Texas Teacher Retirement System Invests in SPS Commerce, with 4,954 Shares

February 1, 2023

Trending News ☀️

The Texas Teacher Retirement System recently announced their purchase of 4,954 shares of SPS ($NASDAQ:SPSC) Commerce, Inc. (SPSC). SPSC is a cloud-based supply chain and retail analytics platform, allowing companies to automate and streamline their order fulfillment and inventory management processes. The company’s platform provides an integrated suite of services that help clients to optimize the supply chain, improve inventory accuracy, and reduce costs. With this investment, the Texas Teacher Retirement System believes that SPSC is well-positioned for long-term growth and success. The company’s platform is designed to be easy to use and deploy, allowing customers to quickly realize the benefits of the technology.

Additionally, the company has forged strong partnerships with many leading retailers and manufacturers, providing a solid foundation for future growth. The Texas Teacher Retirement System is confident that SPSC’s innovative platform and experienced management team will allow the company to continue to build on its success in the years to come.

Price History

The news of the investment has been met with mostly positive sentiment. On the same day, SPS COMMERCE stock opened at $133.5 and closed at $136.1, up 2.2% from its previous closing price of $133.1. This is a good sign for investors, as it indicates that the company’s stock is increasing in value. It is likely to draw attention from other investors and increase interest in the company’s offerings. SPS COMMERCE is an established player in the technology industry and is well-known for its supply chain solutions and financial services. It has a long history of providing innovative solutions to customers around the world and is constantly seeking to improve its offerings.

The investment from TRS could help SPS COMMERCE expand its operations and reach more customers. It could also be a sign that the company’s stock will continue to rise in value as more investors take notice of its strong performance. Overall, the news of the TRS investment in SPS COMMERCE is positive for both parties involved. The company will benefit from the additional capital and attention, while TRS will benefit from its investment in a successful company with a bright future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sps Commerce. More…

| Total Revenues | Net Income | Net Margin |

| 431.61 | 51.98 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sps Commerce. More…

| Operations | Investing | Financing |

| 107.81 | -75.21 | -41.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sps Commerce. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 637.09 | 129.43 | 14.09 |

Key Ratios Snapshot

Some of the financial key ratios for Sps Commerce are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.7% | 23.5% | 15.6% |

| FCF Margin | ROE | ROA |

| 20.8% | 8.4% | 6.6% |

VI Analysis

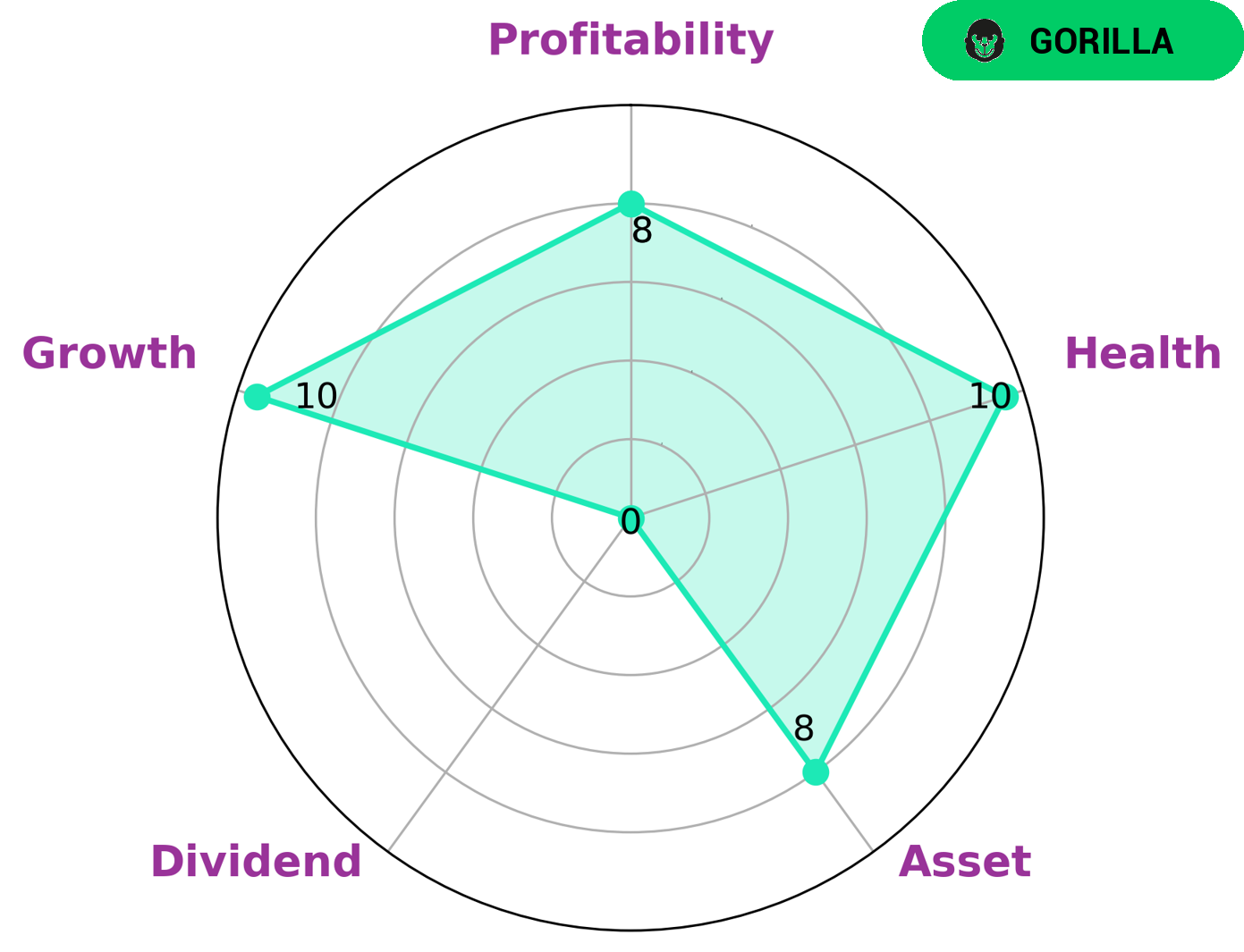

Investors looking for a company with a strong long-term potential should take a closer look at SPS COMMERCE. Through the use of VI (Valuation Intelligence) app, investors can easily analyze the fundamentals of SPS COMMERCE to assess its potential. The VI Star Chart assigns SPS COMMERCE a health score of 10/10 based on its cashflows and debt. This indicates that the company is able to pay off debt and fund future operations. Furthermore, the chart also shows that SPS COMMERCE is doing well in terms of assets, growth, and profitability. However, it is weak in terms of dividends. SPS COMMERCE has been classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Such companies are likely to attract investors interested in long-term investing. They are also likely to appeal to investors seeking companies that have demonstrated their ability to generate consistent returns over time. In conclusion, SPS COMMERCE is an attractive long-term investment option for investors who are looking for a company with a strong competitive advantage and the potential for consistent returns. Through the use of the VI app, investors can quickly assess the fundamentals of the company and determine if it is right for them. More…

VI Peers

The company offers a suite of solutions that enable businesses to automate and optimize their supply chain operations. Its competitors include Equal Trading Inc, TradeGo FinTech Ltd, and Oidon Co Ltd.

– Equal Trading Inc ($OTCPK:EQTD)

SalaryGo is a leading financial technology company that provides innovative solutions to businesses and individuals worldwide. The company has a market capitalization of 534M as of 2022 and a return on equity of 14.25%. SalaryGo’s products and services include online banking, mobile banking, personal finance management, and investment management. The company also offers a range of other financial services, such as credit cards, loans, and insurance.

Summary

The Texas Teacher Retirement System recently invested in SPS Commerce, Inc. with 4,954 shares. The current sentiment around the investment is mostly positive, indicating that it could be a good decision for the retirement system. The company has been performing well financially, with an increase in revenue and earnings in the past few years. Investors should take a close look at the fundamentals of SPS Commerce before making any decisions, as there are still risks associated with investing in the company.

However, with strong financials and positive sentiment, SPS Commerce looks like a smart investment for the Texas Teacher Retirement System.

Recent Posts