Black Hills Beats Expectations with $1.73 GAAP EPS, $921.2M Revenue

May 4, 2023

Trending News 🌥️

The company reported $1.73 GAAP earnings per share (EPS), $0.01 above estimates, while revenue of $921.2M exceeded projections by $166.5M. These impressive results are due to the contributions of all three of its business segments – Utility, Non-regulated Energy, and Power Generation. The Utility segment’s performance was strong, due to the weather-normalized increase in energy sales to residential customers and increased gas sales.

Lastly, Power Generation saw a 14% increase in natural gas and hydroelectric power production. With the current level of success and the potential for growth, Black Hills ($NYSE:BKH) is an investment opportunity not to be missed.

Earnings

The earning report of BLACK HILLS for FY2022 Q4 as of December 31 2022 has exceeded expectations, with total revenue of $130.6M USD and net income of $72.5M USD. This marks a 13.8% increase in total revenue and a 2% increase in net income when compared to the previous year. In the last 3 years, BLACK HILLS has seen an impressive jump in total revenue from $486.4M USD to $130.6M USD. This, coupled with their earnings per share of $1.73, has resulted in a successful quarter with record-breaking results.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Black Hills. More…

| Total Revenues | Net Income | Net Margin |

| 2.55k | 258.39 | 10.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Black Hills. More…

| Operations | Investing | Financing |

| 584.8 | -603.88 | 32.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Black Hills. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.62k | 6.53k | 44.36 |

Key Ratios Snapshot

Some of the financial key ratios for Black Hills are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.7% | 3.9% | 18.0% |

| FCF Margin | ROE | ROA |

| -0.8% | 9.7% | 3.0% |

Stock Price

On Wednesday, BLACK HILLS reported an impressive quarterly performance with GAAP earnings per share (EPS) of $1.73 and total revenue of $921.2 million. Furthermore, this propelled the company’s stock price as it opened at $64.5 and closed at $64.4, up by a modest 0.4% from the last closing price of 64.2. This strong performance was driven by higher sales across all of BLACK HILLS’ major business segments, including electricity, natural gas, and energy services, and reflects the success of the company’s strategic initiatives to expand into new markets and optimize their existing portfolio of businesses. Live Quote…

Analysis

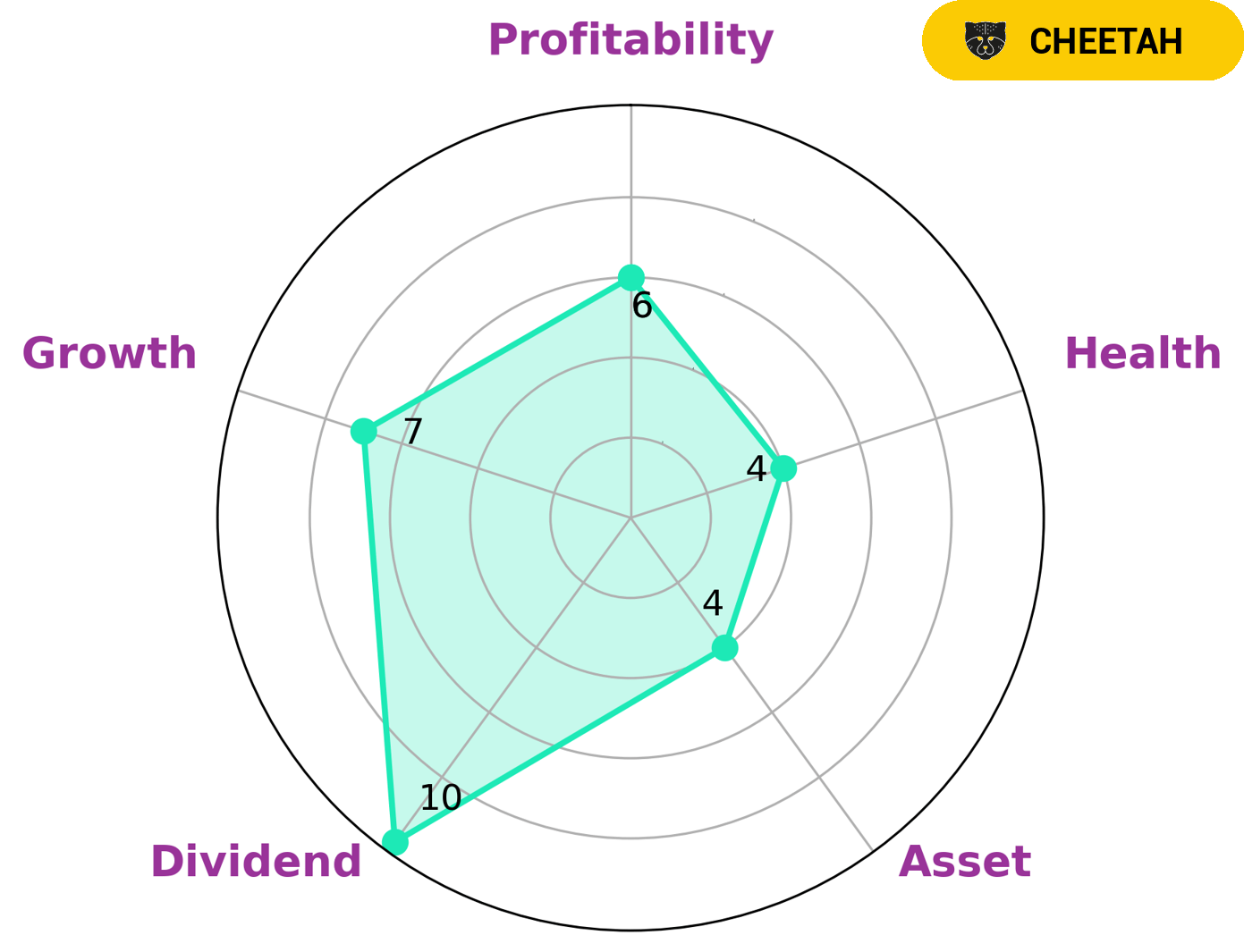

GoodWhale has conducted an analysis of BLACK HILLS‘ wellbeing and found that, according to Star Chart, the company is strong in dividends and growth, with a medium ranking in asset and profitability. BLACK HILLS has an intermediate health score of 4/10 with regard to its cashflows and debt, suggesting that it is likely to ride out any crisis safely without the risk of bankruptcy. We have classified BLACK HILLS as a ‘cheetah’, or a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe that investors looking for fast growth and potential returns could be interested in such a company. However, due to its lower stability, potential investors should be aware of the risks involved in investing in BLACK HILLS. They should also be aware that the company may not be able to sustain the same level of growth in the future. More…

Peers

The company operates through four segments: Electric Utilities, Gas Utilities, Coal Mining, and Power Generation. Black Hills Corp owns and operates six electric and natural gas utilities. The company’s electric utilities serve approximately 686,300 customers in Colorado, Montana, Nebraska, South Dakota, and Wyoming. Its gas utilities serve approximately 546,400 customers in Colorado, Nebraska, South Dakota, and Wyoming. Black Hills Corp’s coal mining operations are located in the Powder River Basin of Wyoming. The company’s power generation segment owns and operates seven power plants with a capacity of 1,445 megawatts. Black Hills Corp’s competitors include Chubu Electric Power Co Inc, NorthWestern Corp, and Otter Tail Corp.

– Chubu Electric Power Co Inc ($TSE:9502)

Chubu Electric Power Co Inc is a Japanese electric utility company that services the Chubu region on the island of Honshu. It has a market cap of 928.54B as of 2022 and a Return on Equity of -1.25%. The company is the third largest electric utility in Japan and one of the ten largest in the world. It serves over 19 million people and has over 46,000 employees.

– NorthWestern Corp ($NASDAQ:NWE)

Northwestern Corp is a holding company that, through its subsidiaries, engages in the generation, transmission, and distribution of electricity in the United States. The company has a market cap of 3.01B as of 2022 and a Return on Equity of 11.07%. The company’s subsidiaries include Northwestern Public Service Company, which provides electric utility service in South Dakota; Montana-Dakota Utilities Co, which provides electric and natural gas utility service in North Dakota, South Dakota, and Montana; and Nipsco Industries, Inc, which provides electric utility service in Indiana and Illinois.

– Otter Tail Corp ($NASDAQ:OTTR)

Otter Tail Corporation is a holding company that engages in the electric, manufacturing, and plastics businesses in the United States. It operates through the following segments: Electric, Manufacturing, and Plastics. The Electric segment generates, transmits, and distributes electricity in Minnesota, North Dakota, and South Dakota. The Manufacturing segment designs and manufactures metal fabricated products and components primarily for the medical device and other industries. The Plastics segment manufactures and sells plastic products. The company was founded by John N. Teigen in 1907 and is headquartered in Fergus Falls, MN.

Summary

Black Hills has released its quarterly earnings report, surpassing market estimates. Their GAAP EPS of $1.73 beat consensus estimates by one penny while their revenue of $921.2M exceeded consensus by $166.5M. Overall, financial performance was strong, suggesting that the company is in a favorable position to continue growing. Investors should consider this positive news when making future investment decisions in Black Hills.

Recent Posts