Pagseguro Digital Intrinsic Value – PagSeguro: Unlocking Deep Value with Rapidly Expanding Profitability

May 20, 2023

Trending News ☀️

PAGSEGURO ($NYSE:PAGS): PagSeguro is a stock with great value and rapidly expanding, highly profitable business. It is a leading Brazilian digital payments company and a leading global provider of fintech and digital commerce solutions. The company has achieved great success by providing users with secure and easy-to-use online payment solutions. It offers a wide range of payment services, including mobile and online payments, digital wallets, and online banking. PagSeguro is committed to the development of innovative products and services to provide customers with a seamless payments experience. Through its innovative platform, PagSeguro is able to offer customers a wide range of options for how they choose to pay. This flexibility allows PagSeguro to meet the needs of different types of customers, from small businesses to large enterprises.

PagSeguro’s rapid expansion is driven by its strong financial performance. The company has consistently achieved double-digit revenue and profit growth over the past several years, due to the increasing demand for digital payments in Brazil and other countries. As the company continues to expand its product offerings, it is well positioned to take advantage of new opportunities in the digital payments market. PagSeguro’s strong financial performance has enabled it to unlock deep value and rapidly expand its profitability. This has enabled the company to invest in new technologies and services, expand into new markets, and increase its competitiveness in the global payments industry. As a result, PagSeguro is well placed to benefit from the continued growth of digital payments around the world.

Stock Price

PAGSEGURO DIGITAL is rapidly expanding its profitability, providing investors with deep value opportunities. On Thursday, its stock opened at $12.3 and closed at $12.4, a decrease of 0.6% from the last closing price of 12.5. The company has been making steady progress in its profitability, which has been facilitated by its strong focus on innovation and further penetration in the digital payments market. PAGSEGURO DIGITAL has been deploying capital in order to capture higher growth in the payments sector. It is well positioned to benefit from the growing demand for digital payments and the emerging opportunities offered by the Brazilian market. The company has also invested in technology services and products, such as an e-commerce platform, mobile payment solutions, and integrated financial services. The company’s profitability is being further supported by its solid customer base across the globe.

Additionally, PAGSEGURO DIGITAL’s international presence allows it to capture more customers worldwide, helping it to expand its profitability. With its strong focus on customer satisfaction and rapidly growing profitability, PAGSEGURO DIGITAL is unlocking deep value and providing investors with exciting opportunities for long-term growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pagseguro Digital. More…

| Total Revenues | Net Income | Net Margin |

| 8.91k | 1.5k | 16.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pagseguro Digital. More…

| Operations | Investing | Financing |

| 3.55k | -2.18k | -1.33k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pagseguro Digital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 45.33k | 33.49k | 35.93 |

Key Ratios Snapshot

Some of the financial key ratios for Pagseguro Digital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.9% | – | 55.1% |

| FCF Margin | ROE | ROA |

| 15.9% | 26.3% | 6.8% |

Analysis – Pagseguro Digital Intrinsic Value

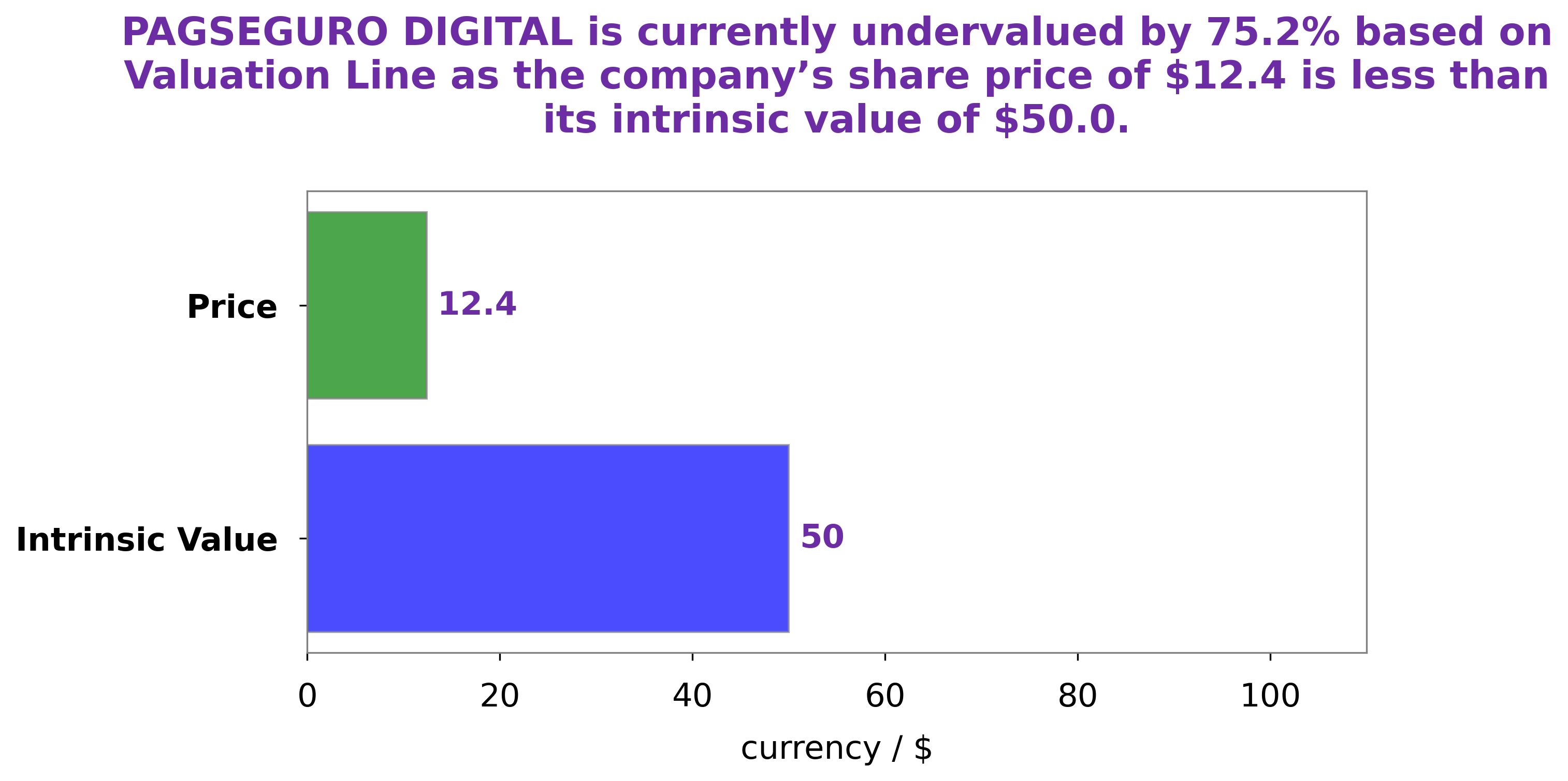

At GoodWhale, we’ve conducted an analysis of PAGSEGURO DIGITAL‘s wellbeing and our proprietary Valuation Line has calculated a fair value of the company’s share at around $50.0. However, the stock is currently trading at $12.4, meaning that it is undervalued by 75.2%. This presents a great opportunity for investors to add some PAGSEGURO DIGITAL shares to their portfolio and take advantage of this undervaluation. More…

Peers

PagSeguro Digital Ltd, One97 Communications Ltd, Getnet Adquirencia E Servicos Para Meios De Pagamento SA, and AGS Transact Technologies Ltd are all competing in the online payment processing industry. All four companies offer similar services, but PagSeguro Digital Ltd has a distinct advantage because it is the only Brazilian company in the group. This gives PagSeguro Digital Ltd a first mover advantage in the Brazilian market and allows the company to better understand the needs of Brazilian customers.

– One97 Communications Ltd ($BSE:543396)

One97 Communications Ltd is a holding company that engages in the provision of digital entertainment services. It operates through the following segments: Digital Entertainment and Others. The Digital Entertainment segment offers online content and services such as music, videos, games, and news. The Others segment includes sale of mobile handsets and accessories, and other value-added services. The company was founded by Vijay Shekhar Sharma in 2000 and is headquartered in Noida, India.

– Getnet Adquirencia E Servicos Para Meios De Pagamento SA ($NASDAQ:GET)

Getnet Adquirencia e Servicos para Meios de Pagamento SA is a Brazil-based company engaged in the provision of payment solutions. The Company offers services in the areas of electronic commerce, m-commerce, point of sale (POS) and others. It also provides solutions for the management and control of expenses, such as virtual cards, corporate cards and prepaid cards. The Company operates through three segments: Merchant Acquiring, which includes the activities of contracting and providing technological solutions that enable acceptance of electronic payments in physical stores; e-Commerce, which includes the contracting and providing of technological solutions that enable the acceptance of electronic payments in online stores; and Financial Institution, which includes the contracting and providing of technological solutions that enable the acceptance of electronic payments by financial institutions.

– AGS Transact Technologies Ltd ($BSE:543451)

Transact Technologies Ltd is a global provider of integrated payment solutions. The company’s products and services include point-of-sale systems, payment processing services, and software solutions. Transact Technologies Ltd has a market cap of 9.88B as of 2022 and a Return on Equity of 20.68%. The company’s products and services are used by merchants of all sizes, from small businesses to large enterprises. Transact Technologies Ltd is headquartered in New York, New York.

Summary

PAGSEGURO DIGITAL is an attractive investment opportunity for long-term investors. The company’s financials have been steadily improving and the stock price is up significantly over the last year. PAGSEGURO has a strong balance sheet and great forward-looking prospects, with a diversified revenue base across digital payments, e-commerce, and financial services. Profitability has been steadily growing, as evidenced by the impressive returns on equity and cash flow.

The company’s growth has been fueled by an expanding user base, driven by its innovative products and services that make digital payments and e-commerce easier and more convenient. PAGSEGURO also has a strong international presence, with operations in Latin America, Europe, and North America. With a healthy outlook and strong fundamentals, PAGSEGURO is an ideal stock for long-term investors looking to reap potential benefits in the future.

Recent Posts