Banque Cantonale Vaudoise Reduces Sempra Holdings

December 31, 2022

Trending News 🌥️

It operates in the energy and infrastructure markets, including the natural gas and electric industries. The company is one of the largest energy companies in North America, with operations in the United States, Mexico, South America and Canada. Recently, Banque Cantonale Vaudoise (BCV), a Swiss cantonal bank, has reduced its holdings in SEMPRA ($NYSE:SRE). The decision to reduce SEMPRA holdings by BCV is likely due to the company’s financial performance. The company also suffered from a decrease in demand for energy services due to the global economic downturn caused by the pandemic. In addition, SEMPRA has been facing increasing investor pressure due to its failure to meet expectations with regard to its long-term growth plan. Given these factors, it is understandable why BCV chose to reduce its SEMPRA holdings.

However, this could be an opportunity for other investors looking for value in the energy sector. Despite its challenges, SEMPRA has a strong portfolio of assets and is well-positioned for long-term growth.

Market Price

On Tuesday, Banque Cantonale Vaudoise, a Swiss bank, reduced its holdings in Sempra, a large energy and infrastructure company. While the stock of Sempra opened at $158.2, it closed the day at $158.8, up 0.7% from the previous closing price of $157.8. Currently, media exposure for Sempra has been mostly negative. This is due to the company’s involvement in a number of recent controversies, such as a lawsuit regarding its involvement in the California wildfires and a dispute with the Mexican government over a gas pipeline project. In light of these issues, Banque Cantonale Vaudoise decided to decrease its holdings in Sempra. This decision came after the bank was previously one of Sempra’s largest shareholders. In addition to this decision, a number of other banks have also reduced their holdings in the company. Despite these developments, the stock of Sempra has remained relatively stable. This could be due to investors being optimistic about the company’s potential for long-term growth despite its current problems. Overall, Banque Cantonale Vaudoise’s decision to reduce its holdings in Sempra is an indication of the current negative media exposure surrounding the company.

However, despite this, investors are still optimistic about the company’s future prospects and have maintained their share price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sempra. More…

| Total Revenues | Net Income | Net Margin |

| 14.83k | 2.26k | 18.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sempra. More…

| Operations | Investing | Financing |

| 3.95k | -5.51k | 1.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sempra. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 75.56k | 46.27k | 86.15 |

Key Ratios Snapshot

Some of the financial key ratios for Sempra are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.4% | 3.9% | 11.0% |

| FCF Margin | ROE | ROA |

| -6.8% | 6.8% | 2.4% |

VI Analysis

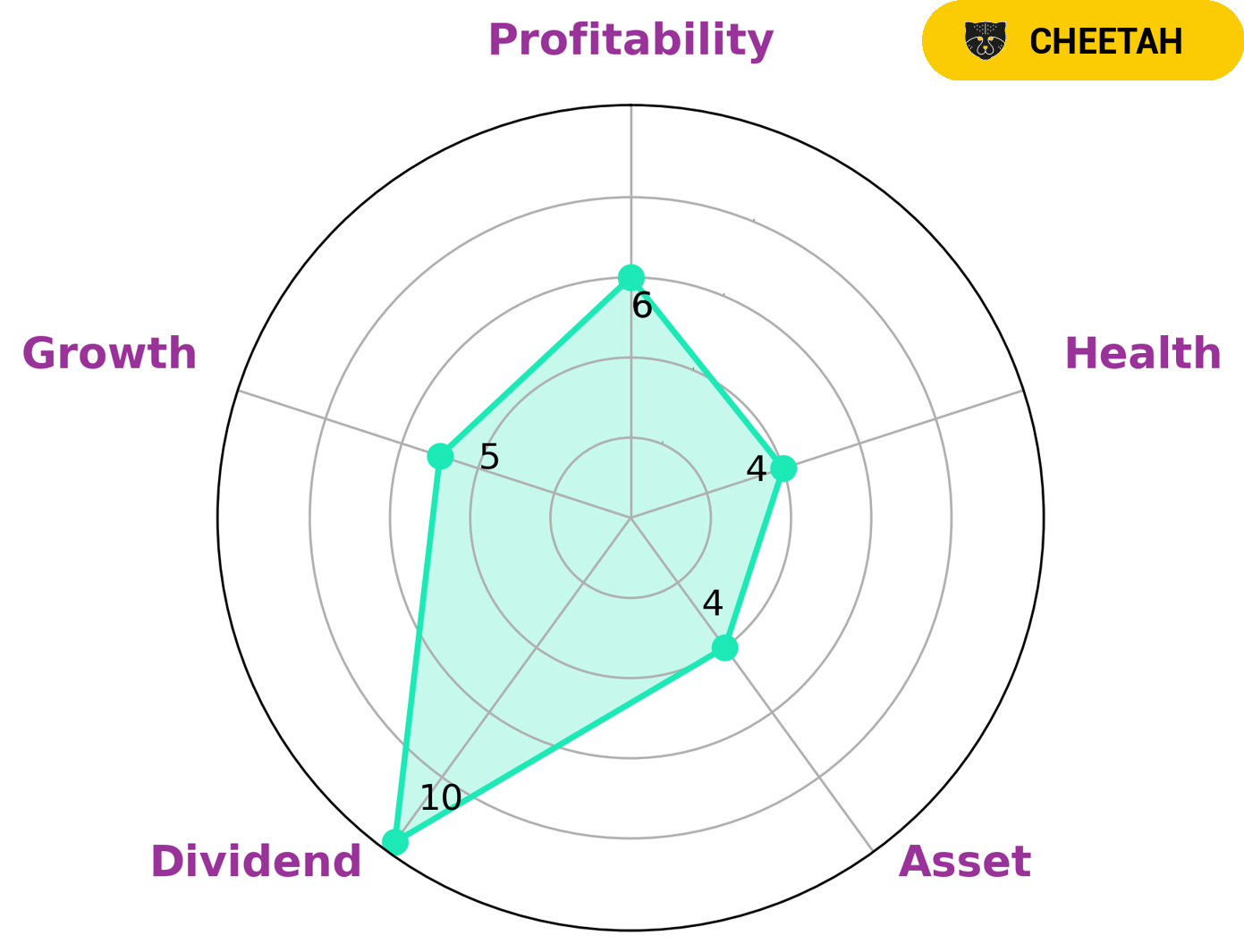

SEMPRA is classified as a ‘cheetah’ type of company, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors looking for capital appreciation opportunities, with the caveat that the stability of the company may not be as strong as other companies. The VI Star Chart gives SEMPRA an intermediate health score of 4/10, considering its cash flows and debt. This indicates that while there may be some risk associated with investing in SEMPRA, the company is likely to have the ability to pay off debt and fund future operations. SEMPRA also has strong dividend metrics and medium ratings in asset, growth and profitability, indicating that it may be an attractive option for investors seeking both capital appreciation and a regular income. The company also has a long-term potential, as evidenced by its fundamentals. Overall, SEMPRA is an interesting company for investors looking for capital appreciation potential, but who must take into account the risk associated with the lower profitability and stability of the company. More…

VI Peers

Sempra Energy is a Fortune 500 energy services holding company based in San Diego, California. The Sempra Energy companies’ 15,000 employees serve approximately 32 million consumers worldwide. Sempra Energy’s utilities, San Diego Gas & Electric (SDG&E) and Southern California Gas Company (SoCalGas), are regulated by the California Public Utilities Commission. Sempra Energy’s other businesses include Sempra Commodities, Sempra Generation and Sempra LNG.

– Atmos Energy Corp ($NYSE:ATO)

Atmos Energy Corporation is an American natural gas and electricity company headquartered in Dallas, Texas. The company’s operations include natural gas production, transmission and distribution, as well as electricity generation and distribution. As of December 31, 2020, Atmos Energy Corporation operated in 11 states and served approximately 3.6 million natural gas and electricity customers.

Atmos Energy Corporation’s market capitalization is $14.27 billion as of 2022. The company’s return on equity is 6.28%.

Atmos Energy Corporation is one of the largest natural gas and electricity companies in the United States. The company is headquartered in Dallas, Texas and operates in 11 states. As of December 31, 2020, Atmos Energy Corporation served approximately 3.6 million natural gas and electricity customers.

– REN-Redes Energeticas Nacionais Sgps SA ($LTS:0KBT)

REN-Redes Energeticas Nacionais Sgps SA is a Portugal-based holding company engaged in the electricity and gas sector. The Company operates in three segments: Gas and Electricity Transmission, Distribution and Supply, and Renewable Energy. The Gas and Electricity Transmission segment includes the transport of electricity and natural gas through high-voltage lines and pipelines, respectively. The Distribution and Supply segment handles the distribution of electricity and natural gas to end customers, as well as the resale of energy to energy suppliers. The Renewable Energy segment focuses on the generation of electricity from renewable sources, such as wind, solar and hydro power. As of December 31, 2011, REN-Redes Energeticas Nacionais SGPS SA operated through a network of 12,955 kilometers of high voltage lines and 8,290 kilometers of pipelines.

– Alliant Energy Corp ($NASDAQ:LNT)

Alliant Energy Corp is a utility company that generates and distributes electric and natural gas services to customers in the Midwest region of the United States. As of 2022, the company had a market capitalization of $12.63 billion and a return on equity of 9.62%. Alliant Energy Corp is headquartered in Madison, Wisconsin.

Summary

Investing in Sempra can be a risky proposition for investors. Recently, the Banque Cantonale Vaudoise has reduced its holdings in the company, likely due to the current negative media exposure. This could be a sign of potential risks when it comes to investing in Sempra.

In order to get an accurate analysis of Sempra’s financials and stock performance, investors should research and consider the company’s past performance, financial position, and current market trends. It is important to weigh the risks and potential rewards before making a decision on investing in Sempra.

Recent Posts