Caprock Group LLC Reduces Stake in Steel Dynamics,

January 3, 2024

☀️Trending News

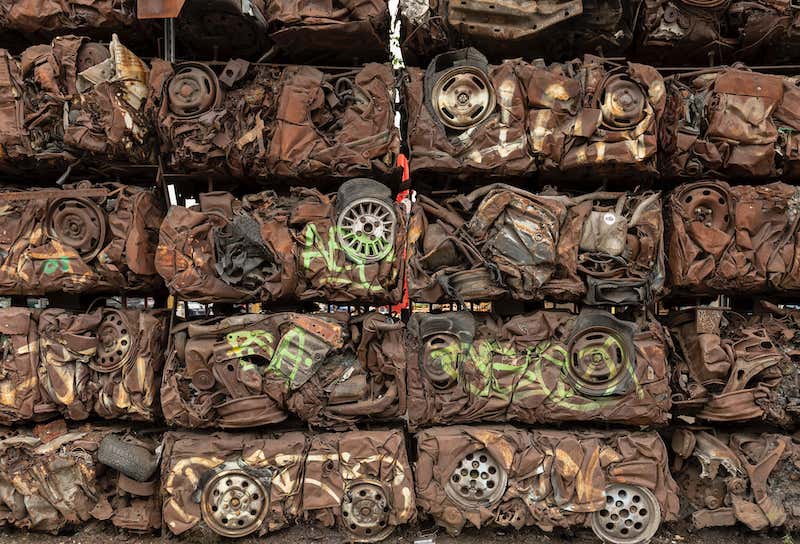

It has been reported that Caprock Group LLC has recently reduced its stake in Steel Dynamics ($NASDAQ:STLD), Inc. (NASDAQ: STLD), a leading American metals and materials processing company. Steel Dynamics is a producer of steel products, such as flat rolled steel, steel beams, angles, and merchant bars, as well as other metal products like aluminum and copper. It also produces recycled ferrous and non-ferrous metals products. The company operates through more than twenty facilities across the U.S. and has a presence in Canada, Mexico, and the Caribbean. Caprock Group LLC is a private equity firm that focuses on investments in the metals and materials industry.

This news follows a string of positive developments in the company’s fortunes. It also reported strong steel shipments and a record backlog for its flat rolled steel segment. With its strong financials and positive outlook, Steel Dynamics Inc. looks primed to continue growing in the near future.

Market Price

On Tuesday, Steel Dynamics, Inc. (STEEL DYNAMICS) saw its stock open at $117.8 and close at $118.9, a 0.7% increase from its previous closing price of 118.1. The stock’s performance and overall outlook remain strong despite Caprock’s exit from the company, suggesting that investors are confident in STEEL DYNAMICS’ long-term prospects. As such, STEEL DYNAMICS could continue to see positive returns in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Steel Dynamics. More…

| Total Revenues | Net Income | Net Margin |

| 19.39k | 2.66k | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Steel Dynamics. More…

| Operations | Investing | Financing |

| 3.8k | -1.7k | -1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Steel Dynamics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.93k | 6.07k | 53.69 |

Key Ratios Snapshot

Some of the financial key ratios for Steel Dynamics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.5% | 63.9% | 18.2% |

| FCF Margin | ROE | ROA |

| 11.9% | 25.0% | 14.7% |

Analysis

At GoodWhale, we conducted a financial analysis of STEEL DYNAMICS. Our results show that it falls into the “rhino” classification, indicating that it has achieved moderate revenue or earnings growth. In terms of investor interest, STEEL DYNAMICS has a lot to offer. It has particularly strong assets, dividends, growth, and profitability. Moreover, it has an impressive health score of 10/10, indicating that it is well-equipped to sustain future operations in times of crisis. All of these factors make STEEL DYNAMICS an attractive investment option for many types of investors. More…

Peers

The steel industry is extremely competitive, with Steel Dynamics Inc. facing stiff competition from BCH JSC, KG Dongbusteel, Kalyani Steels Ltd, and other companies. Steel Dynamics Inc. has remained a strong competitor by investing in new technologies and expanding its production capabilities. The company has also been able to keep its costs low by utilizing its large scale and efficient operations.

– BCH JSC ($HNX:BCA)

Dongbu Steel is one of the largest steel manufacturers in South Korea. The company has a market cap of 895.02B as of 2022 and a return on equity of 17.61%. Dongbu Steel produces a wide range of steel products including hot and cold rolled steel, galvanized steel, stainless steel, and more. The company also has a large presence in the global market, with plants and offices in countries such as the United States, China, and India.

– KG Dongbusteel ($KOSE:016380)

Kalyani Steels Ltd is an Indian steel company with a market cap of 13.05 billion as of 2022. The company has a return on equity of 11.27%. The company produces a range of steel products including rebars, wire rods, and merchant products. The company has a strong presence in the Indian market and is expanding its operations in the international market.

Summary

Caprock Group LLC recently reduced its stake in Steel Dynamics, Inc., a steel producer and metals recycler based in the United States. The announcement had a negative impact on the stock price, but the company has many positive attributes that could make it attractive to investors. In conclusion, Steel Dynamics has solid fundamentals and could be an attractive investment for those looking for long-term returns.

Recent Posts