“Keep an Eye on PagSeguro Digital Ltd.: Is It the Right Choice for You?”

February 6, 2023

Trending News 🌥️

PAGSEGURO ($NYSE:PAGS): PagSeguro Digital Ltd. is a Brazilian financial technology company that provides an e-commerce and digital payments platform for small and medium-sized businesses, as well as enables individuals to send and receive money transfers. With the rise of digital payments, PagSeguro Digital Ltd. has become a popular choice for investors who want to invest in the growing digital payments industry. In order to determine if it is worth keeping, you need to look at the company’s financials, its competitive position in the digital payments market, and the potential risks associated with investing in the stock. This suggests that the company has sufficient liquidity to fund its operations. In terms of its competitive position, PagSeguro Digital Ltd. has established itself as one of the leading players in the digital payments market, with a large customer base and a well-developed platform.

Additionally, the company has a number of strategic partnerships with large companies, such as Visa and Mastercard, which further reinforces its position in the market. Finally, it is important to consider the potential risks associated with investing in PagSeguro Digital Ltd., including geopolitical risk and currency volatility. Additionally, the company’s reliance on small and medium-sized businesses could be a risk if there is an economic downturn. In conclusion, while PagSeguro Digital Ltd. may be an attractive choice for investors looking to capitalize on the growth of digital payments, it is important to consider all of the factors outlined above before deciding whether or not it is a keeper for your portfolio.

Market Price

PagSeguro Digital Ltd. (PAGS) is a company that provides financial technology solutions for businesses and consumers in Brazil and Latin America. On Friday, PAGSEGURO DIGITAL stock opened at $9.9 and closed at $9.6, representing a drop of 5.3% from its last closing price of 10.2. PAGSEGURO DIGITAL has been making impressive strides in its market segment, especially in the Brazilian market. It has a wide array of services and products, ranging from digital payments to virtual POS solutions, and has a strong focus on customer service. Furthermore, its growing international presence makes it an attractive option for those interested in investing in the Latin American market.

However, potential investors should also keep an eye on PAGSEGURO DIGITAL’s financial performance, as this could be a major factor in making an informed decision. Investors should also be aware of potential competition from other financial technology companies in the region, which could potentially impact PAGSEGURO DIGITAL’s performance over time. Overall, potential investors should consider all the risks and opportunities associated with investing in PAGSEGURO DIGITAL before making a decision. Its competitive advantages in terms of customer service and product offerings should not be overlooked, but investors should also keep an eye on potential financial and competitive headwinds that could affect the company’s performance in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pagseguro Digital. More…

| Total Revenues | Net Income | Net Margin |

| 8.66k | 1.4k | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pagseguro Digital. More…

| Operations | Investing | Financing |

| 1.72k | -1.96k | 516.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pagseguro Digital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.28k | 31.76k | 34.13 |

Key Ratios Snapshot

Some of the financial key ratios for Pagseguro Digital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 37.3% | – | 50.2% |

| FCF Margin | ROE | ROA |

| -6.4% | 24.0% | 6.3% |

Analysis

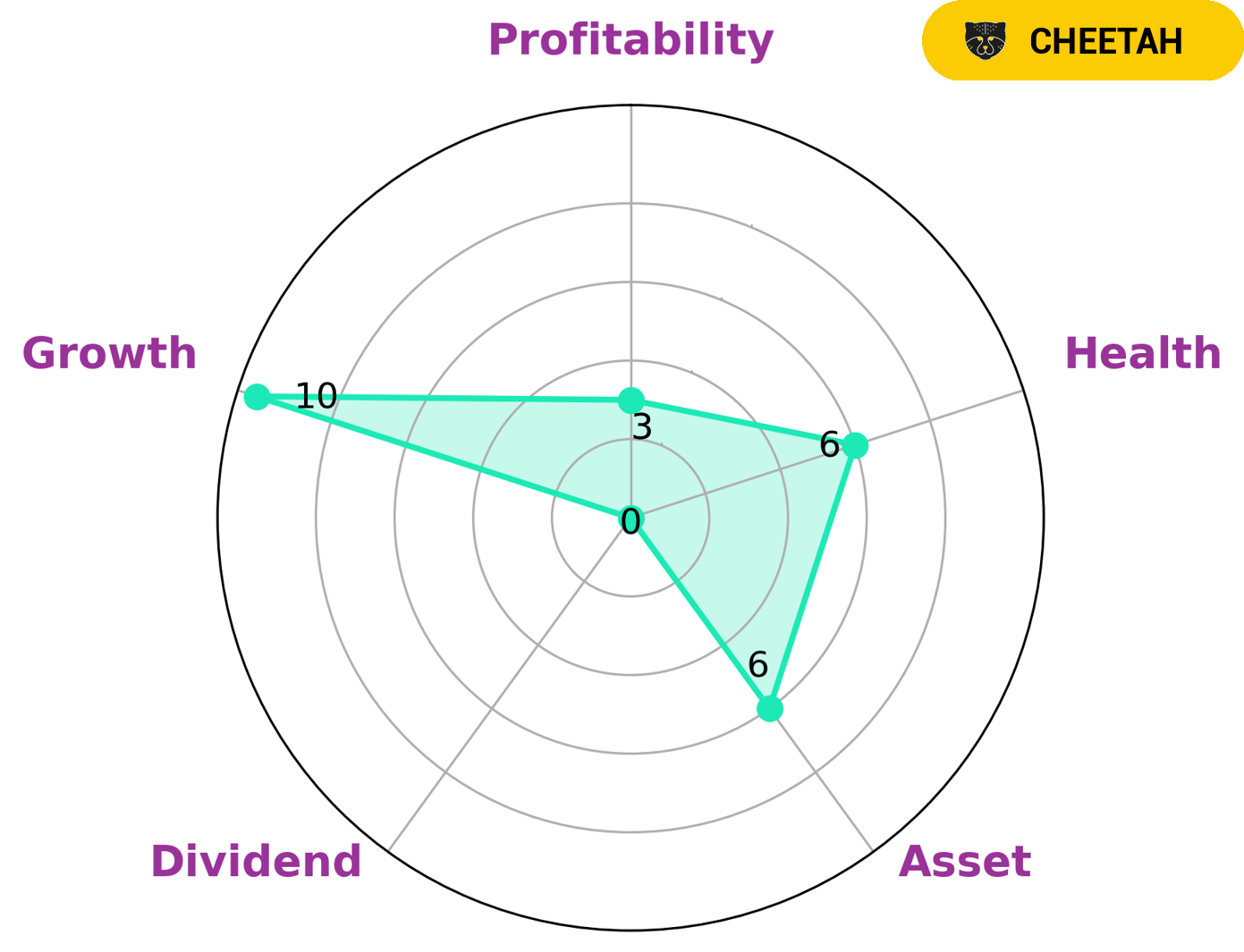

GoodWhale has conducted an analysis of PAGSEGURO DIGITAL‘s wellbeing, which revealed that the company has an intermediate health score of 6/10 with regard to its cashflows and debt. This indicates that PAGSEGURO DIGITAL might be able to pay off debt and fund future operations. Additionally, the company is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. When looking at the company’s other metrics, PAGSEGURO DIGITAL is strong in growth, medium in asset and weak in dividend, profitability. As such, investors who are looking for more stable companies with lower risk profiles may be less likely to invest in PAGSEGURO DIGITAL. On the other hand, investors who are looking for higher returns and are willing to take on more risk may be more interested in investing in the company. Overall, PAGSEGURO DIGITAL appears to be an attractive investment opportunity for investors who are willing to take on more risk in exchange for higher returns. However, it is important to note that the company’s stability and longevity may be more at risk than other types of companies. As such, investors should conduct their own due diligence before investing in the company. More…

Peers

PagSeguro Digital Ltd, One97 Communications Ltd, Getnet Adquirencia E Servicos Para Meios De Pagamento SA, and AGS Transact Technologies Ltd are all competing in the online payment processing industry. All four companies offer similar services, but PagSeguro Digital Ltd has a distinct advantage because it is the only Brazilian company in the group. This gives PagSeguro Digital Ltd a first mover advantage in the Brazilian market and allows the company to better understand the needs of Brazilian customers.

– One97 Communications Ltd ($BSE:543396)

One97 Communications Ltd is a holding company that engages in the provision of digital entertainment services. It operates through the following segments: Digital Entertainment and Others. The Digital Entertainment segment offers online content and services such as music, videos, games, and news. The Others segment includes sale of mobile handsets and accessories, and other value-added services. The company was founded by Vijay Shekhar Sharma in 2000 and is headquartered in Noida, India.

– Getnet Adquirencia E Servicos Para Meios De Pagamento SA ($NASDAQ:GET)

Getnet Adquirencia e Servicos para Meios de Pagamento SA is a Brazil-based company engaged in the provision of payment solutions. The Company offers services in the areas of electronic commerce, m-commerce, point of sale (POS) and others. It also provides solutions for the management and control of expenses, such as virtual cards, corporate cards and prepaid cards. The Company operates through three segments: Merchant Acquiring, which includes the activities of contracting and providing technological solutions that enable acceptance of electronic payments in physical stores; e-Commerce, which includes the contracting and providing of technological solutions that enable the acceptance of electronic payments in online stores; and Financial Institution, which includes the contracting and providing of technological solutions that enable the acceptance of electronic payments by financial institutions.

– AGS Transact Technologies Ltd ($BSE:543451)

Transact Technologies Ltd is a global provider of integrated payment solutions. The company’s products and services include point-of-sale systems, payment processing services, and software solutions. Transact Technologies Ltd has a market cap of 9.88B as of 2022 and a Return on Equity of 20.68%. The company’s products and services are used by merchants of all sizes, from small businesses to large enterprises. Transact Technologies Ltd is headquartered in New York, New York.

Summary

PagSeguro Digital Ltd. is a Brazilian fintech company that specializes in digital payments and banking services. The company is listed on the Brazilian stock exchange and its stock price has recently declined. However, investors may still be interested in the company due to its growing presence in the Latin American market, its wide network of services such as online payments, credit cards, and digital banking, and its increasing customer base. Despite the recent drop in stock prices, PagSeguro Digital remains a potential investment option for those looking for a well-established and rapidly growing fintech company.

Recent Posts