Victory Capital Management Increases Stake in SPS Commerce, Inc

June 3, 2023

🌥️Trending News

Victory Capital Management Inc. has recently increased its stake in SPS ($NASDAQ:SPSC) Commerce, Inc., making it one of the company’s largest shareholders. SPS Commerce, Inc. is an on-demand retail platform provider that serves customers, suppliers, and partners to facilitate business transactions and optimize supply chains. The company boasts of a rich portfolio of solutions and services that span the entire retail lifecycle, including point-of-sale, order/fulfillment, inventory/replenishment, supplier collaboration, pricing optimization, and analytics. Victory Capital Management Inc., which is an independent investment management firm that provides a wide range of absolute return, active and integrated multi-asset strategies.

As such, the firm recognized the potential that SPS Commerce, Inc. has to offer and decided to increase its stake in the company. This move is likely to further solidify the company’s position in the market, as Victory Capital’s large base of investments and resources will provide additional financial support for SPS Commerce, Inc. to continue developing innovative solutions and services.

Stock Price

After opening at $163.1, the stock closed at $157.9, 2.7% lower than the prior closing price of 162.4. This latest development follows Victory Capital Management Inc.’s recent announcement that it has added to its already sizable position in SPS Commerce stock. While the drop in stock price is concerning, investors remain hopeful that Victory Capital Management Inc.’s investment will ultimately benefit SPS Commerce in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sps Commerce. More…

| Total Revenues | Net Income | Net Margin |

| 471.55 | 57.82 | 12.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sps Commerce. More…

| Operations | Investing | Financing |

| 117.34 | -123.05 | -14.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sps Commerce. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 696.93 | 131.04 | 15.49 |

Key Ratios Snapshot

Some of the financial key ratios for Sps Commerce are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.1% | 18.8% | 15.1% |

| FCF Margin | ROE | ROA |

| 20.5% | 8.1% | 6.4% |

Analysis

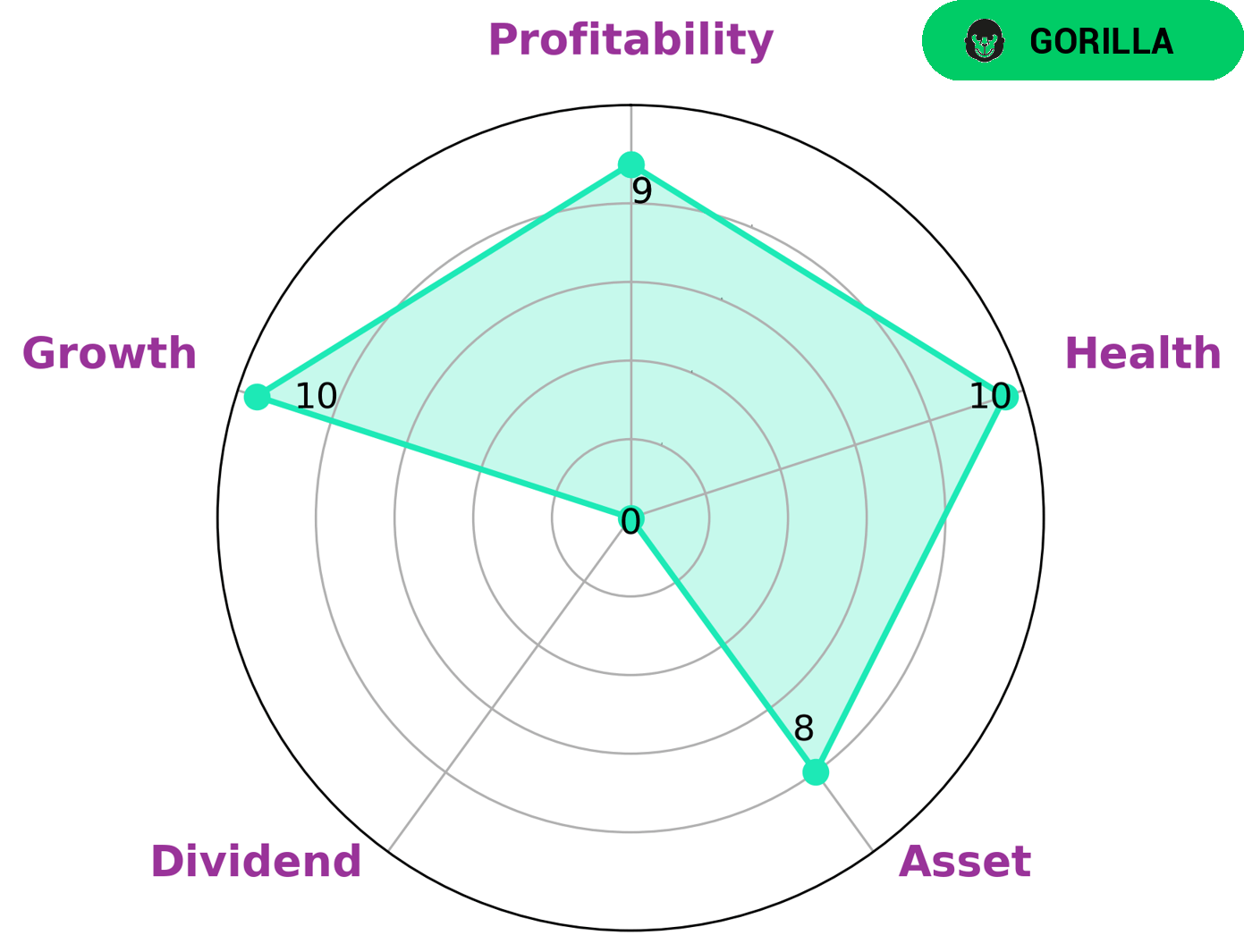

After conducting a thorough analysis of SPS COMMERCE‘s financials, GoodWhale has classified the company as a ‘gorilla’ – a type of company that has achieved consistent and high revenue or earnings growth due to its strong competitive advantage. As such, we believe that this type of company is highly attractive to investors, especially those who prioritize stability and growth. One of the key strengths of SPS COMMERCE is its high health score of 10/10 with regard to its cashflows and debt, suggesting that the company is capable of sustaining future operations in times of crisis. Furthermore, SPS COMMERCE is strong in terms of asset and growth, as well as profitability. Its only weak point is in the area of dividends. More…

Peers

The company offers a suite of solutions that enable businesses to automate and optimize their supply chain operations. Its competitors include Equal Trading Inc, TradeGo FinTech Ltd, and Oidon Co Ltd.

– Equal Trading Inc ($OTCPK:EQTD)

SalaryGo is a leading financial technology company that provides innovative solutions to businesses and individuals worldwide. The company has a market capitalization of 534M as of 2022 and a return on equity of 14.25%. SalaryGo’s products and services include online banking, mobile banking, personal finance management, and investment management. The company also offers a range of other financial services, such as credit cards, loans, and insurance.

Summary

SPS Commerce, Inc. is a highly attractive investment opportunity for Victory Capital Management Inc. The company has seen steady growth in recent years, boasting a strong balance sheet, impressive financials, and a wide array of products and services. This makes SPS Commerce an attractive choice for investors looking to capitalize on their investments. Victory Capital Management Inc. has shown their confidence by increasing their holdings in the company. With their broad suite of digital solutions and comprehensive customer service, SPS Commerce is well-positioned to continue to grow and make solid investments for its shareholders.

Recent Posts