Broadwind Announces Receipt of $175M in New Tower Orders from Global Wind Turbine Manufacturer

January 17, 2023

Trending News 🌥️

BROADWIND ($NASDAQ:BWEN), Inc. (BWEN) is a NASDAQ-listed manufacturing company that specializes in creating custom products and services including industrial, power, and wind turbine components. The company has recently announced the receipt of ~$175M in new tower orders from a leading global wind turbine manufacturer. This two-year order will occupy around 50% of the optimal tower production capacity of Broadwind‘s facilities in 2023 and 2024, with fulfillment beginning in 2023 and concluding in 2024. This order is expected to provide a significant revenue boost for the company and will help it maintain its competitive edge in the global wind turbine market. The new towers are designed to meet the needs of the global wind turbine industry and will be of the highest quality to ensure superior performance and safety. The towers produced by Broadwind are expected to be more efficient, cost-effective, and durable than those of its competitors.

Broadwind’s management team is confident that this order will help the company capitalize on its position as a leader in the global wind turbine market and further enhance its reputation as a reliable supplier of high-quality components. With this latest order, Broadwind has demonstrated its commitment to providing the best possible products and services to its customers. It is a testament to the company’s unwavering commitment to excellence and its ability to meet the needs of its customers. This order is expected to be highly beneficial for Broadwind’s long-term success and will help the company build on its position as a leading provider of custom products and services for the wind turbine industry.

Share Price

This news caused the company’s stock to soar by 96.9% from the previous closing price of 2.3, and opened at $3.6 and closed at $4.4. The new orders are expected to provide a significant boost to Broadwind‘s revenue and profitability in coming quarters. The company is a leader in providing advanced technology and services to the wind industry, and this new order will provide a strong foundation for further growth. Broadwind has been investing in its operations to increase its production capacity and meet the growing demand for its towers. The company has invested in new technologies, improved operational efficiency and increased its workforce to meet the demands of its clients.

The new order will help Broadwind further expand its operations and solidify its market position. The new order will also help Broadwind continue to build relationships with its customers and partners in the industry. The company has demonstrated its commitment to quality products, reliable services and innovative solutions to the wind turbine market. The new order will strengthen these relationships and help Broadwind become an even more trusted partner in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Broadwind. More…

| Total Revenues | Net Income | Net Margin |

| 162.71 | -10.97 | -6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Broadwind. More…

| Operations | Investing | Financing |

| -12.27 | -3.1 | 14.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Broadwind. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 126.06 | 77.45 | 2.35 |

Key Ratios Snapshot

Some of the financial key ratios for Broadwind are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.4% | – | -5.1% |

| FCF Margin | ROE | ROA |

| -9.4% | -10.6% | -4.1% |

VI Analysis

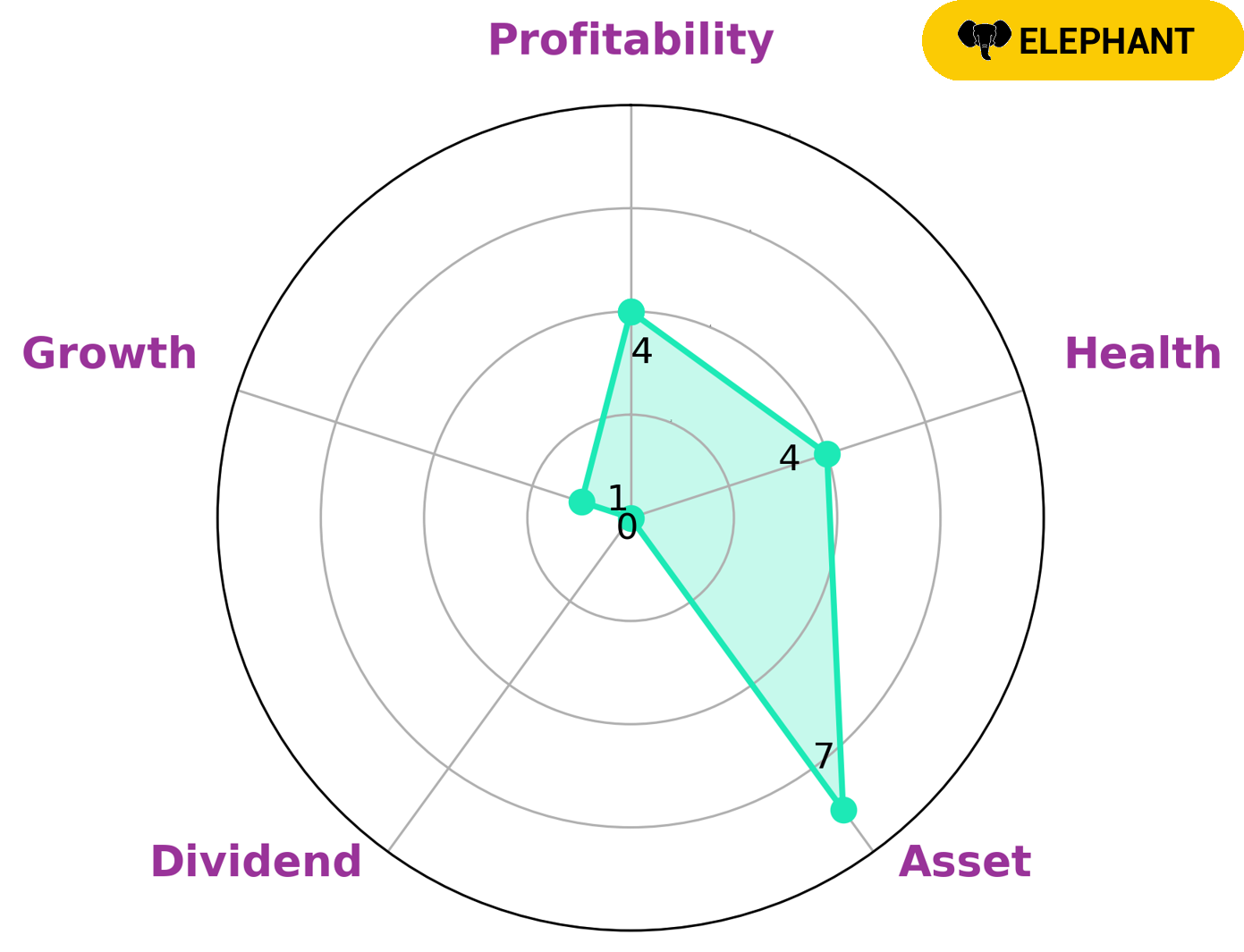

Company fundamentals are an important indicator of long-term potential, and the VI app provides a simple way to analyze the data. According to the VI Star Chart, BROADWIND has an intermediate health score of 4/10, which suggests that it is likely to weather any crisis without the risk of bankruptcy. BROADWIND is classified as an ‘elephant’, which means it has a strong asset base after liabilities are accounted for. Investors who are interested in BROADWIND may be looking for a stable asset base. The company has medium profitability, but is weak in terms of dividend and growth potential. Investors who are looking for a long-term investment may be more inclined towards BROADWIND due to the strong asset base and relative stability compared to other companies in its industry. However, those who are looking for a high-growth or dividend-yielding investment may be better off looking elsewhere. More…

VI Peers

Its products and services include wind turbines, gearboxes, and service and maintenance. Broadwind Inc. has a strong presence in the United States, Europe, and China. The company’s main competitors are Siemens Energy AG, Bloom Energy Corp, and Inox Wind Ltd.

– Siemens Energy AG ($OTCPK:SMEGF)

Siemens Energy AG is a German company that focuses on the development and production of energy technologies. The company has a market cap of 10.48B as of 2022 and a Return on Equity of -4.82%. The company’s main products include gas and wind turbines, power generation equipment, and transmission and distribution systems.

– Bloom Energy Corp ($NYSE:BE)

As of 2022, Bloom Energy Corp has a market cap of 4.26B and a Return on Equity of 7545.01%. Bloom Energy is a publicly traded company that provides clean energy solutions. The company’s mission is to make clean energy affordable and accessible to everyone. Bloom Energy’s technology enables organizations to generate power from a variety of renewable sources, including solar, wind, and water. The company’s products are designed to be reliable and efficient, and to provide customers with a cost-effective way to reduce their carbon footprint.

– Inox Wind Ltd ($BSE:539083)

Inox Wind Ltd is an Indian wind energy company. The company has a market cap of 35.63B as of 2022 and a Return on Equity of -13.74%. The company is involved in the design, manufacture, and installation of wind turbines.

Summary

Broadwind, a company specializing in wind-related infrastructure, recently announced the receipt of $175 million in new tower orders from a global wind turbine manufacturer. This news caused the stock price to move up the same day, indicating that investors were pleased with the announcement. Broadwind appears to remain a strong player in the wind infrastructure market and is likely to see further demand for their services as the global wind industry continues to grow. Investors should keep an eye on any further developments from Broadwind and consider adding the company to their portfolios.

Recent Posts