Gates Industrial Corp PLC Rated ‘Hold’ by Nine Ratings Firms

June 27, 2023

🌥️Trending News

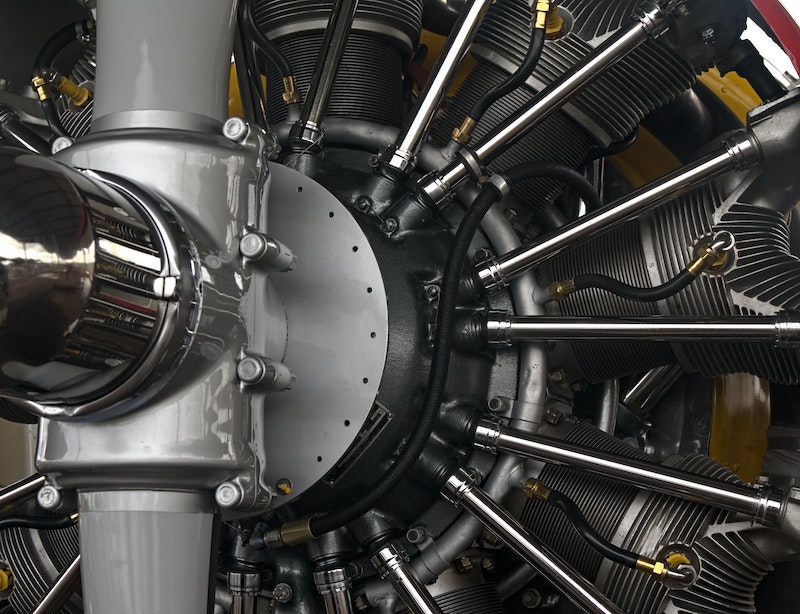

Gates Industrial ($NYSE:GTES) Corp PLC, a leading global manufacturer of fluid power and power transmission solutions, has recently been rated “Hold” by nine ratings firms. This average rating is based on the firm’s current price-earnings (P/E) ratio, earnings growth, and other factors. With headquarters in Denver, Colorado, Gates Industrial Corporation PLC provides innovative products, services, and solutions to customers in nearly every industry. Its innovative portfolio of products includes power transmission products, fluid power products, and solutions that control and monitor the pressure and flow of fluids, as well as other related products. Analysts have expressed their opinion on Gates Industrial Corp PLC’s financial performance. They also believe that its shares are currently overvalued due to the high P/E ratio. With strong revenue growth in recent years and a solid balance sheet, the company has been able to maintain its position as one of the leading industrial companies in the world.

However, the analysts are cautious of the stock due to the high P/E ratio and lack of earnings growth.

Market Price

Nine ratings firms have recently given Gates Industrial Corporation PLC (GATES) a ‘Hold’ rating. On Monday, GATES stock opened at $12.8 and closed at $13.0, up by 1.2% from its previous closing price of 12.8. There has been considerable optimism regarding the company’s performance, however, analysts remain split on the perspective for GATES stock in the future.

The ‘Hold’ rating is seen as an indication that the company is unlikely to experience significant growth or decline in the near future. While the short-term outlook for GATES may be uncertain, it is worth noting that many analysts remain bullish on the company’s long-term prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gates Industrial. More…

| Total Revenues | Net Income | Net Margin |

| 3.56k | 216.3 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gates Industrial. More…

| Operations | Investing | Financing |

| 423.7 | -95.6 | -139.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gates Industrial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.28k | 3.73k | 11.28 |

Key Ratios Snapshot

Some of the financial key ratios for Gates Industrial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.9% | 10.4% | 11.4% |

| FCF Margin | ROE | ROA |

| 9.6% | 8.0% | 3.5% |

Analysis

At GoodWhale, we conducted an analysis of GATES INDUSTRIAL‘s wellbeing and it revealed some interesting insights. Our Risk Rating report showed that GATES INDUSTRIAL falls into the medium risk category when it comes to financial and business aspects. The score indicates that there is room for improvement, but it is not an overly risky investment. We also detected one risk warning in the balance sheet, which suggests that investors should take extra caution. To get more details about this warning and to access our full range of reports, be sure to register on goodwhale.com. More…

Peers

In the industrial sector, there is intense competition between Gates Industrial Corp PLC and its competitors Trelleborg AB, Graco Inc, and Vishal Bearings Ltd. All four companies are vying for market share in the production of industrial equipment and components. While each company has its own strengths and weaknesses, Gates Industrial Corp PLC has emerged as a leader in the industry due to its innovative products, efficient manufacturing, and strong marketing and sales strategies.

– Trelleborg AB ($OTCPK:TBABF)

Trelleborg AB is a Swedish industrial group that develops, manufactures, and sells products and services for a wide range of industries worldwide. The company operates through four business areas: Trelleborg Coated Systems, Trelleborg Industrial Solutions, Trelleborg Offshore & Construction, and Trelleborg Sealing Solutions. Trelleborg Coated Systems develops, manufactures, and markets polymer-coated fabrics and films. Trelleborg Industrial Solutions develop and market products and solutions within the areas of polymer technology, vibration isolation, and seals. Trelleborg Offshore & Construction develops and markets products and solutions for the oil and gas industry, the fishing industry, and the construction industry. Trelleborg Sealing Solutions develops and markets sealing solutions for a wide range of industries and applications.

– Graco Inc ($NYSE:GGG)

Graco Inc. is a publicly traded company with a market capitalization of $11.77 billion as of 2022. The company has a return on equity of 19.47%. Graco Inc. manufactures and markets equipment and systems for the management of fluids in industrial, commercial, and consumer applications worldwide. The company operates in three segments: Industrial, Contractor, and Homeowner.

– Vishal Bearings Ltd ($BSE:539398)

Vishal Bearings Ltd is an Indian company that manufactures and supplies a range of bearings and related products. The company has a market cap of 756.45M as of 2022 and a return on equity of 27.82%. Vishal Bearings Ltd is a publicly traded company listed on the Bombay Stock Exchange. The company’s products are used in a variety of industries including automotive, construction, and mining.

Summary

Gates Industrial Corporation PLC is a global manufacturer of power transmission, fluid power, and motion control products and services. This indicates that the company’s stock is expected to perform in line with the market, but investors should be aware of potential risks. Despite the ratings, investors should consider their individual risk tolerance, goals and financial situation before investing in the company. Analysts recommend that investors research the company’s financials, management team, and competitive landscape before investing.

Recent Posts