Charge Enterprises Sees Major Increase in Infrastructure Backlog to $107M

April 21, 2023

Trending News ☀️

Charge Enterprises ($NASDAQ:CRGE) is a leading energy company providing reliable, cost-efficient solutions for customers across the United States. Recently, the company announced an unprecedented increase in its infrastructure backlog to a record $107 million. This news has been received positively by both investors and industry analysts as a major step forward for the company. The company has stated that it will continue to focus on providing high-quality customer solutions and sustainable energy solutions in order to meet customer needs.

The new record of infrastructure backlog also confirms Charge Enterprises’ status as one of the leading energy companies in the country. Through its recent acquisition of new energy solutions and its commitment to expanding its customer base, Charge Enterprises is well on its way to becoming one of the most successful energy companies in the nation. With this new record in place, the company is poised to continue its success and remain at the forefront of the industry.

Stock Price

The backlog now sits at $107M, a significant jump from their previous level. On Wednesday, the company’s stock opened at $1.2 and closed at $1.1, a decrease of 0.9% from the previous closing price of 1.1. This slight dip in stock value did not seem to be connected to the increase in backlog as the stock had been steadily rising for several weeks prior to the announcement. Going forward, investors will be watching to see how Charge Enterprises is able to manage the growth in their project portfolio and deliver on their promises to shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Charge Enterprises. More…

| Total Revenues | Net Income | Net Margin |

| 697.83 | -68.39 | -7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Charge Enterprises. More…

| Operations | Investing | Financing |

| -11.37 | -2.01 | 22.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Charge Enterprises. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 168.45 | 127.63 | 0.2 |

Key Ratios Snapshot

Some of the financial key ratios for Charge Enterprises are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -2.6% |

| FCF Margin | ROE | ROA |

| -1.7% | -26.2% | -6.7% |

Analysis

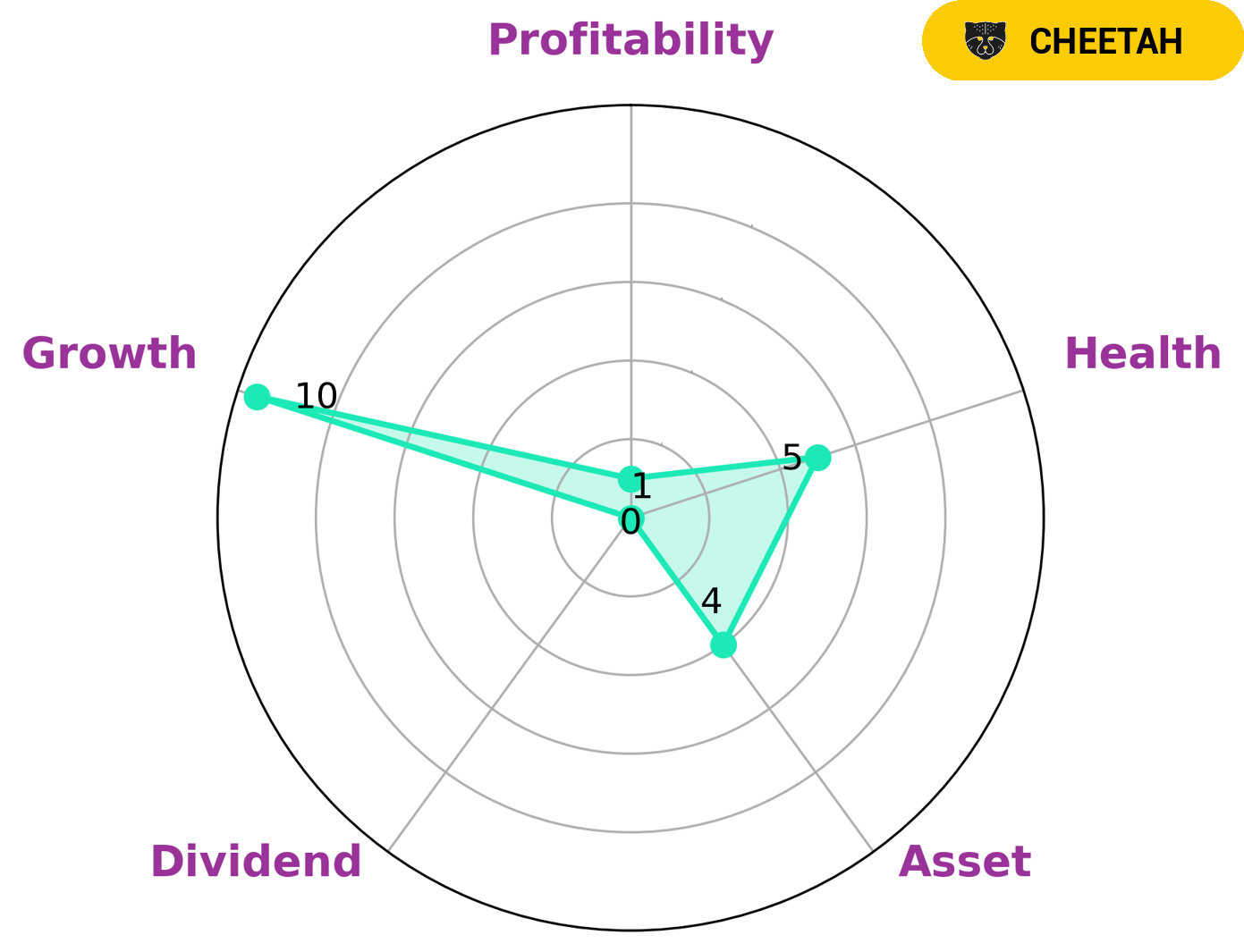

GoodWhale performed an analysis of CHARGE ENTERPRISES‘s fundamentals and found that the company is classified as ‘cheetah’ on the Star Chart. This classification indicates that the company has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. We can conclude that investors who are looking for growth opportunities may be interested in such a company. Furthermore, CHARGE ENTERPRISES is strong in growth, medium in asset and weak in dividend, profitability. It also has an intermediate health score of 5/10 with regard to its cashflows and debt, indicating that CHARGE ENTERPRISES is likely to sustain future operations in times of crisis. More…

Peers

The Company is engaged in the business of providing technology and marketing solutions for the electric vehicle industry. Charge Enterprises Inc has a strategic alliance with Ascentech KK, Quest Co Ltd, and Ntegrator International Ltd.

– Ascentech KK ($TSE:3565)

Ascentech KK is a Japanese company with a market cap of 6.79B as of 2022. The company has a return on equity of 17.08%. Ascentech KK is involved in the manufacturing of semiconductor devices and other electronic components.

– Quest Co Ltd ($TSE:2332)

Since its establishment in 2001, Quest has been a leading provider of end-to-end enterprise software solutions. The company has a market cap of 6.02B as of 2022 and a ROE of 11.79%. Quest provides a comprehensive suite of solutions that helps organizations automate their business processes, improve their operational efficiency, and optimize their customer experience. The company’s products and services are used by more than 10,000 customers in over 100 countries.

Summary

Charge Enterprises has reported a record-breaking infrastructure backlog of $107M, demonstrating the company’s strong potential for investment. This backlog is a positive sign for the company’s financial outlook, as it suggests that there is an increasing demand for their services. With the right strategy, Charge Enterprises could capitalize on this trend and generate a return for investors.

The company’s financial position, including its cash flow, liquidity, and debt levels, should also be closely monitored to determine whether an investment in the company is prudent. With the right analysis, Charge Enterprises could be an attractive option for investors.

Recent Posts