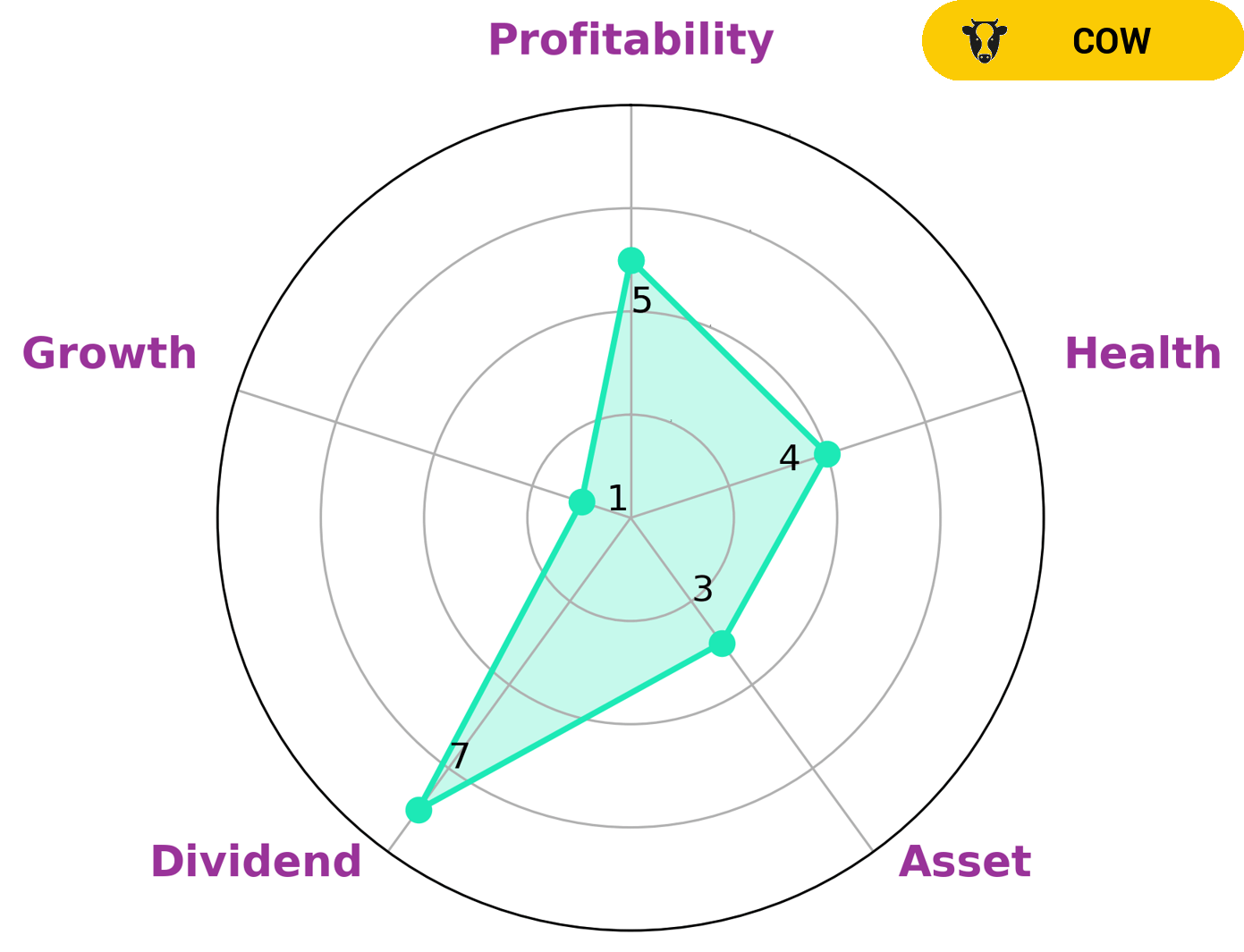

GoodWhale has conducted an analysis of EXELON CORPORATION‘s wellbeing, with a classification of ‘cow’ based on our Star Chart assessment. We believe this type of company is likely to pay out consistent and sustainable dividends, which may be appealing to investors seeking steady returns. On the whole, EXELON CORPORATION has an intermediate health score of 4/10, judging by its cashflows and debt. This suggests that the company is likely to be able to survive any crisis without risk of bankruptcy. In terms of specific areas of wellbeing, EXELON CORPORATION is strong in dividend, medium in profitability, and weak in both asset and growth. More…

Peers

In the United States, the electric power industry is organized into regional transmission organizations (RTOs) and independent system operators (ISOs) that operate wholesale electricity markets. Exelon Corp, New Jersey Resources Corp, Public Service Enterprise Group Inc, and Consolidated Edison Inc are all major players in the electric power industry. These companies compete against each other to provide electricity to consumers in their respective service areas.

– New Jersey Resources Corp ($NYSE:NJR)

New Jersey Resources Corp is a publicly traded energy services holding company with subsidiaries that provide natural gas and electricity to residential, commercial, and industrial customers in New Jersey and Pennsylvania. The company also owns and operates a regulated interstate natural gas pipeline and a regulated interstate natural gas storage system. As of December 31, 2020, the company had 2,841 employees.

– Public Service Enterprise Group Inc ($NYSE:PEG)

Public Service Enterprise Group Inc (PSEG) is a publicly traded diversified energy company with a market cap of $27.57 billion as of 2022. The company is engaged in the generation, transmission, and distribution of electricity and natural gas. It also provides energy-related products and services through its subsidiaries. PSEG’s return on equity (ROE) was -5.39% as of 2022.

PSEG was founded in 1903 and is headquartered in Newark, New Jersey. The company operates in the United States and has approximately 10,000 employees. PSEG’s primary business segments include Electric Operations, Gas Operations, and Energy Resources & Trade.

Public Service Enterprise Group Inc is a large, diversified energy company with a long history. The company has a market cap of $27.57 billion and an ROE of -5.39%. PSEG operates in the electricity generation, transmission, and distribution business as well as the natural gas business. The company also provides energy-related products and services through its subsidiaries.

– Consolidated Edison Inc ($NYSE:ED)

Consolidated Edison Inc is a holding company that engages in the business of providing energy services through its subsidiaries. The company operates in four segments: electric, gas, steam, and other. It has a market cap of $29.44B as of 2022 and a return on equity of 8.28%.

The company was founded in 1884 and is headquartered in New York, NY.

Summary

Exelon Corporation, a diversified energy company, recently reported their first quarter financials. The company reported Non-GAAP earnings per share (EPS) of $0.70, which was $0.04 higher than expected. Revenue totaled $5.56 billion, exceeding forecast by $20 million. Analysts have noted that this strong result is a positive indication of the company’s financial health.

Exelon is diversified across a variety of energy sources and serves around 10 million customers. Investors are encouraged to watch the company closely as it continues to adapt to changing market conditions.

Recent Posts