Investor Buys 35,000 Shares of Alto Ingredients, Should You Follow Suit?

January 28, 2023

Trending News ☀️

Alto Ingredients ($NASDAQ:ALTO) Inc. (ALTO) is a leading supplier of food ingredients, additives, and flavors for the food and beverage industry. Recently, an investor has purchased 35,000 shares of the company’s stock, raising questions about whether or not it is a good investment. It is a publicly traded company on the NASDAQ exchange and has a market capitalization of over $1 billion. Alto Ingredients Inc. also specializes in providing organic and non-GMO ingredients to meet the needs of its customers. It has a strong track record of delivering consistent financial performance and returns to shareholders. The company has seen double-digit growth year-over-year for the last five years and is expected to continue this trend in the future.

Analysts recommend researching the company’s financials to ensure that it is a sound investment. Investors should also take into account the company’s track record, management team, and future prospects when deciding if it is a good investment for them. Overall, the recent purchase of 35,000 shares of Alto Ingredients Inc. by an investor is encouraging, but investors should do their own due diligence before making any investment decisions. Investing in any company carries some risk, so it is important to understand the risks and rewards associated with investing in ALTO before investing any money.

Stock Price

On Friday, news began to circulate that an investor had purchased 35,000 shares of Alto Ingredients Inc., causing many to wonder if they should follow suit. Right now, the news about this company is mostly positive, and the stock opened at $3.3 on Friday.

However, by the end of trading the stock had dropped by 1.2% from its last closing price of $3.3, closing at $3.2 instead. Ultimately, it is up to individual investors to make decisions about their own portfolios, but there are a few key points to consider before investing in this company.

First, it is important to analyze the current market conditions and understand how the stock is likely to perform in the future. It is also necessary to research the company itself, looking into its financials, operations, and management team.

Additionally, it is a good idea to compare Alto Ingredients Inc. with other stocks in the same industry to get a better understanding of how it could fare in the coming months. Finally, it is important to consider your own financial situation and risk tolerance before making any investment decisions. Before investing in Alto Ingredients Inc., you should ensure that the company is a good fit for your portfolio and that you are comfortable with the amount of risk involved. Ultimately, whether or not you decide to invest in Alto Ingredients Inc. is up to you. It is important to do your research and make an informed decision that best suits your own financial goals and risk tolerance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alto Ingredients. More…

| Total Revenues | Net Income | Net Margin |

| 1.39k | 25.76 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alto Ingredients. More…

| Operations | Investing | Financing |

| 43.5 | 27.12 | -40 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alto Ingredients. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 454.67 | 119.67 | 4.9 |

Key Ratios Snapshot

Some of the financial key ratios for Alto Ingredients are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.2% | 7.5% | 2.2% |

| FCF Margin | ROE | ROA |

| 1.5% | 5.4% | 4.1% |

VI Analysis

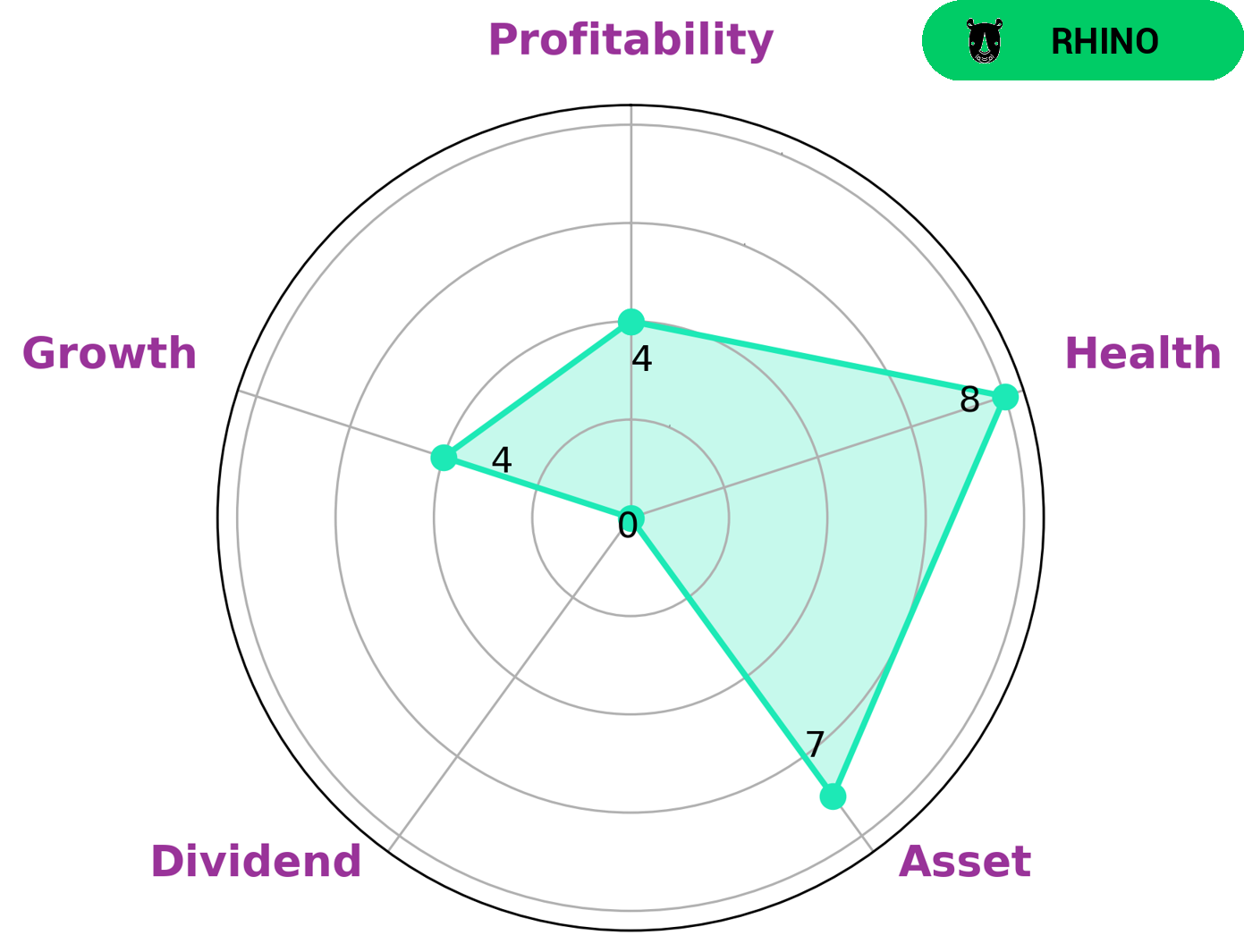

Analysis of ALTO INGREDIENTS has been made easier with the help of the VI app, illustrating the company’s long-term potential. According to VI Star Chart, ALTO INGREDIENTS has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Additionally, ALTO INGREDIENTS is classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who may be interested in such a company include those who are looking for a reliable and well-established company that is able to generate moderate returns. ALTO INGREDIENTS is strong in terms of assets, and medium in terms of growth, profitability and dividend. For investors looking for a long-term investment, ALTO INGREDIENTS is an attractive option due to its reliable and consistent performance. Overall, through the use of the VI app, investors are able to gain a better understanding of ALTO INGREDIENTS and its potential to generate returns. With its strong asset base and moderate growth rate, ALTO INGREDIENTS provides a promising long-term investment opportunity for those looking for reliable returns. More…

VI Peers

It is no secret that the food and beverage industry is intensely competitive. Players large and small are vying for a share of the pie, and Alto Ingredients Inc is no exception. The company competes against some of the biggest names in the business, including Green Plains Inc, Cinkarna Celje, and AVT Natural Products Ltd. Despite the challenges, Alto Ingredients Inc has managed to carve out a place for itself in the industry, thanks to its innovative products and commitment to customer satisfaction.

– Green Plains Inc ($NASDAQ:GPRE)

Green Plains Inc is a publicly traded company that produces and sells ethanol and related products. The company has a market cap of 1.65 billion as of 2022 and a return on equity of -1.51%. The company’s products are used in the transportation, industrial, and consumer sectors. Green Plains Inc is headquartered in Omaha, Nebraska, and has operations in the United States, Canada, and Europe.

– Cinkarna Celje ($LTS:0NOO)

Cinkarna Celje is a Slovenian chemical company with a market cap of 179.75M as of 2022. The company’s Return on Equity is 17.95%. Cinkarna Celje produces a range of chemicals, including pigments, dyes, and resins. The company has a long history, dating back to the early 20th century.

– AVT Natural Products Ltd ($BSE:519105)

AVT Natural Products Ltd, with a market capitalization of 16.04 billion as of 2022 and a return on equity of 18.75%, is a company engaged in the manufacture and sale of natural products. The company has a wide range of products that it offers to its customers, which include herbs, spices, and other natural ingredients. AVT Natural Products Ltd has a strong presence in the market and is well-known for its quality products. The company has a good reputation for its customer service and is always willing to help its customers with any problems they may have.

Summary

ALTO Ingredients Inc. has recently seen an influx of investor interest, with 35,000 shares being acquired. The company’s performance over the past few months has been positive, with increasing revenue, profits and stock price. Analysts recommend investing in ALTO Ingredients Inc. due to its strong financials and a potential for further growth. Investors should consider their own financial goals, risk tolerance and any potential risks associated with the company before making an investment decision.

Recent Posts