Mirae Asset Global Investments Sells Over 192K Shares of TuSimple Holdings

June 2, 2023

☀️Trending News

TUSIMPLE ($NASDAQ:TSP): TuSimple Holdings Inc. is a leading provider of autonomous trucking solutions and provides long-haul transportation services to its customers. It has grown to become a global leader in autonomous trucking, and its stock is publicly traded on the Nasdaq Global Select Market. The company is focused on developing innovative products that can reduce costs, increase safety, and improve efficiency in the trucking industry. This includes developing advanced driver assistance systems (ADAS), machine learning algorithms, and autonomous driving technologies.

The company’s goal is to deploy vehicles that can save time, money, and lives by eliminating human error from the equation. TuSimple Holdings Inc.’s products are designed to reduce fuel costs, emissions, and accidents while enabling faster deliveries. Through its partnerships with major industry players, including UPS, Paccar, Volvo, and Navistar, TuSimple Holdings Inc. is well-positioned to continue to innovate and lead the charge in autonomous trucking.

Market Price

This came as a surprise to many investors as the stock had been performing steadily and gradually increasing in value over the past few weeks. The transaction has increased speculation surrounding the future of TUSIMPLE HOLDINGS and the potential opportunities for growth that could result from the sale of shares. As the company continues to make strides in the autonomous driving industry, investors are eager to see what the future holds for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tusimple Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 8.69 | -451.48 | -5193.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tusimple Holdings. More…

| Operations | Investing | Financing |

| -320.28 | -12.78 | 0.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tusimple Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.26k | 97.66 | 5.18 |

Key Ratios Snapshot

Some of the financial key ratios for Tusimple Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 786.1% | – | -5231.4% |

| FCF Margin | ROE | ROA |

| -3831.6% | -23.6% | -22.6% |

Analysis

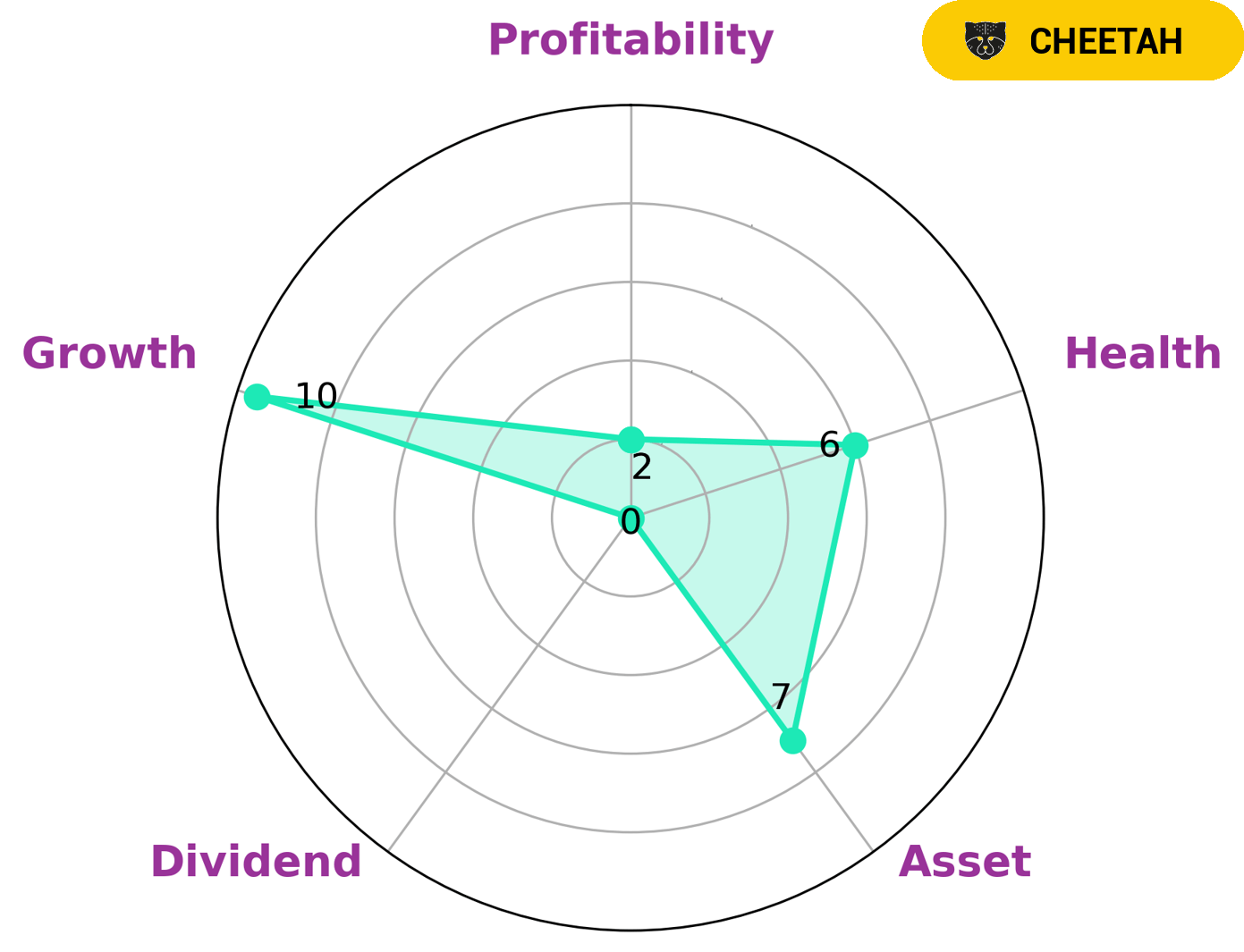

GoodWhale recently conducted an analysis of TUSIMPLE HOLDINGS‘s financials. Our Star Chart tool showed that TUSIMPLE HOLDINGS is strong in asset and growth, but weak in dividend and profitability. Additionally, the company has an intermediate health score of 6/10 taking into consideration its cashflows and debt; this would indicate that it is likely to safely ride out any crisis without the risk of bankruptcy. Based on the information gathered from our analysis, we have classified TUSIMPLE HOLDINGS as a ‘cheetah’ type of company – meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for companies with high growth potential, but are willing to take on higher risks, would likely be interested in TUSIMPLE HOLDINGS. More…

Peers

The competition between TuSimple Holdings Inc and its competitors is fierce. Each company is vying for a share of the market and the prize money that comes with it. Nikola is a leading company in the electric vehicle market, while ANE (Cayman) Inc is a leading company in the autonomous navigation market.

– Embraer SA ($NYSE:ERJ)

Embraer SA is a Brazilian aerospace conglomerate that produces commercial, military, and executive aircraft and provides aviation services. As of 2022, it has a market capitalization of 1.93 billion dollars and a return on equity of 4.38%. The company’s products include the Legacy 600 and 650, Phenom 100 and 300, and the Lineage 1000. It also provides services such as aircraft maintenance, pilot training, and engineering support.

– Nikola Corp ($NASDAQ:NKLA)

Nikola Corporation is an American electric vehicle and clean energy company founded in 2015. It is headquartered in Phoenix, Arizona. The company designs and manufactures zero-emission vehicles, vehicle components, energy storage systems, and electric vehicle drivetrains. It also develops electric vehicle infrastructure solutions. Nikola Corporation’s market cap is 1.37B as of 2022. The company has a Return on Equity of -76.12%.

– ANE (Cayman) Inc ($SEHK:09956)

Cayman Islands-based CAYMAN (Cayman) Inc is a holding company that, through its subsidiaries, provides investment management and advisory services. The company has a market cap of 2.46B as of 2022 and a return on equity of 16.69%. CAYMAN (Cayman) Inc’s subsidiaries include Cayman Management Ltd, a registered investment advisor; and Cayman Insurance Ltd, a captive insurance company.

Summary

TuSimple Holdings Inc. is a US-based autonomous trucking company that offers various transportation solutions including self-driving technology. Recently, Mirae Asset Global Investments Co. Ltd. sold 192418 shares of the company, demonstrating a substantial investment in the company’s stock. The stock price moved up the same day, indicating that investors have confidence in TuSimple’s future growth prospects. Analysts have noted that the company is likely to benefit from the increasing demand for autonomous delivery services in the years to come, as well as from its partnerships with various brands.

Additionally, TuSimple’s focus on reducing operating costs and improving efficiency is expected to further boost its potential for future growth. As such, investors may be wise to monitor developments with TuSimple Holdings Inc. in order to take advantage of any further potential gains in the stock price.

Recent Posts