Wolfe Research Cites AES Corporation’s Coal Divestment, Tax Credit Headwinds as Reasons for Downgrade

April 18, 2023

Trending News ☀️

It is a leading independent power producer focused on providing clean, affordable, and reliable energy. Recently, Wolfe Research has downgraded the company citing its coal divestment as a major factor.

In addition, the company is facing headwinds in terms of tax credits which have also dampened the outlook of the company. This decision is seen as a move in the right direction by many experts, but it has caused some financial concerns for the company as it could lead to significant charges associated with exiting the coal business. In addition, AES ($NYSE:AES) is also facing headwinds due to potential changes to tax credits that could lead to higher taxes and decreased profitability. While the company is taking positive steps towards transitioning to cleaner sources of energy, it is important that they consider the financial implications of these decisions in order to ensure long-term success.

Price History

On Monday, the stock of AES Corporation opened at $24.3 and closed at the same price, dropping 2.1% from the previous closing price of $24.9. Wolfe Research cited the company’s divestment from its coal-fired power plants and facing headwinds from the recent tax credit extension as reasons for the downgrade. As such, Wolfe Research reduced the stock rating from “Outperform” to “Market Perform”. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aes Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 12.62k | -546 | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aes Corporation. More…

| Operations | Investing | Financing |

| 2.71k | -5.84k | 3.76k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aes Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 38.36k | 33.86k | 3.64 |

Key Ratios Snapshot

Some of the financial key ratios for Aes Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.4% | 2.8% | 7.5% |

| FCF Margin | ROE | ROA |

| -14.6% | 20.3% | 1.5% |

Analysis

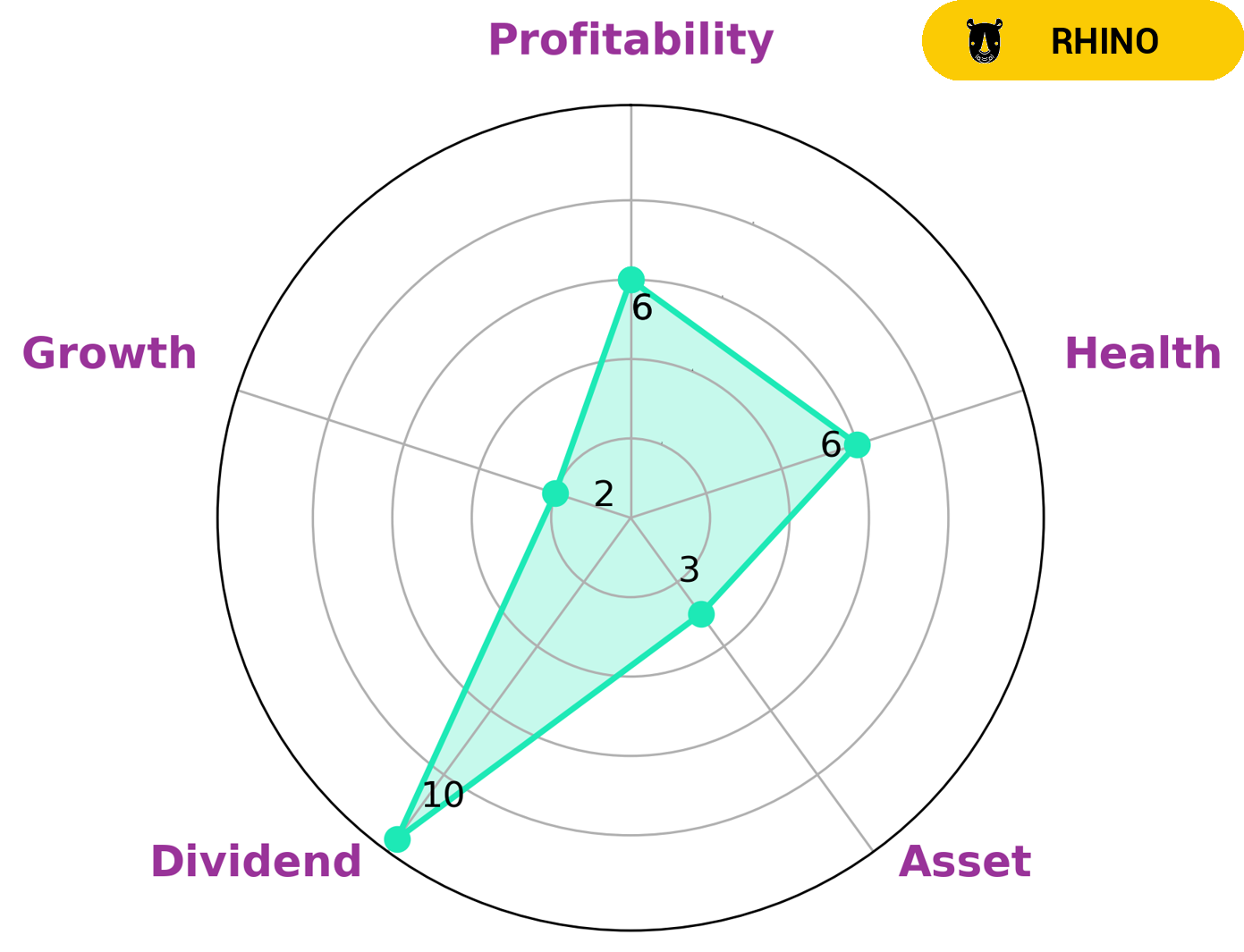

At GoodWhale, we analyzed the financials of AES CORPORATION to better understand its capabilities and potential. We found that its Star Chart classified it as a ‘rhino’, indicating that it has achieved moderate revenue or earnings growth. This type of company might be of particular interest to investors looking for dividend income with a moderate risk. We also discovered that AES CORPORATION is strong in dividend, medium in profitability and weak in asset, growth. In terms of health, AES CORPORATION has an intermediate score of 6/10 with regard to its cashflows and debt, indicating that it might be able to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company’s main competitors are Iberdrola SA, Portland General Electric Co, and ALLETE Inc.

– Iberdrola SA ($LTS:0HIT)

Iberdrola SA is a Spanish electric utility company. It is the largest producer of wind power in the world and a major player in the Spanish electricity market. Iberdrola also has a strong presence in the United Kingdom, Mexico, and the United States. The company has a market capitalization of 58.35 billion as of 2022 and a return on equity of 11.07%. Iberdrola is a vertically integrated utility, meaning it is involved in all aspects of the electricity business, from generation to distribution to retail sales. The company has a diversified generation portfolio that includes nuclear, hydro, renewable, and thermal power plants. Iberdrola is also one of the largest distributors of electricity in Spain and the United Kingdom.

– Portland General Electric Co ($NYSE:POR)

The company’s market cap is 3.82B as of 2022. The company’s ROE is 9.64%. The company is a diversified electric utility with operations in Oregon, Washington and Idaho. The company’s primary business is the generation, transmission and distribution of electricity. The company also owns and operates a coal-fired power plant and a natural gas-fired power plant.

– ALLETE Inc ($NYSE:ALE)

Pall Corporation is a global leader in providing filtration, separation and purification solutions to meet the critical fluid management needs of customers across the broad spectrum of life sciences and industry. Pall’s products are key to the success of customers in the medical, biopharmaceutical, semiconductor, water purification, aerospace, and energy markets. The company’s products are used every day by people around the world, in a wide range of applications and industries. Pall Corporation has a market cap of 2.89B as of 2022 and a Return on Equity of 4.57%.

Summary

AES Corporation is a global power company that has recently seen a downgrade in its stock at Wolfe Research due to its exit from the coal industry. This exit has created tax credit headwinds that could potentially limit its ability to generate profits and could lead to reduced dividend payments. Investors should carefully assess the potential impact of these headwinds before investing in AES Corporation. Analysts recommend investors monitor the company’s progress as it transitions away from coal and seek out alternative investments if they are not comfortable with AES’s risk profile.

Recent Posts