Mario Gabelli Suggests Expansion of Sportsman’s Warehouse Board of Directors

April 29, 2023

Trending News 🌥️

Renowned investor Mario Gabelli recently recommended that Sportsman’s Warehouse ($NASDAQ:SPWH), a premier retailer of sporting goods and apparel, expand its board of directors by adding an additional member. This would make the board more competent to handle the growth and future goals of the company. Sportsman’s Warehouse, Inc., is a leading, full-line retailer of sporting goods and apparel in the United States. Through its online presence, Sportsman’s Warehouse provides a convenient shopping experience to its customers.

The company’s stock is traded on the Nasdaq Global Select Market under the ticker symbol SPWH. Mario Gabelli’s recommendation for Sportsman’s Warehouse to expand its board of directors will help ensure that the company has the expertise and experience to reach its future goals. It will also provide an opportunity to bring in new perspectives and opinions that can help the company grow and succeed in a dynamic retail environment.

Market Price

On Friday, Mario Gabelli, an influential investor in Sportsman’s Warehouse, suggested an expansion of the company’s board of directors. This news sent the stock up 1.1%, opening at $6.2 and closing at $6.2, slightly higher than its prior closing price of $6.2. Gabelli believes that adding experienced individuals to the Sportsman’s Warehouse board of directors will help to drive the company’s growth and success. He has been actively advocating for the company’s expansion and has received support from other investors as well. The board of directors of Sportsman’s Warehouse are currently made up of seven members, including Gabelli himself.

He believes that adding two to three more members to the board would create a better balance of expertise and experience that can help the company progress. The company has not yet responded to Gabelli’s suggestion, but it is likely that an expansion of the board of directors will be considered in the near future. If approved, it could lead to a renewed commitment to making Sportsman’s Warehouse a success and further strengthening their stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sportsman’s Warehouse. More…

| Total Revenues | Net Income | Net Margin |

| 1.4k | 40.52 | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sportsman’s Warehouse. More…

| Operations | Investing | Financing |

| 46.79 | -60.59 | -40.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sportsman’s Warehouse. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 858.96 | 565.85 | 7.81 |

Key Ratios Snapshot

Some of the financial key ratios for Sportsman’s Warehouse are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.4% | 20.2% | 4.1% |

| FCF Margin | ROE | ROA |

| -1.2% | 12.6% | 4.2% |

Analysis

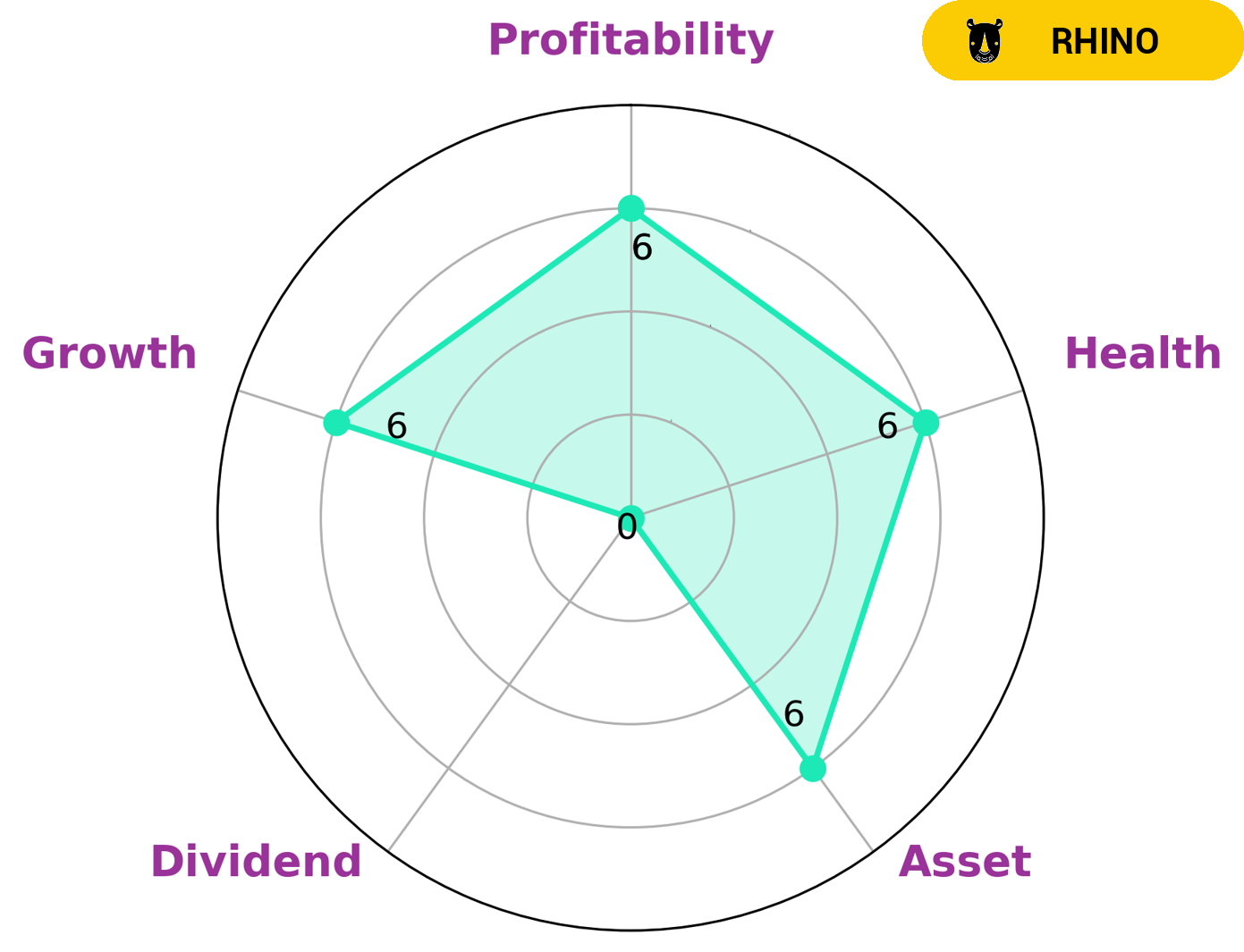

At GoodWhale, we analyzed the financials of SPORTSMAN’S WAREHOUSE and found that its intermediate health score of 6/10 with regard to its cashflows and debt is likely to sustain future operations in times of crisis. We found that SPORTSMAN’S WAREHOUSE is strong in medium in asset, growth, profitability and weak in dividend. After analyzing the data, we have classified SPORTSMAN’S WAREHOUSE as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. We believe that investors who appreciate stability and moderate growth may be interested in SPORTSMAN’S WAREHOUSE. We recommend that those investors consider their goals and objectives before investing in this company to make sure it fits with their investment strategy. Additionally, investors should consider other factors such as management, competitive landscape, and any related risks before making an investment decision. More…

Peers

Headquartered in Midvale, Utah, the company operates over 90 stores across the United States. Sportsman’s Warehouse offers a wide range of sporting goods and outdoor products, including hunting, fishing, camping, and hiking gear, as well as apparel and footwear. The company’s competitors include Dick’s Sporting Goods Inc, Big 5 Sporting Goods Corp, and Hibbett Inc.

– Dick’s Sporting Goods Inc ($NYSE:DKS)

Dicks Sporting Goods is an American sporting goods retailer headquartered in Coraopolis, Pennsylvania. The company was founded in 1948 by Richard “Dick” Stack. As of 2019, it operates more than 850 stores in 47 states. The company offers a wide range of products, including apparel, footwear, and equipment for sports and fitness activities.

– Big 5 Sporting Goods Corp ($NASDAQ:BGFV)

Big 5 Sporting Goods Corp is a retailer of sporting goods and apparel in the United States. The company has a market cap of 280.08M as of 2022 and a Return on Equity of 19.14%. The company operates stores under the Big 5 Sporting Goods, Big 5 Sporting Goods Outlet, and Big 5 Trading Post banners. The company offers a wide variety of products, including athletic shoes, apparel, and accessories, as well as a variety of outdoor and recreational equipment.

– Hibbett Inc ($NASDAQ:HIBB)

Hibbett, Inc. is a publicly traded company with a market capitalization of 780.18 million as of 2022. The company operates in the retail sector and focuses on selling sporting goods and apparel. Hibbett has a return on equity of 27.86%.

Summary

Investment analysis of Sportsman’s Warehouse has suggested by Mario Gabelli that the company should add a board member to its team. This comes as part of a strategy to strengthen the company’s corporate governance, as well as to increase shareholder value. Gabelli believes adding a dedicated board member will help the company better align itself with its goals and objectives.

Additionally, the board could provide valuable insights when making decisions related to Capital expenditures, expanding product lines, and mergers and acquisitions. It is expected that this will help Sportsman’s Warehouse better capitalize on opportunities in the competitive retail industry.

Recent Posts