Altria Group dividend calculator – Altria Group: Enjoy Lucrative Dividend Yields Despite Lack of Price Appreciation

May 3, 2023

Trending News ☀️

The Altria Group ($NYSE:MO) is one of the most recognizable and reliable companies in the world, and its stock is a great dividend play for investors. Although the company’s stock price has not appreciated significantly over the past few years, investors are still able to enjoy lucrative dividend yields from Altria. Altria Group is one of the largest producers and marketers of tobacco products, wine and spirits in the world. The company also owns a diverse portfolio of well-known brands, including Marlboro, Copenhagen, Skoal, Parliament, Virginia Slims, Black & Mild, and more. Altria’s competitive advantage lies in its extensive distribution channel, which allows it to reach consumers in almost every corner of the globe.

This makes it an attractive investment for those looking for steady income without having to worry about price appreciation. Altria’s dividend is reliable and safe, and the company has no intention of cutting or suspending it any time soon. Investors should take advantage of this unique opportunity to capitalize on the generous dividend yields offered by Altria without having to worry about price appreciation.

Dividends – Altria Group dividend calculator

The Altria Group is a great option for those interested in dividend stocks. In the last three years, the company has issued a consistent annual dividend per share of 3.72 USD, 3.68 USD, and 3.52 USD, respectively. This has resulted in growing dividend yields from 2021 to 2023 of 7.75%, 7.46%, and 7.53%, respectively, with an average dividend yield of 7.58%. Although there has not been a significant increase in stock price appreciation, the dividend yields make it a lucrative investment for those seeking steady income from investments.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Altria Group. More…

| Total Revenues | Net Income | Net Margin |

| 20.63k | 5.58k | 27.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Altria Group. More…

| Operations | Investing | Financing |

| 8.16k | 760 | -10.35k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Altria Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 36.83k | 40.65k | -2.17 |

Key Ratios Snapshot

Some of the financial key ratios for Altria Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.3% | 3.8% | 40.1% |

| FCF Margin | ROE | ROA |

| 38.5% | -131.7% | 14.0% |

Stock Price

Altria Group, one of the world’s largest tobacco companies, has been offering its investors generous dividend yields despite its lack of price appreciation. On Monday, ALTRIA GROUP opened at $47.6, closing at $47.8, a mere 0.6% increase from the last closing price of 47.5. While investors have not seen significant appreciation in terms of stock prices, Altria Group’s dividends remain a lucrative option for investors who seek steady returns. Live Quote…

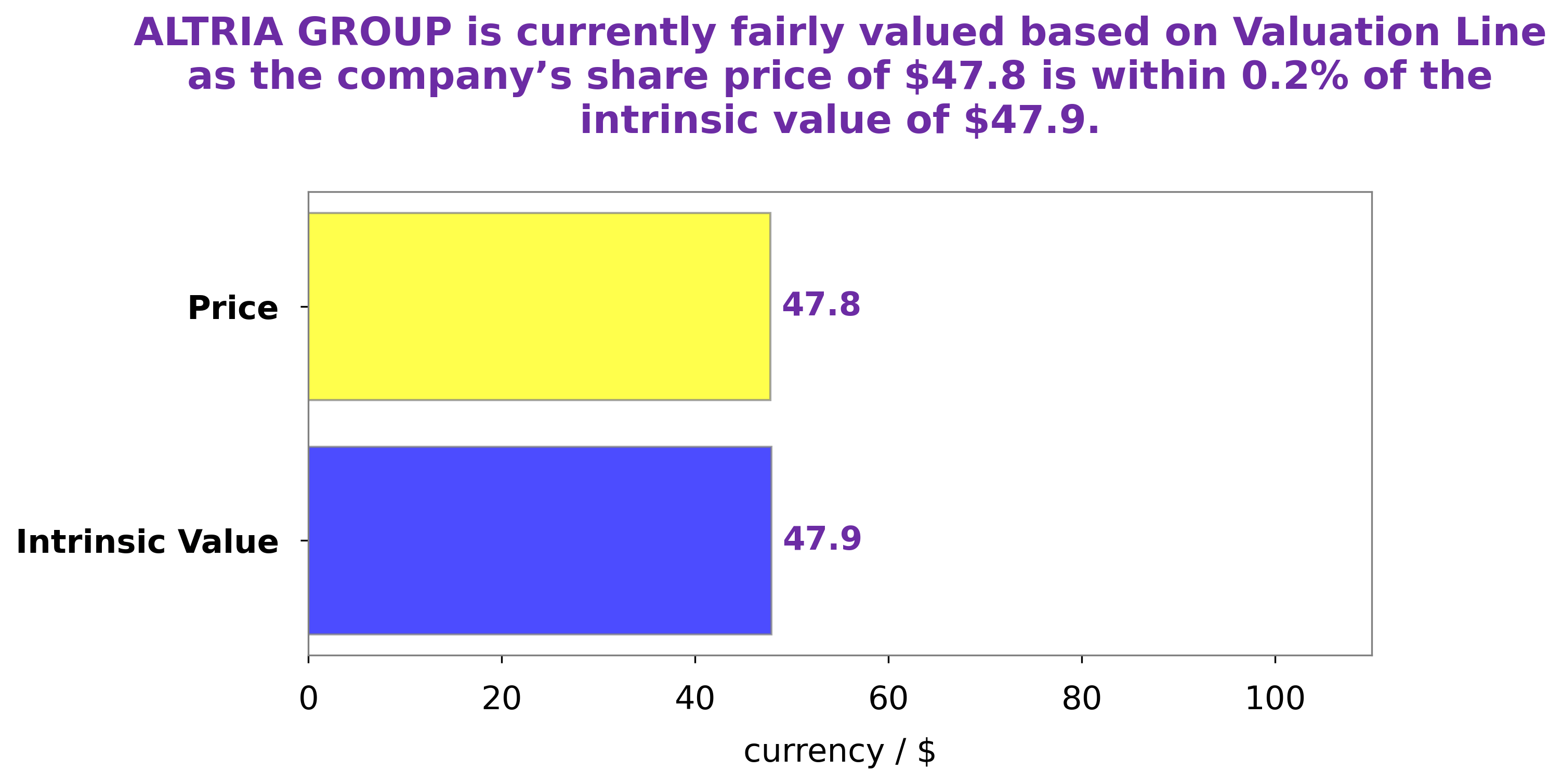

Analysis – Altria Group Intrinsic Stock Value

At GoodWhale, we’ve conducted an in-depth analysis of the ALTRIA GROUP‘s fundamentals. After careful consideration of their financials, our proprietary Valuation Line has concluded that the intrinsic value of an ALTRIA GROUP share is approximately $47.9. We’re pleased to report that the current trading price of ALTRIA GROUP stock is $47.8, which is very close to the intrinsic value and a fair price for investors looking to purchase shares in the company. More…

Peers

The tobacco industry is fiercely competitive, with Altria Group Inc up against Swedish Match AB, Imperial Brands PLC, British American Tobacco PLC, and other companies. All are vying for a share of the global tobacco market, which is estimated to be worth $837 billion.

– Swedish Match AB ($LTS:0GO4)

Founded in 1862, Swedish Match is a leading manufacturer of tobacco products with a portfolio of well-known brands, including Red Man, Timber Wolf, and White Owl. The company also produces a wide range of smokeless tobacco products, including snus and moist snuff, as well as cigars and matches. Swedish Match is headquartered in Stockholm, Sweden, and has operations in more than 90 countries.

Swedish Match has a market capitalization of 167.51 billion as of 2022 and a return on equity of -107.57%. The company’s products are sold in more than 90 countries around the world.

– Imperial Brands PLC ($LSE:IMB)

Imperial Brands PLC is a tobacco company with a market cap of 19.07B as of 2022. The company has a Return on Equity of 50.52%. Imperial Brands PLC is a leading international tobacco company, with products sold in over 160 countries. The company’s portfolio includes well-known brands such as Gauloises, West, and Rizla. Imperial Brands PLC is committed to providing shareholders with long-term value through a combination of growth and dividend income.

– British American Tobacco PLC ($LSE:BATS)

British American Tobacco PLC is a large multinational tobacco company with operations in over 50 countries. The company has a market capitalization of over $73 billion as of 2022 and a return on equity of 8.35%. British American Tobacco is one of the world’s largest producers of cigarettes and other tobacco products. The company’s brands include Dunhill, Lucky Strike, and Pall Mall. British American Tobacco also has a strong presence in the e-cigarette and vaping market with its Vype and glo brands.

Summary

Altria Group is a leading international tobacco company, offering a variety of products including cigarettes, smokeless tobacco, cigars, and other tobacco products. Altria has a strong cash flow and offers reliable and consistent dividend yields, making it an attractive option for income investors. The company has a long history of paying dividends and boasts a robust balance sheet with minimal debt. As such, Altria is an ideal option for conservative investors who are looking to generate steady, predictable income while minimizing risk.

Recent Posts