Investors Take Note: Lands’ End, Stock Jumps 9.21% This Week in Specialty Retail Field

January 18, 2023

Trending News 🌥️

Lands’ End ($NASDAQ:LE), Inc. is a leading specialty retailer of clothing and home goods. Investors have been delighted by Lands’ End, Inc.’s stock performance this week, with the company’s shares rising by 9.21%. This increase has been particularly impressive given the current economic climate, which has seen many other companies struggle. These positive trends are further bolstered by Lands’ End, Inc.’s strong financial position.

The company has no debt and a healthy balance sheet, which gives it the flexibility to invest in growth initiatives. This strong financial position has allowed the company to invest in new products, expand its online presence, and launch new marketing campaigns. The company’s strong financial position and customer loyalty indicate that it is well-positioned to continue to grow and succeed in the future.

Share Price

On Wednesday, the stock opened at $9.0 per share and closed at $9.1, a 1.9% increase from its last closing price of $8.9. The company has also announced plans to focus more heavily on e-commerce operations and digital marketing strategies, leading to higher customer engagement and sales. Lands’ End recently launched a new loyalty program, which is expected to drive more customers to the brand and further boost revenue. These strong financial results and aggressive expansion initiatives have investors feeling optimistic about the future of the company.

Lands’ End is well-positioned to take advantage of the current retail environment and continue its growth trajectory. Investors are encouraged to take note of this positive news and consider buying into the company’s stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lands’ End. More…

| Total Revenues | Net Income | Net Margin |

| 1.58k | -2.12 | -0.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lands’ End. More…

| Operations | Investing | Financing |

| -49.07 | -26.95 | 66.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lands’ End. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.21k | 827.4 | 11.68 |

Key Ratios Snapshot

Some of the financial key ratios for Lands’ End are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.1% | -6.9% | 1.9% |

| FCF Margin | ROE | ROA |

| -4.8% | 4.7% | 1.5% |

VI Analysis

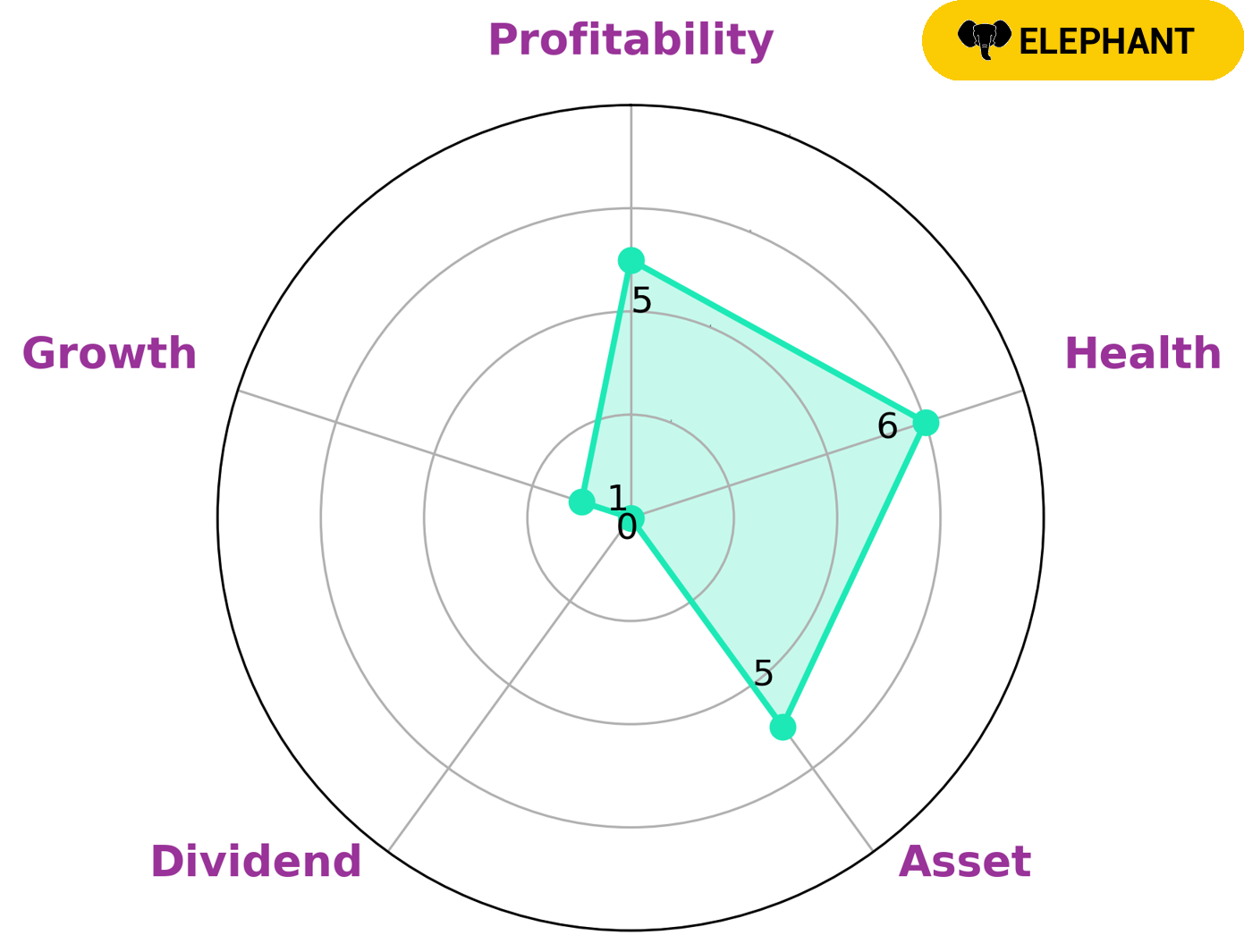

For those interested in gauging a company’s long-term potential, the VI app provides a simple analysis of Lands’ End’s fundamentals. According to the VI Star Chart, Lands’ End is strong in its asset management, medium in both profitability and dividend, and weak in growth. In terms of overall health, Lands’ End has an intermediate score of 6/10, indicating that it may be able to sustain future operations even in times of crisis. Lands’ End is classified as an “elephant”, which is a type of company that boasts a wealth of assets after deducting liabilities. Investors who are looking for a company with a strong asset base, but with some room for growth, may be drawn to Lands’ End. The company’s medium scores in profitability and dividends may also appeal to those looking for a steady income. As with any investment, potential investors should conduct further research before committing to any particular stock. More…

VI Peers

In the retail sector, competition is fierce. Many companies are vying for the same market share, and Lands’ End Inc is no exception. Its main competitors are Movado Group Inc, Vaibhav Global Ltd, and LL Flooring Holdings Inc. All of these companies are large and well-established in the industry. They all offer similar products and services, and they all compete for the same customers.

– Movado Group Inc ($NYSE:MOV)

Movado Group Inc is a company that designs, manufactures, and markets watches and jewelry. The company has a market cap of 738.32M as of 2022 and a Return on Equity of 18.27%. Movado Group Inc designs, manufactures, and markets watches and jewelry under the Movado, Concord, Ebel, ESQ, Coach, Hugo Boss, Juicy Couture, Lacoste, Tommy Hilfiger, and HUGO BOSS brands. The company was founded in 1881 and is headquartered in New York, New York.

– Vaibhav Global Ltd ($BSE:532156)

The company’s market capitalization is $57.23 billion as of 2022 and its return on equity is 10.1%. The company is engaged in the business of providing global financial services.

– LL Flooring Holdings Inc ($NYSE:LL)

LVL flooring Holdings Inc is a publicly traded company with a market cap of 225.6 million as of 2022. The company’s return on equity is 7.43%. LVL Flooring produces and sells laminate flooring products under the LVL Flooring brand name. The company offers a variety of laminate flooring products, including planks, tiles, and sheets. LVL Flooring’s products are sold through a network of retailers and distributors in the United States, Canada, and Europe.

Summary

Lands’ End Inc. has seen an impressive 9.21% increase in stock prices this week, making it an attractive option for investors. This growth can be attributed to the company’s success in the specialty retail market and its focus on providing quality apparel and home products. Analysts believe that the company’s financials and competitive position are strong, and that its strong brand and customer loyalty will continue to drive future growth. As a result, Lands’ End Inc. is a wise investment choice for those looking to take advantage of the current market conditions.

Recent Posts