Sterling Check Stock Intrinsic Value – Sterling Check Reports Record Earnings, Revenues Exceed Expectations

May 10, 2023

Trending News 🌥️

Sterling Check ($NASDAQ:STER) has reported record earnings, with its Non-GAAP earnings per share (EPS) of $0.24 surpassing estimates by $0.02 and revenue of $179.27M exceeding expectations by $3.75M. Sterling Check is an international financial services company that provides banking and financial services to individuals, businesses and governments. The company’s highly diversified portfolio and global presence have enabled them to stay ahead of their competitors and deliver a wide range of products and services.

Over the past few years, Sterling Check has consistently delivered strong financial performance, driven by strong growth in both revenues and profits. This record earnings report further solidifies their position as a leader in the financial services industry.

Earnings

STERLING CHECK reported record earnings in its FY2022 Q4 report as of December 31 2022. Total revenue during this quarter was 169.92M USD, representing a 2.1% decrease from the previous year. Net income during this period was 7.7M USD, a significant 385.2% decrease from the previous year. Despite the decrease in net income, STERLING CHECK’s total revenues have grown steadily over the last 3 years, increasing from 128.5M USD to 169.92M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sterling Check. More…

| Total Revenues | Net Income | Net Margin |

| 766.78 | 19.41 | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sterling Check. More…

| Operations | Investing | Financing |

| 104.26 | -20.14 | -25.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sterling Check. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.41k | 670.61 | 7.62 |

Key Ratios Snapshot

Some of the financial key ratios for Sterling Check are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | – | 7.5% |

| FCF Margin | ROE | ROA |

| 11.0% | 4.9% | 2.6% |

Stock Price

On Tuesday, STERLING CHECK reported record earnings, with revenues exceeding expectations. Following the news of the impressive results, the stock opened at $11.3 and closed at $12.2, a rise of 7.8% from its previous closing price of $11.3. This marked the highest close in the company’s history, signaling strong investor confidence in STERLING CHECK. The impressive results are likely to fuel further growth for the company in the future. Live Quote…

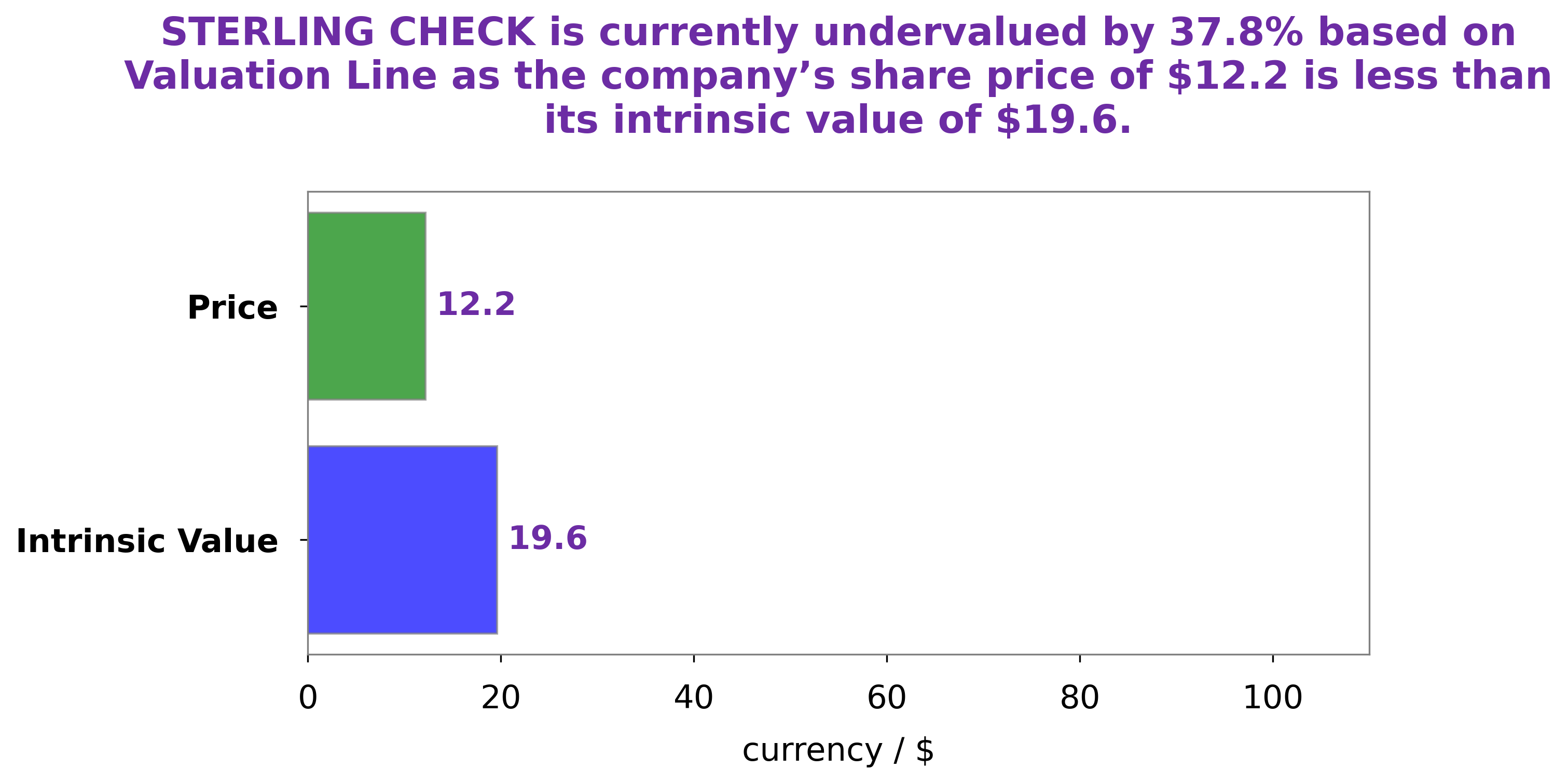

Analysis – Sterling Check Stock Intrinsic Value

GoodWhale recently conducted an analysis of STERLING CHECK‘s wellbeing. After rigorous calculations, we have determined that the fair value of STERLING CHECK share is around $19.6. This figure was determined by our proprietary Valuation Line, an accurate and reliable method for estimating stock values. However, currently STERLING CHECK stock is traded at only $12.2, meaning the stock is undervalued by 37.8%. This may be a good opportunity for those looking to invest in STERLING CHECK shares, as they are currently being offered at a discounted price. More…

Peers

The competition among Sterling Check Corp and its competitors is intense. Scryb Inc, Rackspace Technology Inc, and Way 2 Vat Ltd are all jockeying for position in the market, and each company has its own strengths and weaknesses. Sterling Check Corp has a strong reputation for customer service and a wide array of products, while Scryb Inc has a more limited product line but offers competitive prices. Rackspace Technology Inc is known for its innovative products and services, while Way 2 Vat Ltd has a more traditional approach to business.

– Scryb Inc ($OTCPK:SCYRF)

Scryb Inc is a publicly traded company with a market capitalization of $16.73 million as of 2022. The company has a negative return on equity of 105.94%. Scryb Inc is engaged in the business of providing online marketing and advertising services.

– Rackspace Technology Inc ($NASDAQ:RXT)

Rackspace Technology, Inc. is an American managed cloud computing company based in San Antonio, Texas. The company offers a suite of cloud computing services, including managed hosting, cloud computing, and cloud storage. Rackspace was founded in 1998 and went public in 2008. As of 2018, it employed over 4,000 people.

– Way 2 Vat Ltd ($ASX:W2V)

Way 2 Vat Ltd is a company that provides VAT services. It has a market cap of 4.83M as of 2022. The company was founded in 2006 and is headquartered in London, United Kingdom.

Summary

Sterling Check reported strong financial results for the quarter ended, with non-GAAP EPS of $0.24, surpassing the estimated earnings by $0.02. Revenue of $179.27M was also higher than projections by $3.75M. This significant beat in both metrics was well received by investors, and the stock price reacted accordingly, moving up on the same day. In terms of financial health, Sterling Check is doing well, with a solid balance sheet and healthy cash flows, making it look like a good long-term investment option.

Further, their product offerings are well-received in the market, providing a steady stream of returns. In conclusion, Sterling Check appears to be a sound investment option for investors looking for growth potential in the near-term.

Recent Posts