Institutional Investors Reap Rewards from Ecolab’s One-Year Returns

June 9, 2023

☀️Trending News

Institutional investors have been reaping the rewards of Ecolab Inc ($NYSE:ECL).’s one-year returns. With institutional investors owning 77% of Ecolab Inc.’s shares, it’s no surprise that the company has seen an excellent return on investment in the last year. This substantial ownership gives institutional investors a large degree of influence over the share price, and the results of the past week have added even more to their returns. Ecolab Inc. is a leading global provider of technology-based water, hygiene, and energy solutions and services. With a proven track record of innovation and sustainability, Ecolab Inc. is well-positioned to capitalize on industry trends and continue to provide value for its shareholders.

The strong returns that Ecolab Inc. has seen over the past year have made it an attractive option for institutional investors. Investors who have held on to their shares have been rewarded with excellent returns and are seeing the benefits of a long-term approach. With such substantial ownership, these institutions will continue to have a large degree of influence over the stock price and are likely to remain invested as long as Ecolab Inc. continues to deliver strong results.

Price History

On Monday, institutional investors who invested in ECOLAB INC were rewarded with positive returns, as the stock opened at $172.9 and closed at $173.4, up by 0.2% from last closing price of 173.1. The stock’s rise is an indication of investor confidence in the sustainability of the company and its growth potential. Institutional investors are poised to benefit further from ECOLAB INC’s share price appreciation in the coming months, as the company continues to build upon its successes. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ecolab Inc. More…

| Total Revenues | Net Income | Net Margin |

| 14.49k | 1.15k | 8.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ecolab Inc. More…

| Operations | Investing | Financing |

| 1.79k | -716.8 | -837.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ecolab Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.25k | 13.89k | 25.8 |

Key Ratios Snapshot

Some of the financial key ratios for Ecolab Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | -7.4% | 11.6% |

| FCF Margin | ROE | ROA |

| 7.4% | 14.4% | 5.0% |

Analysis

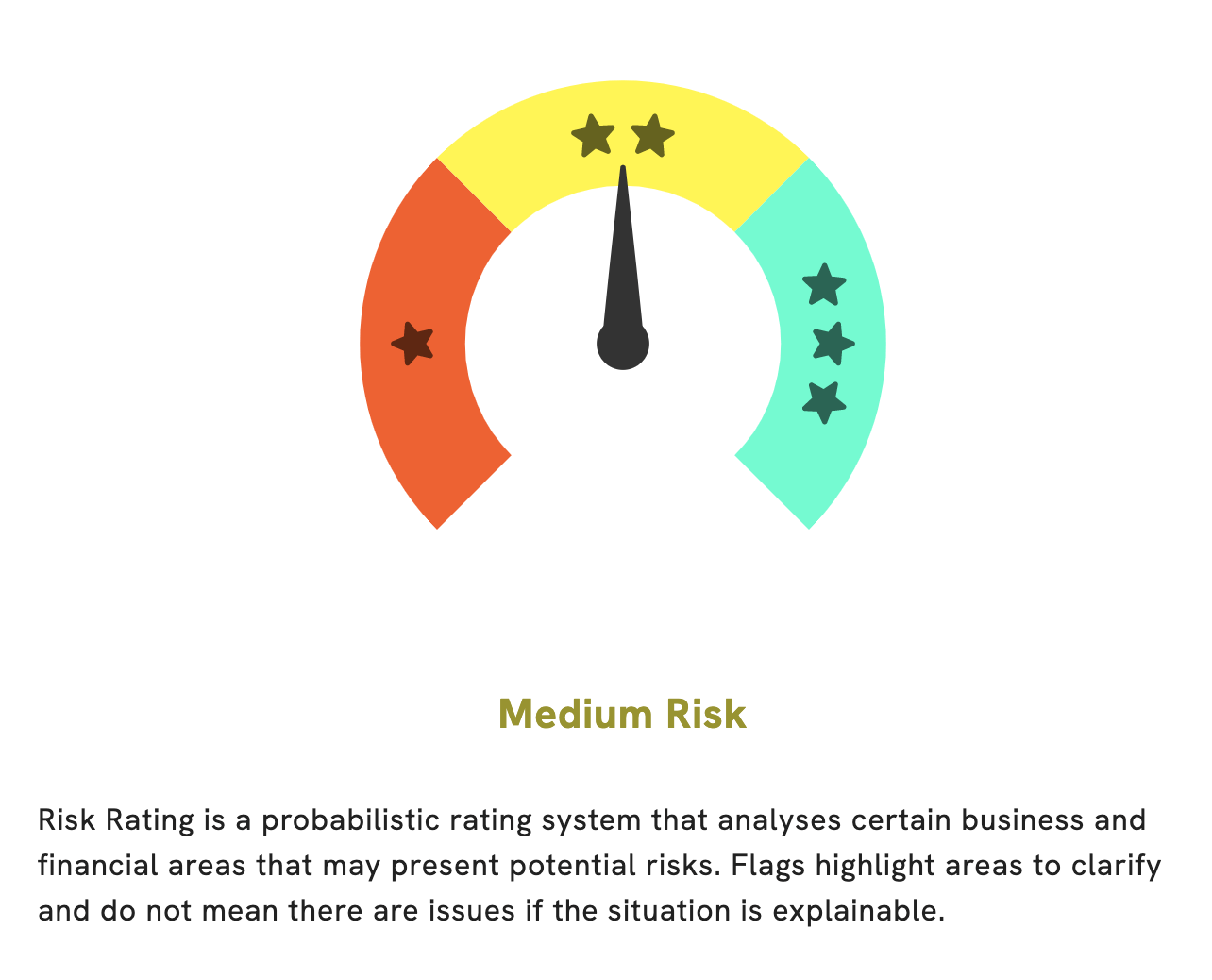

At GoodWhale, we have conducted an analysis of ECOLAB INC‘s finances. We have rated it as a medium risk investment in terms of financial and business aspects. Our Risk Rating tool is designed to help investors make informed decisions based on the financial information of the company. We have detected two risk warnings in ECOLAB INC’s balance sheet – one financial and one non-financial. If you would like to get more details about the risks involved in investing in this company, become a registered user and check it out. Our team is available to answer any queries you may have about ECOLAB INC and our analysis. More…

Peers

Ecolab Inc is a US company that provides water, hygiene and energy technologies and services. Its main competitors are Incitec Pivot Ltd, Givaudan SA and C-Bond Systems Inc.

– Incitec Pivot Ltd ($ASX:IPL)

Incitec Pivot Ltd is an Australian manufacturer and supplier of industrial chemicals and fertilizers. It has a market cap of $6.95 billion and a return on equity of 10.44%. The company produces and supplies a range of products including ammonia, urea, nitric acid, and phosphate fertilizers. It also manufactures and supplies explosives for the mining, quarrying, and construction industries.

– Givaudan SA ($OTCPK:GVDNY)

Givaudan SA is a Swiss company that produces flavors and fragrances. The company has a market cap of 27.11B as of 2022 and a Return on Equity of 15.84%. The company’s products are used in food, beverages, cosmetics, and other consumer products.

– C-Bond Systems Inc ($OTCPK:CBNT)

C-Bond Systems Inc is a company that manufactures and sells products that are used to repair and strengthen concrete. The company has a market cap of 3.46M as of 2022 and a ROE of 105.36%. The company’s products are used in a variety of applications, including repairing cracks in concrete, strengthening concrete structures, and sealing concrete surfaces.

Summary

Ecolab Inc. has been a top performer in the stock market, with strong returns over the past year. This performance has been largely driven by institutional investors, which hold a significant 77% of the company’s stock. This implies that institutional investors have the power to sway the share price of Ecolab Inc. through their activity in the market. As such, investors should keep an eye on how these major stakeholders are buying and selling in order to gain insight into the future of Ecolab Inc.’s stock.

Recent Posts