Cummins Inc dividend – Cummins Now Offering Attractive Dividends at 3-Year Low Prices

December 21, 2023

☀️Trending News

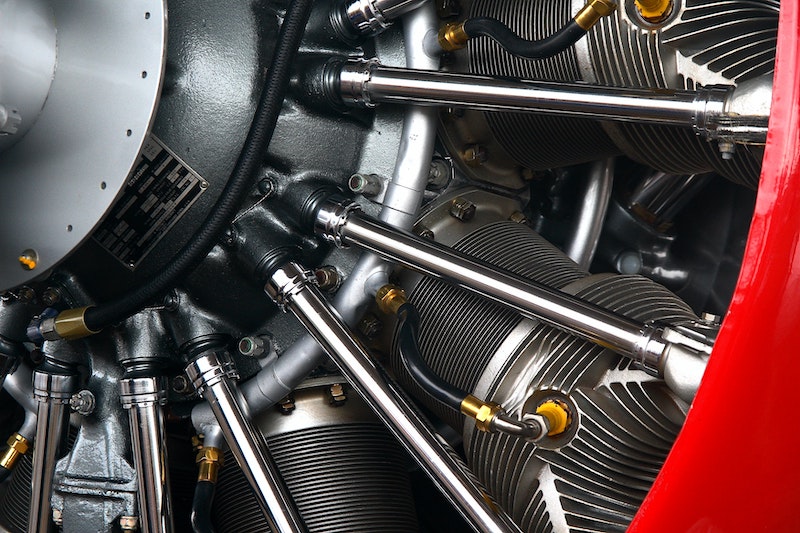

Cummins Inc ($NYSE:CMI)., a global leader in the design, manufacture, distribution and service of diesel and natural gas engines, is now offering attractive dividend payments at their three-year low prices. The company provides power solutions to customers across the globe and has a strong presence in the automotive, construction, power generation, defense, industrial, oil and gas, mining and agriculture industries. The company also manufactures engines for heavy-duty commercial trucks, buses, light-duty vehicles, power generators, construction and mining equipment, and more. Investors can benefit from Cummins’ innovation and experience as their stock price is currently at a three-year low.

With Cummins’ attractive dividend rate and reliable cash flow, it makes for an ideal investment opportunity for those seeking a reliable dividend yield. Cummins’ well-established industry presence and strong financials make it a good option for long-term investments.

Dividends – Cummins Inc dividend

CUMMINS INC has been steadily issuing dividends for the past three years, at 6.39, 6.04, and 5.6 USD per share respectively. This places their dividend yields for 2021-2023 at 2.7%, 2.87%, and 2.31%, which gives an average dividend yield of 2.63%. Thus, if you are looking for an attractive dividend stock, CUMMINS INC may be worth considering.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cummins Inc. More…

| Total Revenues | Net Income | Net Margin |

| 33.29k | 2.8k | 8.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cummins Inc. More…

| Operations | Investing | Financing |

| 3.32k | -1.54k | -1.51k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cummins Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 32.1k | 20.42k | 75.22 |

Key Ratios Snapshot

Some of the financial key ratios for Cummins Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | 24.5% | 12.0% |

| FCF Margin | ROE | ROA |

| 6.5% | 23.8% | 7.8% |

Price History

Cummins Inc. has been offering attractive dividends lately, with their stock prices reaching a 3-year low this Wednesday. When the markets opened, Cummins Inc. stock opened at $244.1, but closed at $240.5, representing a decrease of 1.6% from the last closing price of 244.5. This marks an attractive opportunity for investors to buy Cummins Inc. stock while prices are low and the dividends are attractive. Live Quote…

Analysis – Cummins Inc Intrinsic Stock Value

At GoodWhale, we recently conducted an analysis of CUMMINS INC‘s wellbeing. Our proprietary Valuation Line demonstrates that the fair value of CUMMINS INC’s share is around $294.0. This gap between fair value and market price presents an opportunity for investors to buy into this company at an attractive price. More…

Peers

Cummins Inc is one of the world’s leading manufacturers of engines and related technologies. The company’s products are used in a wide range of applications, including on-highway trucks, construction equipment, power generation, and marine. Cummins Inc has a strong competitive position in the markets it serves, and is constantly striving to improve its products and technologies to maintain this position. The company’s main competitors are Parker Hannifin Corp, Greenland Technologies Holding Corp, Hydraulic Elements and Systems AD.

– Parker Hannifin Corp ($NYSE:PH)

Parker Hannifin Corporation is an American corporation that specializes in motion and control technologies. Parker Hannifin is the world’s largest producer of hydraulic pumps and motors, and it is a major manufacturer of pneumatic cylinders, valves, and other motion-control products. The company has over 60,000 employees in 50 countries, and its products are used in a variety of industries, including aerospace, climate control, electromechanical, filtration, fluid and gas handling, hydraulics, pneumatics, process control, and sealing and shielding.

– Greenland Technologies Holding Corp ($NASDAQ:GTEC)

Greenland Technologies Holding Corp is a leading manufacturer of electronic products and components. The company has a market cap of 26.29M as of 2022 and a return on equity of 8.97%. Greenland Technologies Holding Corp designs, manufactures and sells a broad range of electronic products and components, including semiconductors, printed circuit boards, personal computers, cellphone handsets, digital cameras, and other consumer electronics products.

– Hydraulic Elements and Systems AD ($LTS:0NZ4)

AD is a diversified industrial company that operates in a variety of businesses, including Hydraulic Elements and Systems, Fluid Power, and Filtration. The company has a market cap of 122.81M as of 2022 and a Return on Equity of 13.72%. AD’s Hydraulic Elements and Systems business provides a wide range of products and services to a variety of industries, including construction, mining, and agricultural equipment. The company’s Fluid Power business provides hydraulic and pneumatic components and systems to a variety of industries, including the automotive, aerospace, and defense sectors. The company’s Filtration business provides filtration products and services to a variety of industries, including the food and beverage, pharmaceutical, and oil and gas industries.

Summary

Cummins Inc. is an attractive investment opportunity for those seeking a high dividend yield. Financials are also strong, with total assets increasing year-over-year and free cash flow growing steadily. With a strong dividend yield, attractive valuation, and solid financials, Cummins Inc. is an attractive investment opportunity for dividend investors.

Recent Posts