Saia Intrinsic Value Calculator – Saia Reports Strong Q4 Earnings Despite Revenue Miss

April 29, 2023

Trending News ☀️

Saia ($NASDAQ:SAIA) Inc. (SAIA), a leading provider of transportation and logistics services, recently released its fourth quarter earnings report, which showed strong performance despite a revenue miss. Saia reported a GAAP EPS of $2.85, significantly beating Wall Street forecasts by $0.16.

However, total revenue of $660.5M fell short of the expected figure by $6.78M. This performance was attributed to strong cost control and better-than-expected operating efficiency. Overall, despite the revenue miss, the strong results in other metrics indicate that Saia is well-positioned to continue its growth in the coming quarters. Investors will be looking for further improvements in the company’s cost control, efficiency, and freight volumes as it works to meet its long-term targets.

Share Price

On Friday, SAIA Inc. reported its fourth quarter earnings, despite missing its revenue goals. The stock opened at $279.5 and closed at $297.8, soaring by 14.6% from its previous closing price of $259.9. This strong performance reflects the investors’ confidence in SAIA’s financials and suggests that the missed revenue goal is not a major concern for investors. Despite the current quarter’s revenue miss, investors seem optimistic about SAIA’s future prospects. saia&utm_title=Saia_Reports_Strong_Q4_Earnings_Despite_Revenue_Miss”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Saia. saia&utm_title=Saia_Reports_Strong_Q4_Earnings_Despite_Revenue_Miss”>More…

| Total Revenues | Net Income | Net Margin |

| 2.79k | 357.42 | 12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Saia. saia&utm_title=Saia_Reports_Strong_Q4_Earnings_Despite_Revenue_Miss”>More…

| Operations | Investing | Financing |

| 473.03 | -365.51 | -26.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Saia. saia&utm_title=Saia_Reports_Strong_Q4_Earnings_Despite_Revenue_Miss”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.17k | 595.37 | 59.68 |

Key Ratios Snapshot

Some of the financial key ratios for Saia are shown below. saia&utm_title=Saia_Reports_Strong_Q4_Earnings_Despite_Revenue_Miss”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.0% | 45.5% | 16.9% |

| FCF Margin | ROE | ROA |

| 3.8% | 19.1% | 13.5% |

Analysis – Saia Intrinsic Value Calculator

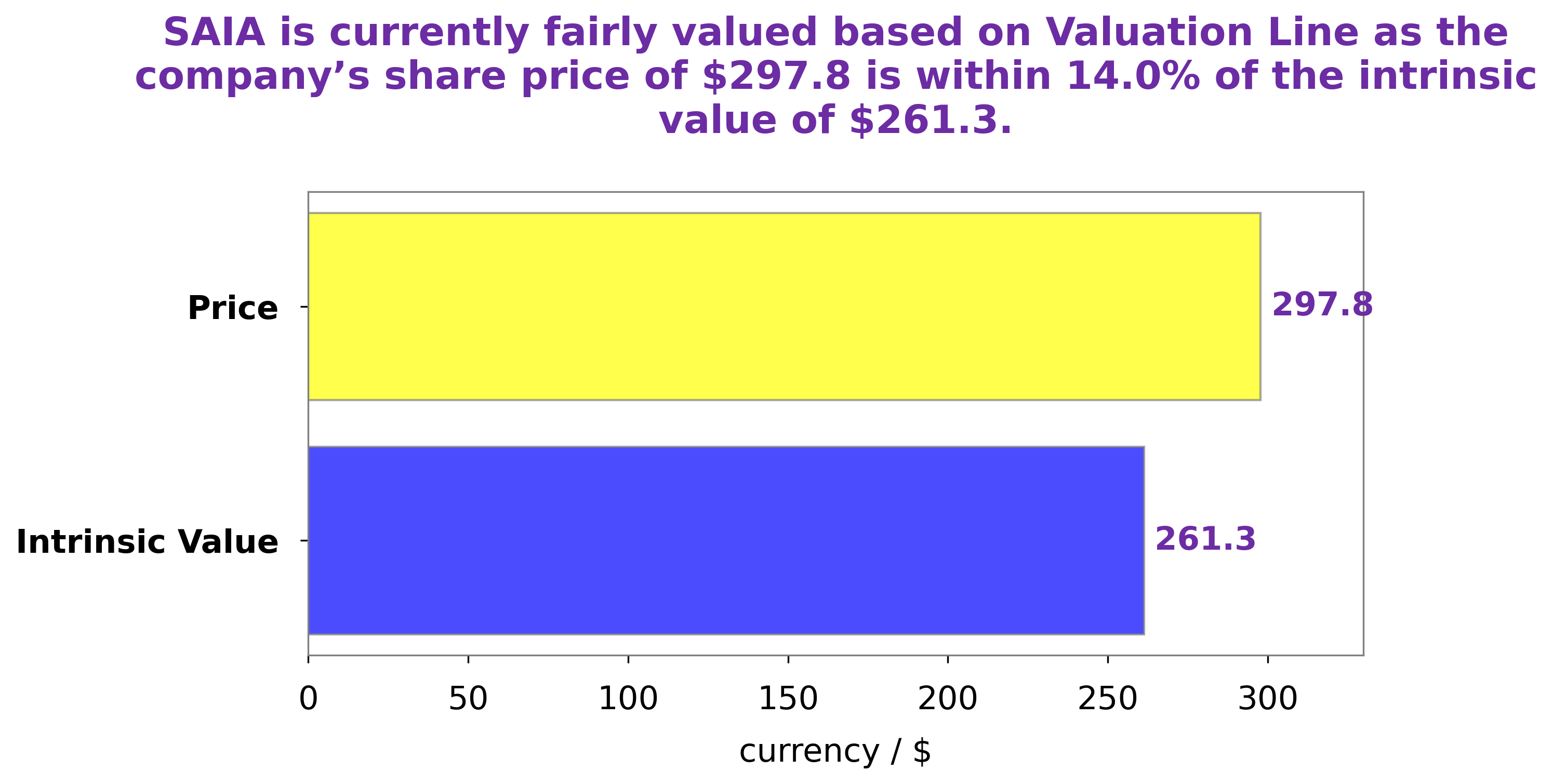

GoodWhale has conducted an analysis of SAIA’s fundamentals, and the results are in. Our proprietary Valuation Line has calculated that the intrinsic value of SAIA share is around $261.3. This means that at the current trading price of $297.8, this stock is fairly priced but slightly overvalued by 14.0%. saia&utm_title=Saia_Reports_Strong_Q4_Earnings_Despite_Revenue_Miss”>More…

Peers

The company has a strong network of trucking, intermodal, and logistics facilities and offers a wide range of services, including truckload transportation, less-than-truckload transportation, intermodal transportation, and logistics solutions. Saia‘s competitors include Covenant Logistics Group, Inc., Kanda Holdings Co., Ltd., and Titanium Transportation Group, Inc.

– Covenant Logistics Group Inc ($NASDAQ:CVLG)

Covenant Logistics Group Inc. is a provider of transportation and logistics services. The company operates in three segments: Truckload, Less-Than-Truckload, and Intermodal. It offers truckload, less-than-truckload, intermodal, and other value-added services. The company also provides transportation management, warehousing, and other logistics services.

– Kanda Holdings Co Ltd ($TSE:9059)

Kanda Holdings Co Ltd is a Japanese conglomerate with a market cap of 11.74B as of 2022. The company has a Return on Equity of 8.89%. Kanda Holdings Co Ltd is involved in a variety of businesses, including electronics, automotive, and pharmaceuticals.

Summary

SAIA Inc. is a provider of transportation services and supply chain solutions. Nonetheless, the stock price moved up the same day, indicating investor confidence in SAIA’s prospects. The company has seen steady revenue growth over the past few years, indicating business success and stability.

Analysts also state that SAIA has a strong financial position with low debt levels and good liquidity. As such, investors looking to add SAIA to their portfolio may consider it a positive investment opportunity.

Recent Posts