MarineMax, Experiences a Drop in Shares Held by Exchange Traded Concepts LLC

April 5, 2023

Trending News 🌥️

MARINEMAX ($NYSE:HZO): MarineMax, Inc., an industry leader in the boating and marine retail industry, recently experienced a drop in shares held by Exchange Traded Concepts LLC. Following the drop, Exchange Traded Concepts now owns only 958 shares of MarineMax’s stock. The company also offers its customers financing, insurance, and extended warranty options, as well as a variety of used and new boats and yachts.

Additionally, MarineMax operates marinas and provides charters for its customers. With its strong presence in the market and its variety of services, MarineMax is well-positioned to continue to see growth and success in the years to come.

Price History

This marked a significant decrease in the stock of MarineMax, Inc. since the previous day’s close, as investors started to express their concerns about the future of the company. This report is a reminder of the importance of staying up to date with the market and monitoring any changes in stocks that may have an impact on investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Marinemax. MarineMax_Experiences_a_Drop_in_Shares_Held_by_Exchange_Traded_Concepts_LLC”>More…

| Total Revenues | Net Income | Net Margin |

| 2.34k | 181.74 | 7.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Marinemax. MarineMax_Experiences_a_Drop_in_Shares_Held_by_Exchange_Traded_Concepts_LLC”>More…

| Operations | Investing | Financing |

| -87.78 | -546.36 | 596.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Marinemax. MarineMax_Experiences_a_Drop_in_Shares_Held_by_Exchange_Traded_Concepts_LLC”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.11k | 1.3k | 37.18 |

Key Ratios Snapshot

Some of the financial key ratios for Marinemax are shown below. MarineMax_Experiences_a_Drop_in_Shares_Held_by_Exchange_Traded_Concepts_LLC”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.7% | 55.9% | 10.9% |

| FCF Margin | ROE | ROA |

| -5.7% | 19.9% | 7.5% |

Analysis

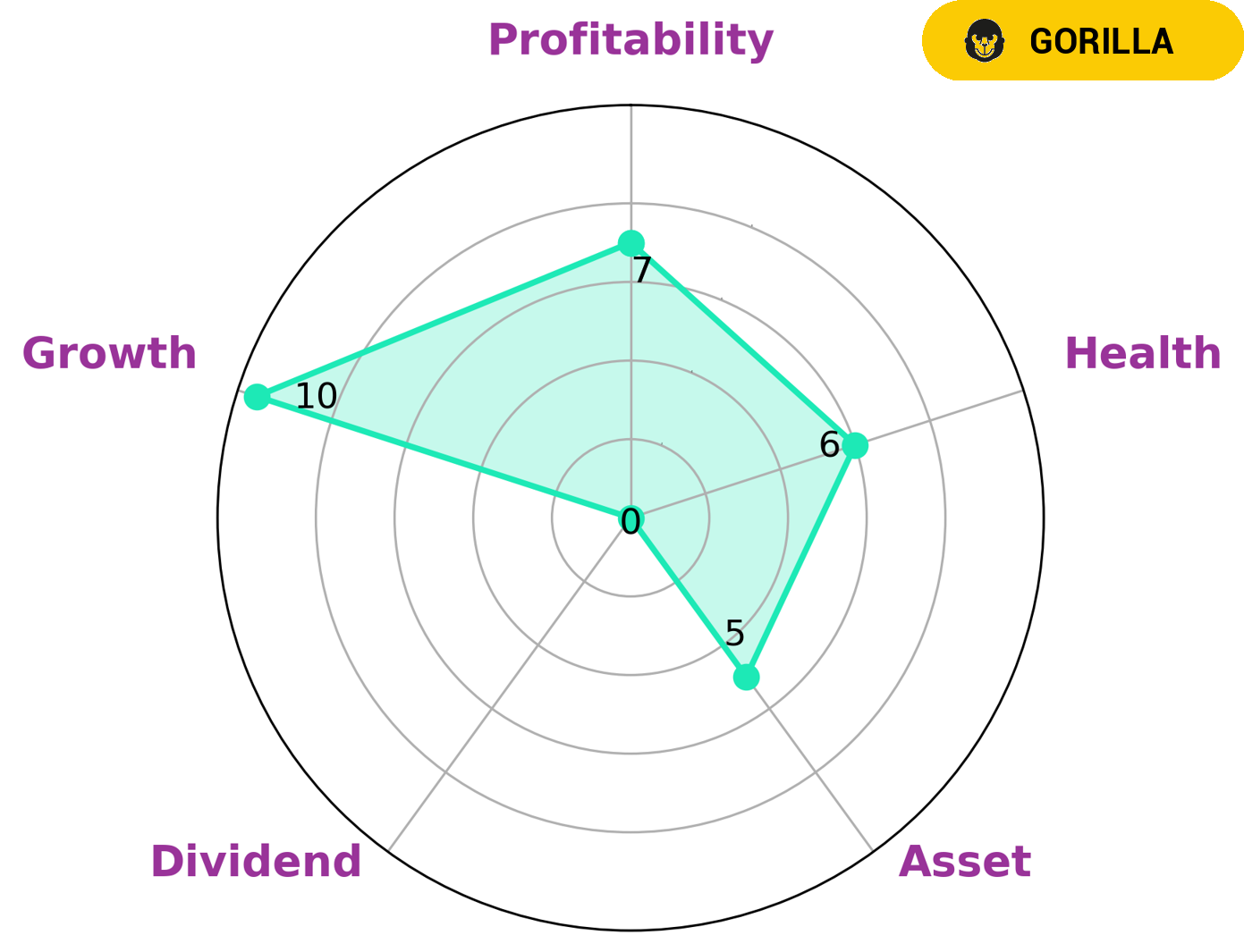

At GoodWhale, we conducted an analysis of MARINEMAX‘s fundamentals. Our Star Chart showed that the company had strong growth and profitability metrics, medium asset metrics, and weak dividend metrics. We also found that it has an intermediate health score of 6 out of 10 considering its cashflows and debt, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. MARINEMAX was classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in investing in a company with strong growth metrics and a strong competitive advantage may be interested in MARINEMAX. Those looking for a steady dividend may want to look elsewhere, however. Overall, MARINEMAX looks to be a promising investment opportunity for those looking for growth potential and an established competitive advantage. More…

Peers

MarineMax Inc is one of the largest recreational boat and yacht retailers in the United States with 63 locations. The company operates in 20 states and sells new and used recreational boats, including pleasure boats, sport boats, and fishing boats, from brands such as Sea Ray, Boston Whaler, Meridian, Hatteras, Azimut Yachts, Ocean Alexander, Galeon Yachts, Grady-White, Harris, Bennington, Crest, MasterCraft, Nautique, Scarab, Scout, Sailfish, Sea Pro, Sportsman, Tahoe, Hurricane, Key West, Regal, Riviera, and Sanpan. MarineMax also offers yacht charters and related services. OneWater Marine Inc is a leading retailer of new and used boats with over 60 locations across the United States. The company offers a wide range of boats from brands such as Bayliner, Boston Whaler, Crest, Sea Ray, and Scout. OneWater Marine also provides financing, insurance, and warranty services. Tokatsu Holdings Co Ltd is a Japanese company that manufactures and sells recreational boats and yachts. Tokatsu Holdings Co Ltd operates in Japan and North America. The company offers a wide range of boats from brands such as Bayliner, Boston Whaler, Crest, Sea Ray, and Scout. Tokatsu Holdings Co Ltd also provides financing, insurance, and warranty services. Lazydays Holdings Inc is one of the largest recreational vehicle dealerships in the United States with locations in Arizona, Colorado, Florida, Georgia, Kansas, Minnesota, Nebraska, Nevada, New Hampshire, New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, and Texas. Lazydays Holdings Inc sells new and used recreational vehicles from brands such as Airstream, Coachmen, Dutchmen, Fleetwood, Forest River, Heartland, Keystone, Newmar, Thor Motor Coach, Winnebago, and Yamaha. Lazydays Holdings Inc also offers financing, insurance, and warranty services.

– OneWater Marine Inc ($NASDAQ:ONEW)

As of 2022, OneWater Marine Inc has a market cap of 470.77M and a Return on Equity of 38.97%. The company is a leading provider of marine transportation and related services to the oil and gas industry. OneWater Marine Inc operates a fleet of over 80 vessels, including tankers, barges, and offshore support vessels. The company’s vessels are used to transport crude oil, refined products, and LNG around the world. OneWater Marine Inc is headquartered in Houston, Texas.

– Tokatsu Holdings Co Ltd ($TSE:2754)

Tokatsu Holdings Co Ltd is a Japanese company that specializes in the manufacture and sale of construction machinery and equipment. The company has a market capitalization of 1.65 billion as of 2022 and a return on equity of 5.23%. Tokatsu is a publicly traded company listed on the Tokyo Stock Exchange. The company was founded in 1948 and is headquartered in Tokyo, Japan. Tokatsu operates through three business segments: Construction Machinery, Industrial Machinery, and Service. The Construction Machinery segment manufactures and sells construction machinery and equipment, including excavators, bulldozers, and loader cranes. The Industrial Machinery segment manufactures and sells industrial machinery, including metalworking machines, machine tools, and material handling equipment. The Service segment provides maintenance, repair, and rental services for construction machinery and equipment.

– Lazydays Holdings Inc ($NASDAQ:LAZY)

Lazydays Holdings Inc is a publicly traded company that owns and operates the largest RV dealership in the United States. The company has a market capitalization of 149.85 million as of 2022 and a return on equity of 33.42%. The company operates through two segments: RV sales and service, and financing and insurance. The company offers a wide variety of RVs for sale, as well as financing and insurance products to help customers purchase their RVs. In addition, the company provides service and repair services for RVs.

Summary

MarineMax (NYSE:HZO) is an attractive investment option due to its strong financials and attractive valuation. This suggests that the company is performing well and is viewed favorably among investors. MarineMax has an impressive balance sheet with low debt levels and good cash flow. Over the past several years, the company has reported strong quarterly earnings. The stock is currently trading at a reasonable price-to-earnings (P/E) ratio, making it an attractive investment opportunity.

Additionally, MarineMax has been able to expand its product offering, providing increased potential for future growth. Overall, MarineMax is an attractive investing option and worth considering for investors interested in this sector.

Recent Posts