SSE Airtricity to Automatically Credit €35 to 247000 Domestic Customer Accounts

May 5, 2023

Trending News ☀️

SSE PLC ($LSE:SSE) is a leading British energy company, providing electricity and gas to millions of customers across the UK and Ireland. Recently, the company’s Irish energy brand, SSE Airtricity, has announced it will be automatically crediting €35 to the accounts of 247000 domestic customers. This refund is a result of a review by the Commission for Regulation of Utilities which concluded that customers had not been accurately charged in accordance with their tariff.

As a result, SSE Airtricity will be providing the refund to all affected customers, with the payment being automatically added to their accounts. This credit is expected to go some way towards compensating customers for any overpayment they may have made.

Share Price

On Friday, SSE PLC stock opened at £18.5 and closed at £18.4, down 0.5% from the prior closing price of 18.5. SSE Airtricity, the PLC’s energy provider arm, has announced the plan in an effort to provide some financial relief to households affected by the coronavirus pandemic. Customers who have already received a credit will not be eligible for the new credit. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sse Plc. More…

| Total Revenues | Net Income | Net Margin |

| 10.69k | 1.64k | 5.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sse Plc. More…

| Operations | Investing | Financing |

| 1.45k | -1.57k | 173.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sse Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.53k | 18.69k | 9.02 |

Key Ratios Snapshot

Some of the financial key ratios for Sse Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | -11.8% | 15.3% |

| FCF Margin | ROE | ROA |

| -1.4% | 10.8% | 3.6% |

Analysis

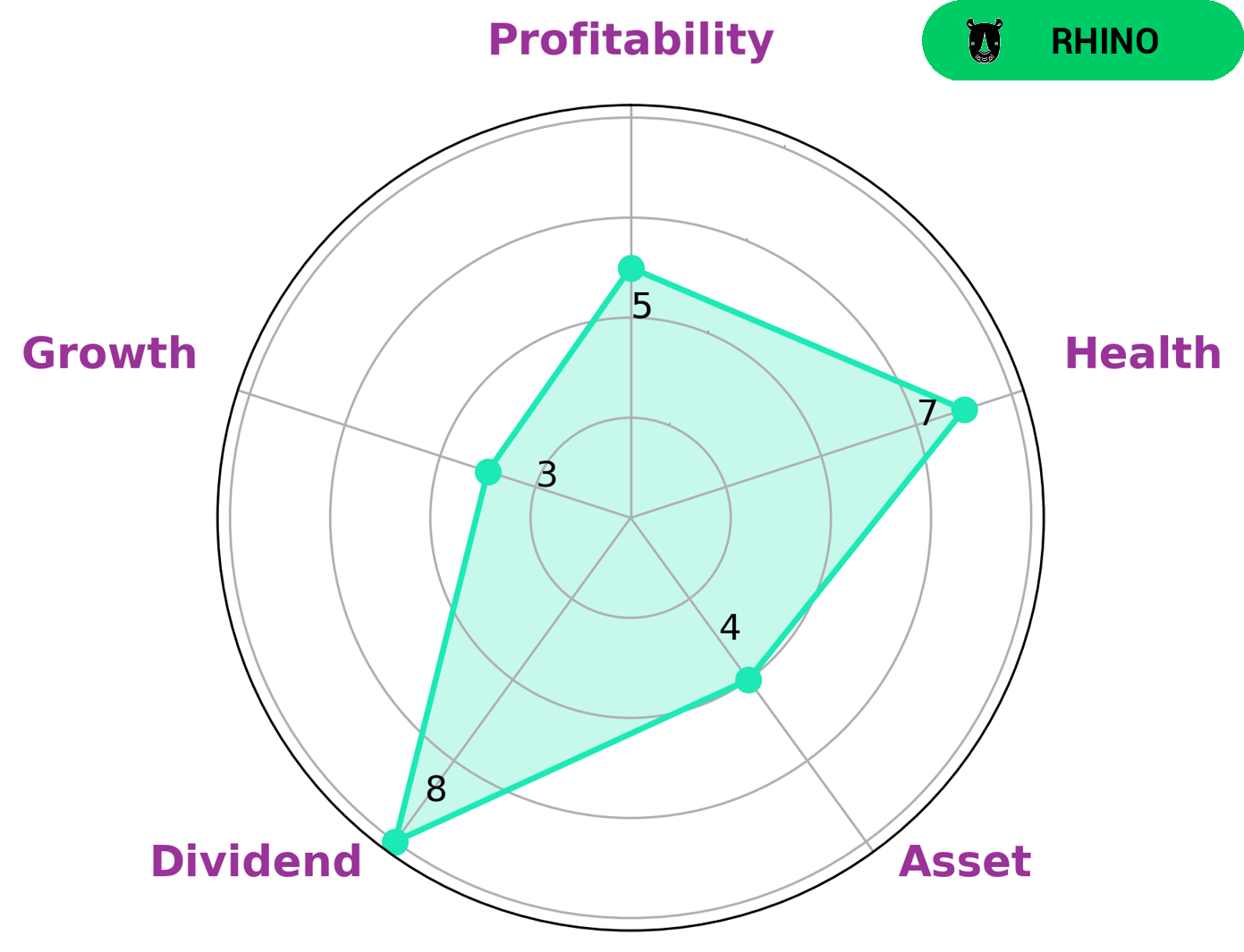

As GoodWhale conducted an analysis of SSE PLC‘s financials, we saw that according to the Star Chart, SSE PLC is strong in dividend, medium in asset, profitability and weak in growth. We classified SSE PLC as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for companies with steady dividends and good cashflows may be interested in investing in SSE PLC. Our health score for SSE PLC is 7/10, which indicates that the company is capable of paying off debt and funding future operations. Furthermore, SSE PLC has a strong portfolio of assets and good profitability. We believe this makes it an attractive investment option for investors seeking long-term growth or steady returns. More…

Peers

In the United Kingdom, SSE PLC is one of the “big six” energy suppliers that compete against each other to provide electricity and gas to residential and commercial customers. The other five companies are REN-Redes Energeticas Nacionais Sgps SA, NorthWestern Corp, OGE Energy Corp, and EDP Distribuicao SA. SSE PLC is the second largest electricity generator in the UK. The company also has gas production, storage, and distribution assets.

– REN-Redes Energeticas Nacionais Sgps SA ($LTS:0KBT)

REN-Redes Energeticas Nacionais Sgps SA is a Portugal-based holding company engaged in the electricity sector. The Company, through its subsidiaries, is active in the generation, transmission, distribution and commercialization of electricity, as well as in the natural gas sector. The Company operates a power grid of approximately 24,000 kilometers in mainland Portugal, the Madeira and Azores archipelagos, totaling around 5.5 million customers. As of December 31, 2011, REN-Redes Energeticas Nacionais Sgps SA had interests in 12 companies, including EDP Distribuicao SA, EDP Gases do Amazonas Ltda, EDP Gases do Nordeste Ltda and EDP Geração SA.

– NorthWestern Corp ($NASDAQ:NWE)

NorthWestern Corp is a holding company that provides electric and natural gas service to residential, commercial, and industrial customers in Montana, South Dakota, and Nebraska in the United States. The company has a market cap of $3.21 billion and a return on equity of 6.65%. NorthWestern Corp is a regulated utility company and is one of the largest providers of electricity and natural gas in the Northwest.

– OGE Energy Corp ($NYSE:OGE)

Duke Energy Corporation is an American electric power holding company headquartered in Charlotte, North Carolina. The company is the largest utility in the United States, with a generating capacity of over 49,000 megawatts. Duke Energy provides electricity to approximately 7.4 million customers in six states: North Carolina, South Carolina, Florida, Indiana, Ohio, and Kentucky. The company also has a commercial business that provides electricity and natural gas to approximately 2 million customers in the United States and Canada.

Duke Energy’s market cap is 7.86B as of 2022. The company has a Return on Equity of 18.73%. Duke Energy is the largest utility in the United States and provides electricity to approximately 7.4 million customers in six states. The company also has a commercial business that provides electricity and natural gas to approximately 2 million customers in the United States and Canada.

Summary

SSE PLC is an energy company that is currently offering customers a €35 credit. Investing in SSE PLC may be a good option for those looking to benefit from the company’s financial strength and track record of revenue growth. Analysts suggest that SSE PLC has strong potential for long-term performance and the company is well-positioned to capitalize on emerging trends in the energy industry.

In addition, its dividend yield remains attractive, making it an attractive investment opportunity for those seeking a regular income. Although SSE PLC shares have recently declined, analysts suggest that this could present a good buying opportunity for investors.

Recent Posts