BGFV Intrinsic Value – Big 5 Sporting Goods Stock Market Alert Predicts Profitable Call Option with Strike Price of $10

April 29, 2023

Trending News ☀️

Big 5 Sporting ($NASDAQ:BGFV) Goods is a leading sporting goods retailer in the United States, offering a wide selection of quality products for the active lifestyle at competitive prices. On April 27th, 2023, Big 5 Sporting Goods issued a stock market alert regarding a call option with a strike price of $10. This alert predicted a profitable call option for investors, as well as giving insight into the company’s overall financial situation. According to the alert, by investing in this option, investors would be able to make a profit from the potential increase in the company’s share value.

The alert also provided information about the company’s financial stability and the potential for future growth. The stock market alert issued by Big 5 Sporting Goods on April 27th, 2023 was seen as a positive sign for investors looking to capitalize on the company’s potential. The call option with a strike price of $10 provided a potentially lucrative opportunity to make a profit while also gaining insight into the company’s financial situation.

Stock Price

This prediction follows the company’s stock opening on Friday at $7.7 and closing at $7.9, an increase of 2.2% from their last closing price. This news has led to optimism among investors, who now see a potential for profits if they act quickly.

However, the sudden resurgence in stock prices indicates that investors may be betting on a quick turnaround for the company in the near future. These positive sentiments have led many analysts to recommend that investors consider buying call options with a strike price of $10. This means that if the stock price remains above $10 when the option expires, investors will be able to make a profit from their investment. While the potential profits from this strategy are not guaranteed, it does provide a unique opportunity for investors looking to capitalize on Big 5 Sporting Goods’ current market situation. If they act quickly, they may be able to take advantage of this potentially lucrative opportunity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BGFV. More…

| Total Revenues | Net Income | Net Margin |

| 995.54 | 26.13 | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BGFV. More…

| Operations | Investing | Financing |

| -28.44 | -13.18 | -30.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BGFV. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 708.79 | 440.01 | 12.12 |

Key Ratios Snapshot

Some of the financial key ratios for BGFV are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.0% | 31.2% | 3.4% |

| FCF Margin | ROE | ROA |

| -4.2% | 7.7% | 3.0% |

Analysis – BGFV Intrinsic Value

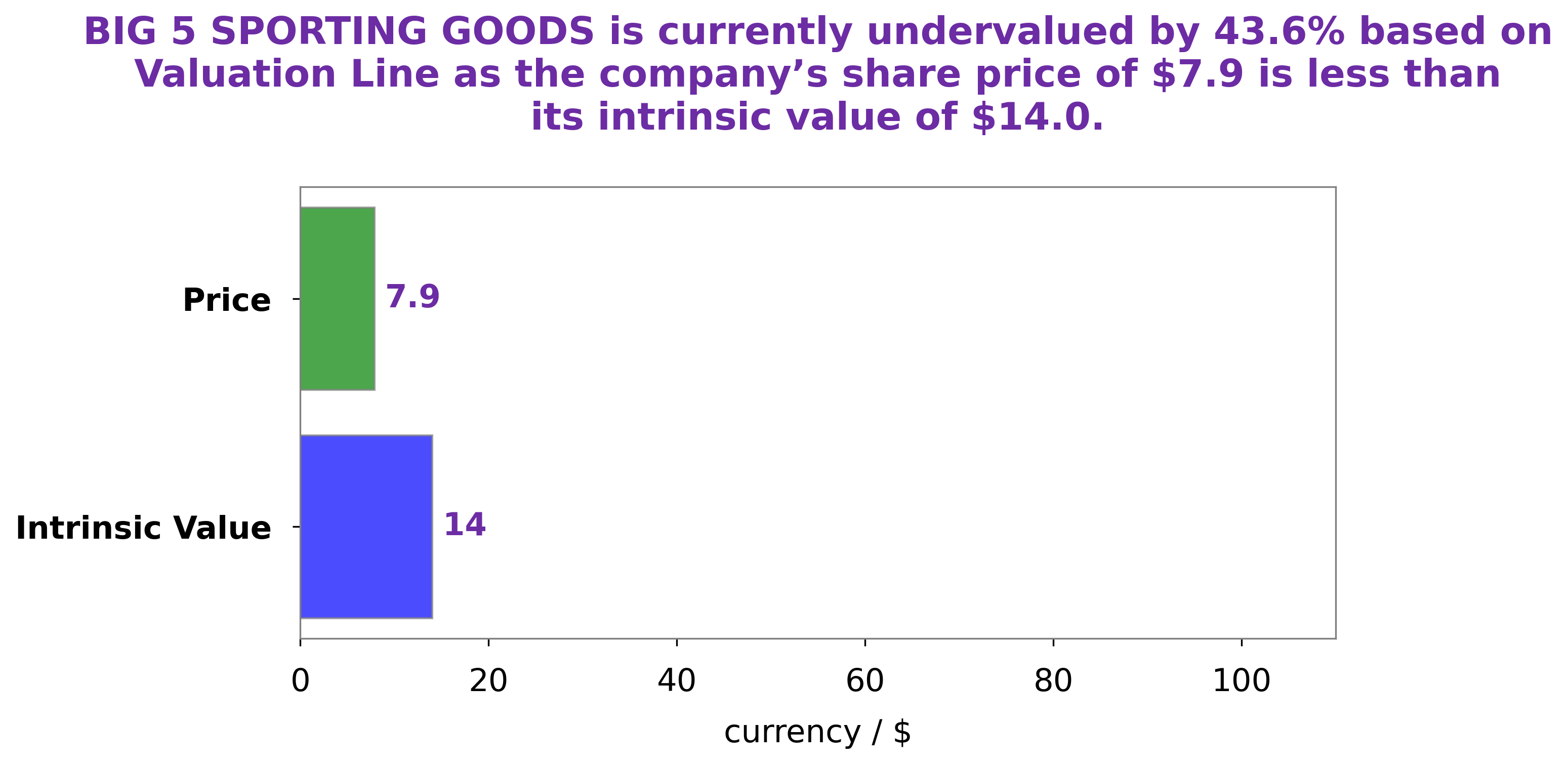

We have used our proprietary Valuation Line to assess the fair value of the company, and have determined that the fair value of BIG 5 SPORTING GOODS shares is around $14.0. Therefore, investors should consider taking advantage of this opportunity to purchase shares in BIG 5 SPORTING GOODS at a discounted price. More…

Peers

In the world of sporting goods, there is intense competition among the big players. Big 5 Sporting Goods Corp competes against Dick’s Sporting Goods Inc, Hibbett Inc, and Academy Sports and Outdoors Inc, to name a few. Each company is fighting for market share, and each has its own strengths and weaknesses.

– Dick’s Sporting Goods Inc ($NYSE:DKS)

Dicks Sporting Goods Inc is an American sporting goods retailer headquartered in Coraopolis, Pennsylvania. The company was founded in 1948 by Richard “Dick” Stack. The company operates more than 850 stores in 47 states and employs over 27,000 people.

The company’s market cap is 8.73B as of 2022 and its ROE is 48.91%. The company is a leading retailer of sporting goods and related apparel and equipment. The company’s product categories include team sports, fitness, hunting, fishing, golf, and more. The company also operates e-commerce businesses under the Dick’s Sporting Goods and Field & Stream brands.

– Hibbett Inc ($NASDAQ:HIBB)

Hibbett Sports, Inc. is a publicly traded company with a market capitalization of $750.08 million as of March 2022. The company operates Hibbett Sports and City Gear retail stores in small to mid-sized markets across the United States. Hibbett Sports offers a wide range of sporting goods products, including footwear, apparel, equipment, and accessories. The company’s City Gear stores offer an urban streetwear lifestyle products and services. Hibbett Sports reported a return on equity of 27.86% for the fiscal year ended January 31, 2022.

Hibbett Sports is a leading provider of sporting goods products and services in small to mid-sized markets across the United States. The company operates Hibbett Sports and City Gear retail stores. Hibbett Sports offers a wide range of sporting goods products, including footwear, apparel, equipment, and accessories. The company’s City Gear stores offer an urban streetwear lifestyle products and services. Hibbett Sports reported a return on equity of 27.86% for the fiscal year ended January 31, 2022.

– Academy Sports and Outdoors Inc ($NASDAQ:ASO)

Academy Sports and Outdoors Inc is an American sporting goods retailer with over 250 stores across the United States. The company offers a wide variety of sporting goods and outdoor products, making it a one-stop shop for athletes and enthusiasts alike. Academy Sports and Outdoors Inc has a market cap of 3.56B as of 2022, a Return on Equity of 36.08%. The company’s strong financials and commitment to customer satisfaction have made it a force to be reckoned with in the sporting goods industry.

Summary

Investors may want to consider buying a call option with a strike price of $10 for Big 5 Sporting Goods. The option is set to expire on April 27th, 2023. An analysis of the company’s financials indicates that it has a healthy balance sheet and has seen increasing sales and profits over the past several quarters.

Additionally, the company has a strong track record of returning value to shareholders through dividends and share buybacks. Investors should carefully consider the risks associated with any investment in Big 5 before making a decision.

Recent Posts