SKELLERUP HOLDINGS Demonstrates Exceptional Skill in Capital Allocation

April 8, 2023

Trending News 🌥️

Skellerup Holdings ($NZSE:SKL) is a New Zealand-based diversified manufacturer and marketer of industrial and agricultural products. Skellerup is renowned for its exceptional skill in capital allocation. The company utilizes a disciplined approach to capital allocation, with a focus on finding opportunities to create value for shareholders. Skellerup typically uses a combination of strategic investments, organic growth, and divestments to bring about value creation. It also explores potential acquisitions where these could help the company to expand its product portfolio or geographic footprint.

In addition, Skellerup is active in stock buybacks, with an objective to maximize returns to shareholders. This allows the company to have financial flexibility in seeking out opportunities for value creation. Furthermore, it enables Skellerup to maintain relationships with lenders and financial institutions that can provide capital for acquisitions or other strategic initiatives. Skellerup Holdings is an excellent example of how effective capital allocation can help a company create value for its shareholders. With a disciplined approach to capital allocation and a strong balance sheet, Skellerup has been able to consistently generate returns for its shareholders over the long run.

Share Price

Friday marked a successful day for SKELLERUP HOLDINGS, as the stock opened at NZ$5.1 and closed at NZ$5.2, representing a 2.5% increase from the last closing price of NZ$5.1. This marked a renewed confidence in the company’s ability to successfully allocate capital, a key factor in driving growth and profitability. SKELLERUP HOLDINGS has demonstrated strong financial performance and efficient capital allocation strategies over the years, which have been rewarded by investors. The company’s high return on equity and solid balance sheet are evidence of its ability to effectively allocate resources.

This has allowed the company to continue to generate value for shareholders and remain competitive in the market. As the company continues to make smart investments, it is likely that investor confidence in the company will remain high. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Skellerup Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 331.88 | 47.58 | 14.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Skellerup Holdings. More…

| Operations | Investing | Financing |

| 43.84 | -11.27 | -33.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Skellerup Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 339.62 | 130.5 | 1.07 |

Key Ratios Snapshot

Some of the financial key ratios for Skellerup Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.8% | 13.7% | 20.1% |

| FCF Margin | ROE | ROA |

| 10.0% | 19.8% | 12.3% |

Analysis

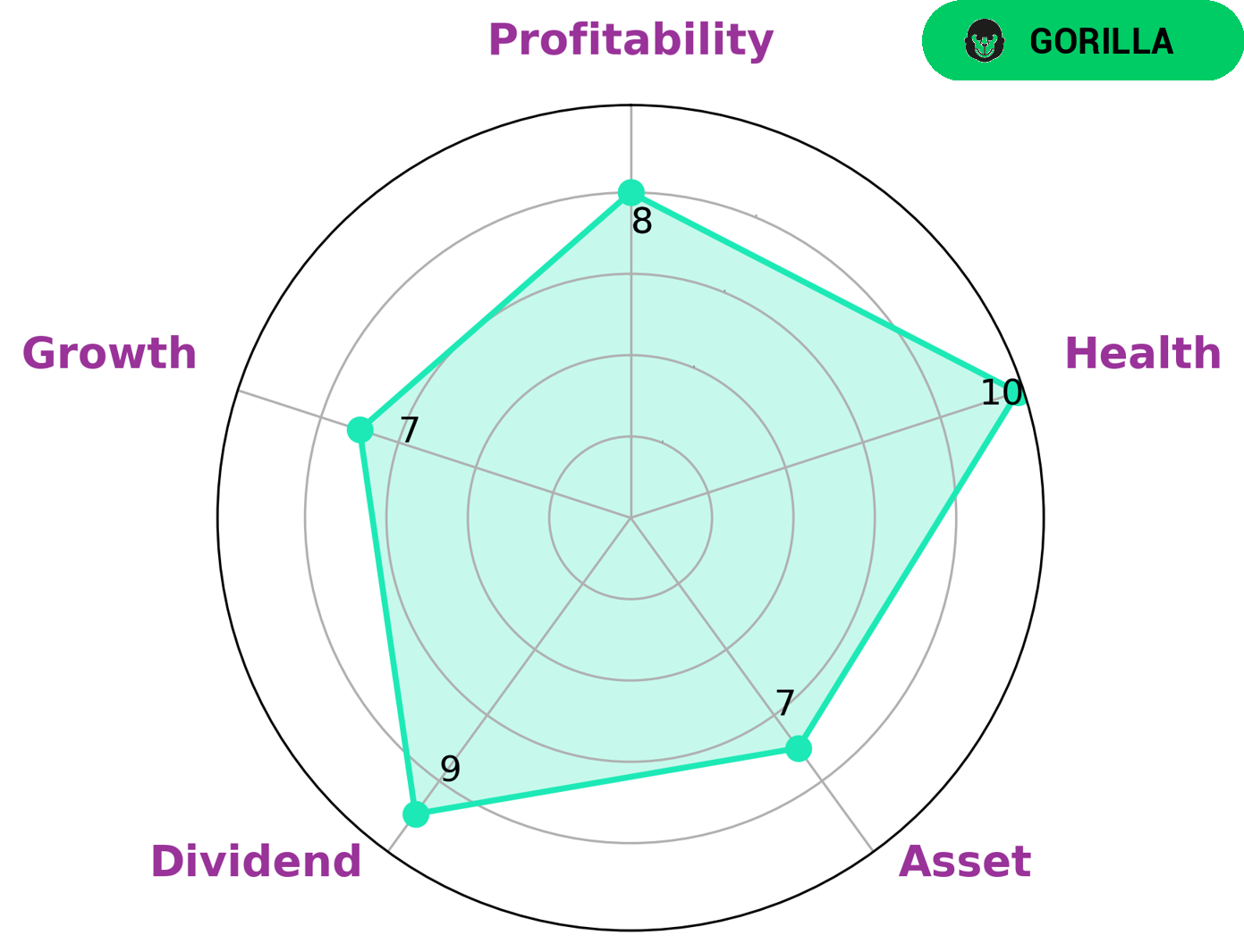

GoodWhale has performed an analysis on the fundamentals of SKELLERUP HOLDINGS and the results show that SKELLERUP HOLDINGS is strong in asset, dividend, growth, and profitability, as indicated by our Star Chart. Furthermore, SKELLERUP HOLDINGS has a high health score of 10/10. This indicates that the company is capable of riding out any financial crisis without the risk of bankruptcy. Moreover, we have classified SKELLERUP HOLDINGS as a ‘gorilla’, a type of company that exhibits stable and high revenue and earning growth due to its strong competitive advantage. We believe that this type of company would be of interest to any investor looking for a safe and profitable long-term investment. More…

Peers

Skellerup Holdings Ltd is engaged in a fierce competition with its competitors such as Kardex Holding AG, Serco Group PLC, OC Oerlikon Corp AG and Pfaffikon. All these companies are vying for the top spot in their respective industries and are determined to gain a competitive edge over each other. In this battle for market share, Skellerup Holdings Ltd is determined to take advantage of its strengths and outpace its rivals.

– Kardex Holding AG ($LTS:0QOL)

Kardex Holding AG is a Switzerland-based company that specializes in innovative storage and retrieval systems for industrial applications. The company has a market capitalization of 1.17 billion as of 2022, which indicates the value investors place on the company’s stock. Additionally, Kardex Holding AG has a Return on Equity (ROE) of 19.37%. This is a measure of the company’s profitability relative to its shareholder’s equity and signifies that the company is doing well in terms of converting their investments into profits.

– Serco Group PLC ($LSE:SRP)

Serco Group PLC is a British-based international service company that provides a range of services to organizations and governments across the globe. Some of its services include technology, defense, justice, immigration, transport and health. The company has a market cap of 1.82B as of 2022, making it one of the largest companies in the UK. It also has an impressive Return on Equity (ROE) of 13.58%, which is higher than the industry average of 10%. This indicates that the company is managing its assets and liabilities efficiently and is generating high returns on its equity investments. Serco Group PLC is well positioned to grow and expand in the future.

– OC Oerlikon Corp AG, Pfaffikon ($LTS:0QO3)

Oerlikon Corporation AG, Pfaffikon is a Swiss high-tech engineering group specializing in machine and plant engineering, as well as advanced materials. With a market capitalization of 1.95 billion in 2022, the company is one of the largest Swiss industrial companies. The return on equity of 12.24% reflects the company’s ability to generate profits from its investments and is indicative of its financial strength. Oerlikon is known for its cutting-edge technologies and products, which are used across many industries, including aerospace, automotive, energy, medical, and textiles. The company has a presence in more than 30 countries and over 11,000 employees worldwide.

Summary

Skellerup Holdings is a New Zealand based company with a long history of successful capital allocation. Through careful investing, the company has achieved impressive returns, demonstrating their excellence in understanding the markets and their own businesses. The company’s management team is experienced, making wise decisions with regards to how to allocate resources for optimal returns. Skellerup Holdings has consistently generated higher returns than many of its peers, largely due to its ability to identify high-valued investments and execute sound investment strategies.

In addition, the company’s diversified portfolio has enabled it to maintain a steady, sustainable growth rate. The company’s long-term outlook is positive, and investors can look forward to continued success from Skellerup Holdings.

Recent Posts