ASO Stock Intrinsic Value – Academy Sports and Outdoors Misses Earnings and Revenue Expectations

June 7, 2023

🌧️Trending News

Revenue of $1.38B also fell short of the predicted amount by $60M. With stores operating at reduced capacity and fewer customers visiting their stores, Academy ($NASDAQ:ASO) Sports and Outdoors experienced a decline in sales. This was further compounded by high inventory levels and disruption to its supply chain caused by the pandemic. Same-store sales also rose 1% year-over-year, indicating that the company was able to partially offset its losses through online sales.

Additionally, the company also reported that it has implemented cost savings initiatives that should help it better cope with the pandemic going forward.

Earnings

In its earning report of FY2023 Q4 as of January 31 2021, ACADEMY SPORTS AND OUTDOORS reported total revenue of 1597.44M USD and net income of 91.52M USD. This marks a decrease of 11.7% in total revenue and 35.4% in net income compared to the same quarter last year. Despite this decrease, the company has managed to grow from a total revenue of 1597.44M USD to 1746.5M USD in the last 3 years. As a result, ACADEMY SPORTS AND OUTDOORS has missed its earning and revenue expectations for this quarter.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ASO. More…

| Total Revenues | Net Income | Net Margin |

| 6.4k | 628 | 9.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ASO. More…

| Operations | Investing | Financing |

| 552 | -108.81 | -592.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ASO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.6k | 2.97k | 21.23 |

Key Ratios Snapshot

Some of the financial key ratios for ASO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.8% | 67.7% | 13.5% |

| FCF Margin | ROE | ROA |

| 6.9% | 33.9% | 11.8% |

Share Price

In after-hours trading, their stock opened at $47.3 and closed at $49.4, up by 1.8% from its prior closing price of 48.5. This was the second consecutive quarter that ASO fell short of earnings estimates. These results reflect the challenging retail environment that many retailers have faced in recent months due to increased competition and changing consumer habits. Despite missing expectations, ASO remains hopeful for the future of the company.

They have made investments in their digital capabilities, which has allowed them to reach new customers and expand their reach. They have also been focused on expanding their product offerings, which they believe will help them attract more customers. Live Quote…

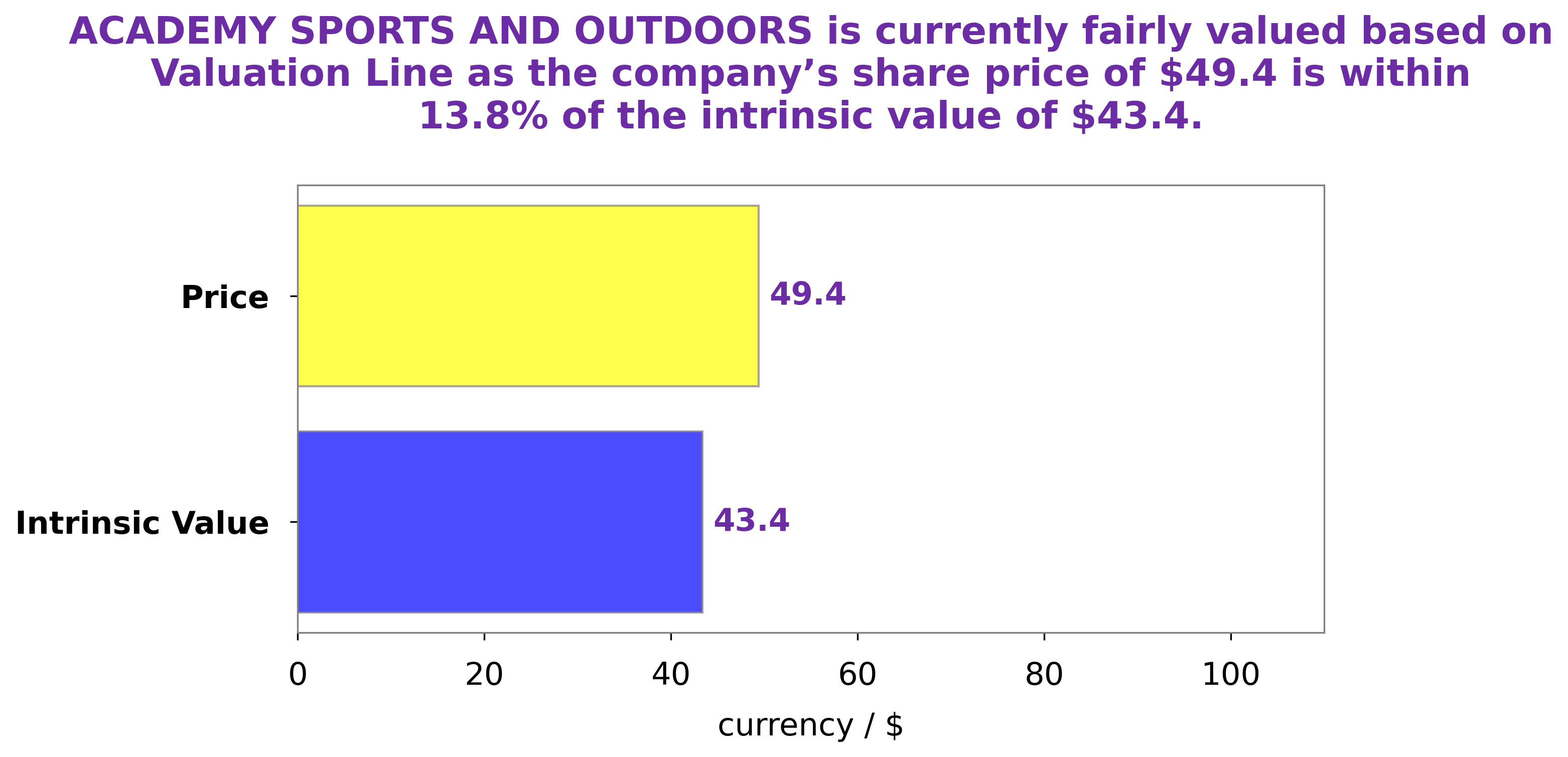

Analysis – ASO Stock Intrinsic Value

At GoodWhale, we have analyzed ACADEMY SPORTS AND OUTDOORS’s financials to be able to provide our users with an accurate valuation of the stock. Through our proprietary Valuation Line, we have determined that the intrinsic value of ACADEMY SPORTS AND OUTDOORS share is around $43.4. This means that, as of right now, the current price of $49.4 is a fair price but overvalued by 13.7%. This means that investors should carefully consider their decision to invest in ACADEMY SPORTS AND OUTDOORS stock at this time. More…

Peers

The company offers a wide range of products for a variety of sports and outdoor activities, including hunting, fishing, camping, and more. Academy Sports and Outdoors Inc competes with XXL ASA, Danang Books And School Equipment JSC, and Book And Education Equipment Jsc.

– XXL ASA ($BER:2XX)

The company’s market cap is 104.96M as of 2022 and its ROE is -1.76%. The company is a provider of internet services.

Summary

Academy Sports and Outdoors reported their non-GAAP earnings per share (EPS) of $1.30, which was $0.34 below the expected amount. Revenue was reported at $1.38 billion, missing the expected figure by $60 million. This could be a discouraging sign for investors, as it suggests the company is seeing slower than anticipated financial growth.

However, it is important to consider current market conditions when assessing the performance of Academy Sports and Outdoors. If the current economic climate is impacting the company’s ability to meet its targets, investors may decide to remain in or make a new investment in ACADEMY SPORTS AND OUTDOORS.

Recent Posts