Chemours Company Offers 18% Return in January 2023 and Attractive Valuation for Long-Term Portfolio Addition.

February 14, 2023

Trending News ☀️

The Chemours Company ($NYSE:CC) had a remarkable start to the year in January 2023, with a return of 18%. It is a leading global chemical company with a focus on innovation and safety. Its shares are traded on the New York Stock Exchange and offer investors an opportunity to gain exposure to the company’s commitment to sustainability and growth. The company has three segments: Titanium Technologies, Fluoroproducts and Chemical Solutions. The Titanium Technologies segment is the largest segment of the company and produces titanium dioxide and other titanium-based products. Despite the success of the Titanium Technologies segment, there have been some short-term challenges due to supply constraints and price hikes.

In response, the company has taken steps to increase capacity, reduce costs and improve efficiency in order to meet customer demand. The company’s Fluoroproducts segment produces a wide range of specialty chemicals used in applications such as air conditioning, refrigeration, and fire protection. Its Chemical Solutions segment produces a variety of specialty chemicals used in industrial, commercial, and consumer products. Furthermore, the company has a strong balance sheet with no debt and ample cash to support its operations. It is well-positioned to weather any short-term challenges as it continues to focus on innovation and safety while increasing capacity and improving efficiency.

Market Price

On Monday, the company’s stock opened at $34.6 and closed at $35.1, representing an impressive 2.1% increase from its previous closing price of $34.4. The strong financial performance of the company has been driven by its operational efficiency and strategic investments. The company is also actively pursuing acquisitions and partnerships to add to its portfolio of products and services. The company is also currently offering an attractive valuation for long-term investments, making it an attractive option for investors looking for value.

This makes it a great opportunity for investors who are looking to maximize their returns without taking on too much risk. The company is positioned well to capitalize on future opportunities and is currently performing well financially. As such, investors looking for an opportunity with high returns and low risk should consider investing in the Chemours Company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chemours Company. More…

| Total Revenues | Net Income | Net Margin |

| 6.79k | 578 | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chemours Company. More…

| Operations | Investing | Financing |

| 754 | -284 | -685 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chemours Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.64k | 6.53k | 7.45 |

Key Ratios Snapshot

Some of the financial key ratios for Chemours Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | 24.0% | 13.3% |

| FCF Margin | ROE | ROA |

| 6.6% | 47.3% | 7.4% |

Analysis

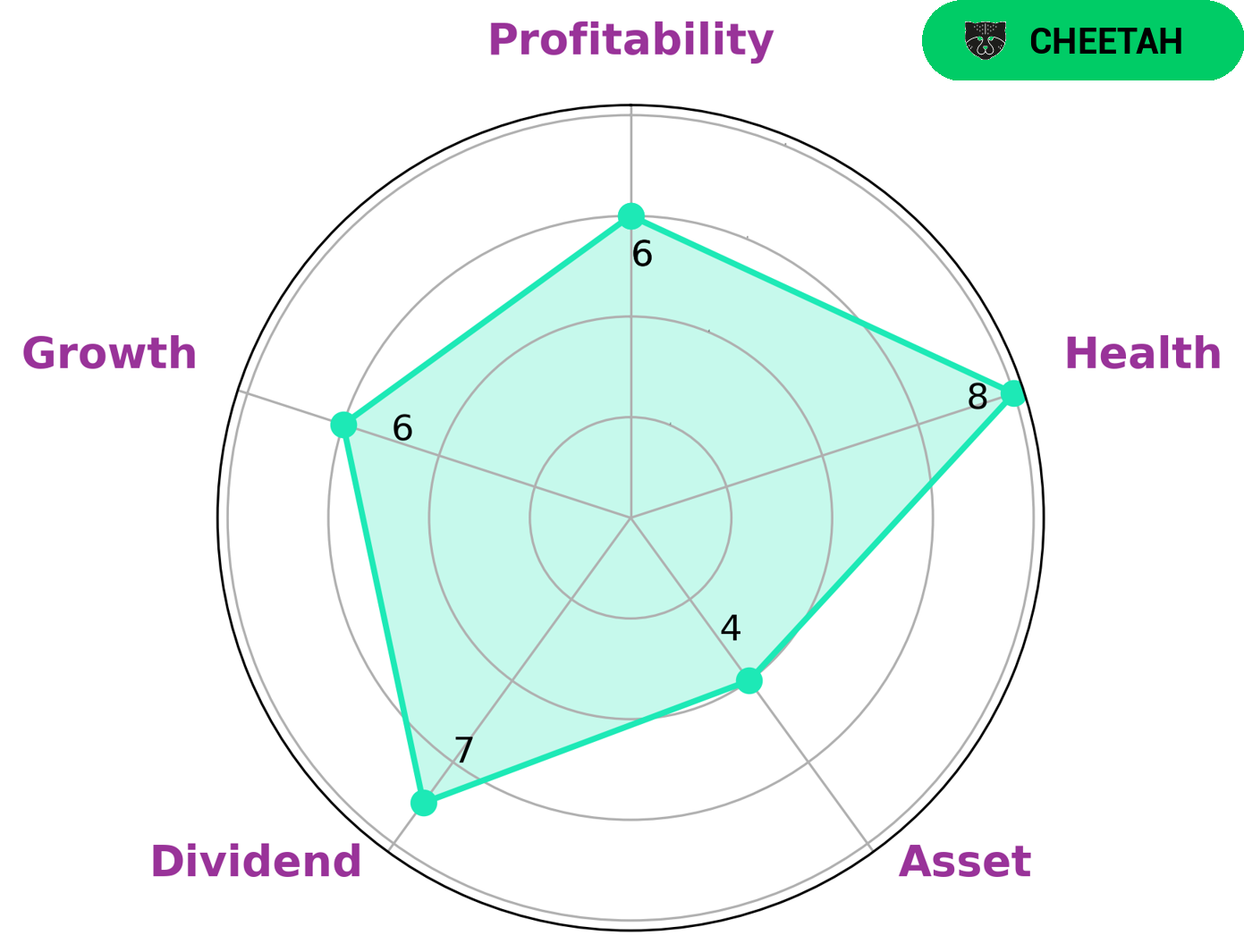

GoodWhale’s financial analysis of CHEMOURS COMPANY reveals a ‘cheetah’ type of company that has achieved fast revenue growth but has lower profitability. The Star Chart shows CHEMOURS COMPANY has a high health score of 8/10 when it comes to cashflows and debt, indicating strong financial footing and the ability to sustain operations in times of crisis. As far as investors, those looking for high dividend yields, moderate asset growth and moderate profitability may be interested in this company. CHEMOURS COMPANY’s overall financials are healthy, with strong cashflows and low debt. The company has done a great job of managing its finances and has built up a reserve that can help it weather any storms in the future. Additionally, CHEMOURS COMPANY is well positioned to continue to grow its revenue, even if profitability is slightly lower. CHEMOURS COMPANY is an attractive option for many investors looking for a reliable dividend-paying stock that also has the potential for asset growth. The company also boasts moderate profitability and has managed to stay strong despite economic downturns. Investors looking for a safe, stable stock would do well to consider CHEMOURS COMPANY as a worthwhile option. More…

Peers

The Chemours Co, Green Earth Institute Co Ltd, Mitsui Chemicals Inc, and AlzChem Group AG are all competitors in the chemical industry. Chemours is a holding company that produces chemicals and related products, while Green Earth is a research institute focused on developing environmentally friendly alternatives to traditional chemicals. Mitsui Chemicals is a Japanese company that produces a wide variety of chemicals, while AlzChem Group is a German company specializing in inorganic and specialty chemicals.

– Green Earth Institute Co Ltd ($TSE:9212)

Green Earth Institute Co Ltd is a company that focuses on environmental protection. It has a market cap of 6.98B as of 2022 and a Return on Equity of -20.43%. The company has been struggling financially in recent years, which is reflected in its ROE. However, it remains committed to its environmental protection mission.

– Mitsui Chemicals Inc ($TSE:4183)

Mitsui Chemicals Inc. is a Japanese chemical company with a market cap of 530.73B as of 2022. The company has a Return on Equity of 12.55%. Mitsui Chemicals Inc. is engaged in the manufacture and sale of chemicals and plastics. The company’s products include polymers, resins, films, fibers, and other chemicals. Mitsui Chemicals Inc. has operations in Japan, Asia, Europe, and the Americas.

– AlzChem Group AG ($LTS:0ACT)

AlzChem Group AG is a German chemical company with a market cap of 152.04M as of 2022. The company has a Return on Equity of 20.28%. AlzChem Group AG produces specialty chemicals for the pharmaceutical, agrochemical, and polymer industries. The company was founded in 1894 and is headquartered in Trostberg, Germany.

Summary

Chemours Company (NYSE:CC) is an attractive option for long-term investors, offering a potential 18% return in January 2023. The stock is currently trading at a reasonable valuation, making it an attractive option for those looking to diversify their portfolio. Analysts are largely positive on the company, forecasting sales and earnings growth over the next few years and citing its transition from legacy chemicals to a higher-margin specialty chemicals and titanium dioxide business. Investment risks include potential volatility from raw material, commodity, and currency prices as well as demand for its products.

However, given its strong balance sheet, industry-leading innovation, and new product launches, Chemours Company may be a good long-term investment choice.

Recent Posts