Orion Engineered Carbons Board of Directors Approves New Share Repurchase Program

May 9, 2023

Trending News ☀️

Orion Engineered Carbons ($NYSE:OEC) S.A is an international specialty chemicals firm that specializes in the production of carbon black, a material used primarily as a reinforcing filler in rubber and plastic products. The company’s Board of Directors recently approved a share repurchase program that allows for the repurchase of up to 10% of the company’s outstanding shares. This program provides a great opportunity for shareholders who wish to sell their shares. It also gives Orion Engineered Carbons S.A greater financial flexibility and supports their long-term growth strategy. With this repurchase program, Orion Engineered Carbons S.A is demonstrating their confidence in the company and their commitment to providing value to their shareholders.

The new repurchase program will be funded by cash on hand or from available borrowings under existing credit facilities. The repurchases will be made from time to time depending on market conditions, legal requirements and other factors. The company reserves the right to discontinue or suspend the repurchase program at any time without prior notice. It is intended to enhance shareholder value and create long-term stability for the company.

Share Price

On Monday, ORION ENGINEERED CARBONS S.A stock opened at $24.9 and closed at $23.9, down by 4.3% from prior closing price of 25.0. The company plans to repurchase up to 3 million shares of its common stock in order to boost its stock price and increase shareholder value. The board has authorized the repurchase of shares through open market purchases, in privately negotiated transactions or otherwise. The share repurchase program will be funded by the company’s existing sources of liquidity, including cash on hand and cash generated from operations.

The timing and amount of repurchases will be based on market conditions, available liquidity and other factors. This share repurchase program may be suspended, modified or discontinued at any time. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for OEC. More…

| Total Revenues | Net Income | Net Margin |

| 2.03k | 106.2 | 5.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for OEC. More…

| Operations | Investing | Financing |

| 81 | -232.8 | 149.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for OEC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.89k | 1.43k | 7.58 |

Key Ratios Snapshot

Some of the financial key ratios for OEC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.2% | 9.3% | 9.7% |

| FCF Margin | ROE | ROA |

| -7.5% | 27.7% | 6.5% |

Analysis

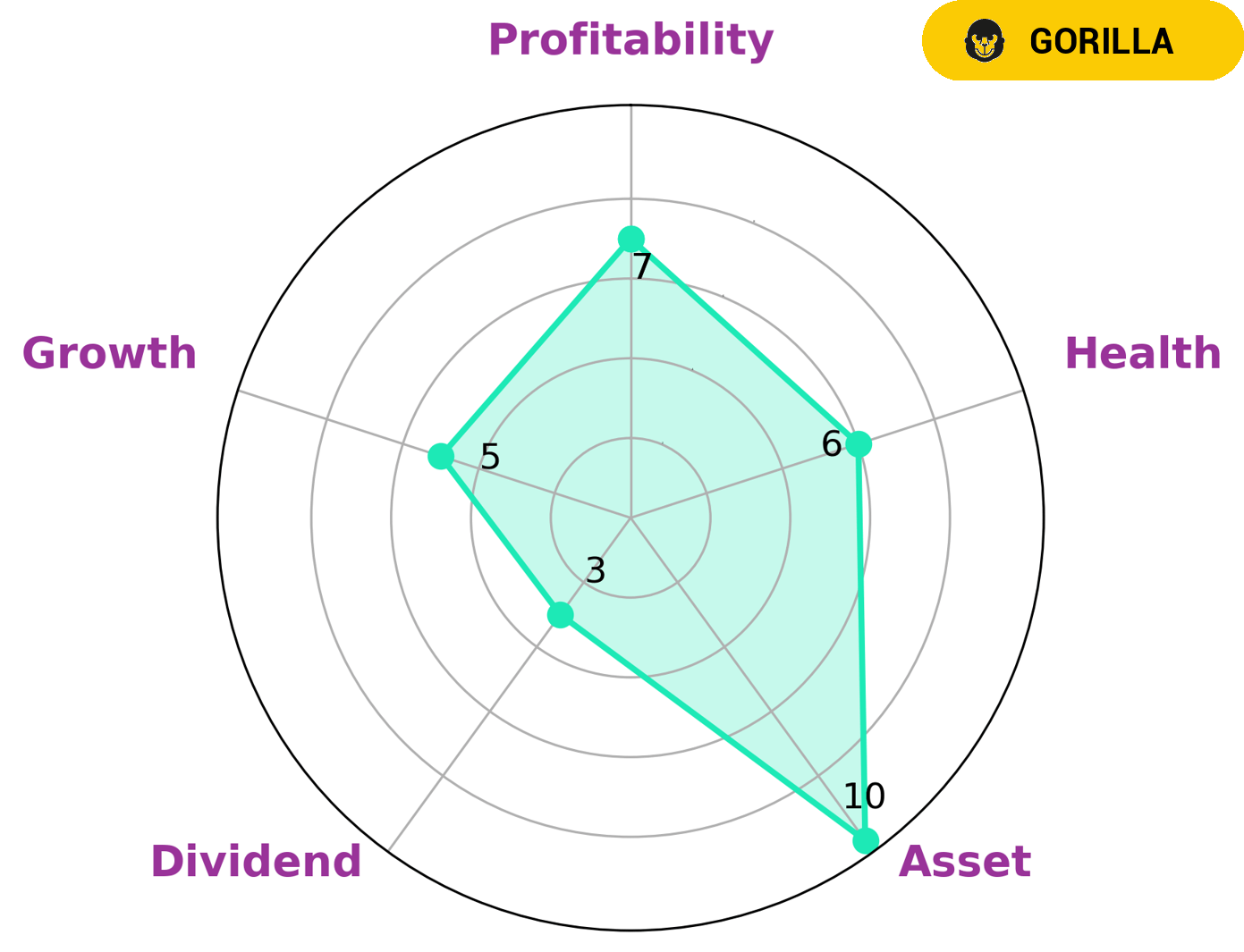

GoodWhale has conducted an analysis of ORION ENGINEERED CARBONS S.A.’s fundamentals, and the results are encouraging. Our Star Chart assessment shows that ORION is strong in asset and profitability and medium in growth and weak in dividend. Furthermore, our assessment puts ORION into the ‘gorilla’ category – a company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Given their intermediate health score of 6/10 with regard to cashflows and debt, ORION is likely to safely ride out any crisis without the risk of bankruptcy. Investors who are looking for companies that have a proven track record of success in their industry and are seeking long-term investments, may find ORION ENGINEERED CARBONS S.A. to be an attractive opportunity. More…

Peers

These companies all seek to provide quality specialty carbon black products to their customers.

– Tinna Rubber & Infrastructure Ltd ($BSE:530475)

Tinna Rubber & Infrastructure Ltd is a leading player in the rubber and infrastructure industry. It is an India-based company that manufactures and supplies a wide range of rubber products and services. With a market cap of 3.8B as of 2023, Tinna Rubber & Infrastructure Ltd is one of the most prominent players in the industry. The company has been able to maintain a strong financial position by having an impressive Return on Equity (ROE) of 25.96%. This indicates the company’s ability to generate profits from its investments and its financial health. Tinna Rubber & Infrastructure Ltd has shown a consistent upward trend in its market cap and ROE, which speaks volumes about its financial stability and performance.

– Showa Rubber Co Ltd ($TSE:5103)

Showa Rubber Co Ltd is a Japanese company that produces and sells rubber products, including tires, hoses, and seals. The company has a market cap of 3.49 billion as of 2023, which is indicative of its size and market standing. It has a Return on Equity (ROE) of 2.89%, which suggests that the company is able to generate a reasonable amount of profits from its investments. Showa Rubber Co Ltd continues to be a major player in the rubber product industry.

– Rubfila International Ltd ($BSE:500367)

Rubfila International Ltd is an Indian-based pharmaceutical company that specializes in the development, production, and distribution of generic drugs. The company has a market cap of 4.27B as of 2023 and a Return on Equity (ROE) of 13.7%. This indicates that the company has been able to generate a high rate of return on its equity investments, which suggests that it is a profitable business and a good investment opportunity. The company also has a strong financial position and is well diversified in its portfolio. The company’s market cap and ROE indicate that it is a stable business, with a solid track record of performance.

Summary

Orion Engineered Carbons S.A. has recently announced their Board of Directors has approved a new share repurchase plan. This news caused a drop in their stock price, as investors anticipate the company expending significant capital for the repurchase. Traders will want to pay close attention to the company’s balance sheet and assess the impact of the repurchase on their finances over the coming months.

Due to the large amount of capital invested in the repurchase, there may be a substantial risk to investors. Analyzing the latest financial reports and other related data can help investors make an informed decision when considering investing in the company.

Recent Posts