KATAPULT HOLDINGS Surpasses Expectations with GAAP EPS of -$0.09 and Revenue of $55.68M

May 12, 2023

Trending News 🌥️

KATAPULT HOLDINGS ($NASDAQ:KPLT), a leading global provider of digital finance and payments services, recently reported a GAAP EPS of -$0.09, surpassing the expected figure by $0.01, and achieved a revenue of $55.68M exceeding the anticipated amount by $2.28M. This has exceeded the expectations of many analysts and investors alike, who were expecting more moderate figures. KATAPULT HOLDINGS is a publicly traded company that provides innovative solutions to help people access and manage their money safely and securely. The company is well known for its pioneering work in the payment technology industry, and its products are used by customers around the world.

KATAPULT HOLDINGS prides itself on its commitment to innovation, providing customers with cutting edge solutions that make it easier to pay and be paid. Moving forward, the company plans to continue to drive innovation and customer satisfaction as it strives to be an industry leader.

Earnings

KATAPULT HOLDINGS recently released their fiscal year 2022 Q4 earning report and the results surpassed expectations. For the period ending on December 31, 2022, the total revenue was recorded at $55.68M USD and the GAAP EPS was -$0.09. This marks a three year decline in total revenue for KATAPULT HOLDINGS with total revenue dropping from $73.36M USD to $48.85M USD.

The fiscal year 2022 Q4 results for KATAPULT HOLDINGS shows an unexpected increase in performance despite significant losses in total revenue and net income. This news has been well-received in the markets and further strengthens the position of KATAPULT HOLDINGS as a leading provider of financial services.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Katapult Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 212.1 | -37.87 | -20.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Katapult Holdings. More…

| Operations | Investing | Financing |

| -20.85 | -1.5 | -4.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Katapult Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 131.9 | 124.77 | 0.07 |

Key Ratios Snapshot

Some of the financial key ratios for Katapult Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.2% | – | -8.5% |

| FCF Margin | ROE | ROA |

| -10.5% | -82.8% | -8.5% |

Stock Price

KATAPULT HOLDINGS made a strong showing on Thursday, with their GAAP earnings per share (EPS) coming in at -$0.09 and revenue of $55.68M, surpassing analyst expectations. The stock opened at $0.7, and closed at $0.7 after a 6.2% increase from the previous closing price of $0.6. The strong results were driven by the company’s commitment to investing in new products and services, as well as an increase in customer demand. The company is now well positioned to continue their momentum into the fourth quarter. Live Quote…

Analysis

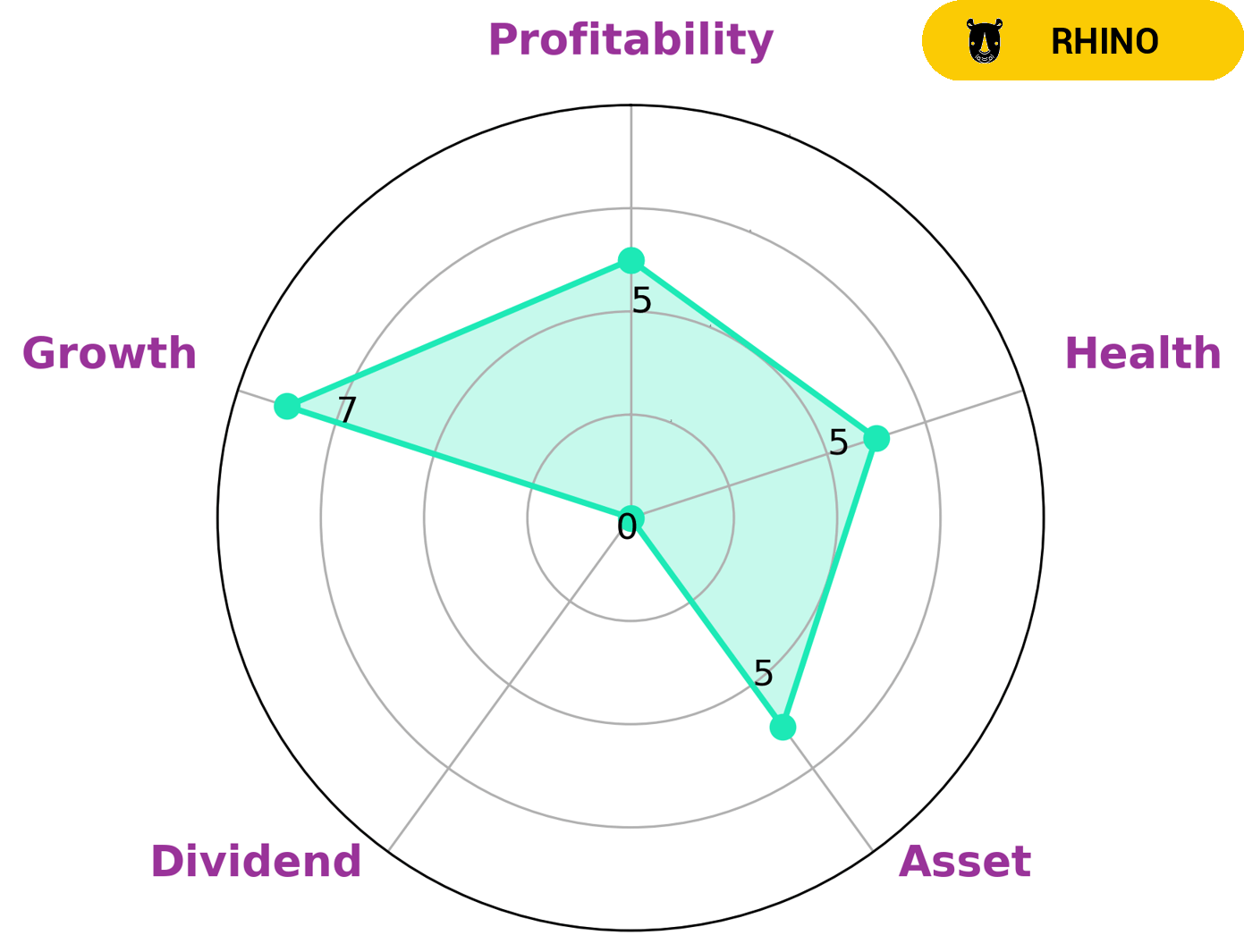

GoodWhale recently conducted an analysis of KATAPULT HOLDINGS‘ wellbeing. We used our proprietary Star Chart to assess their performance across four key pillars: growth, assets, profitability, and dividends. Our analysis revealed that KATAPULT HOLDINGS is strong in growth, medium in assets, profitability, and weak in dividends. Overall, KATAPULT HOLDINGS’ health score comes in at 5/10, indicating that they are likely to sustain future operations even during critical times of crisis. We classify KATAPULT HOLDINGS as a ‘rhino’- a type of company that has achieved moderate revenue or earnings growth. As a result of our analysis, we believe that KATAPULT HOLDINGS may be an attractive investment for investors looking for long-term growth opportunities. Such investors may include venture capitalists, private equity firms, and strategic investors. These firms typically have a longer-term perspective and are willing to take on greater risks in exchange for the potential for higher returns. More…

Peers

Its competitors include Affirm Holdings Inc, Toast Inc, and Fintech Select Ltd.

– Affirm Holdings Inc ($NASDAQ:AFRM)

Affirm Holdings Inc is a financial technology company that offers installment loans to consumers at the point of sale. The company has a market cap of 4.54B as of 2022 and a return on equity of -19.16%. The company’s primary products are Affirm Loans and Affirm Credit, which allow consumers to finance purchases from participating merchants. Affirm also offers Affirm Save, a tool that helps consumers save money on future purchases.

– Toast Inc ($NYSE:TOST)

Toast Inc is a publicly traded company that provides software and hardware solutions for restaurants. As of 2022, the company has a market capitalization of 9.82 billion dollars and a return on equity of -24.64%. The company offers a variety of products and services that aim to help restaurants streamline their operations and improve their customer experience. Some of the company’s notable products include Toast POS, Toast Pay, and Toast Online Ordering. Despite Toast’s negative return on equity, the company’s market cap indicates that it is still a large and influential player in the restaurant software industry.

– Fintech Select Ltd ($TSXV:FTEC)

Fintech Select Ltd is a company that provides financial technology solutions. The company has a market capitalization of 1.6 million as of 2022 and a return on equity of -195.24%. The company provides solutions for payment processing, point-of-sale systems, and mobile commerce. The company also offers consulting and support services.

Summary

KATAPULT HOLDINGS is an investment company that recently reported its earnings. The company reported a GAAP EPS of -$0.09, beating expectations by $0.01, while revenue of $55.68M also beat expectations by $2.28M. Investors reacted positively to the news, pushing the stock price up the same day.

Overall, the company’s performance appears to have exceeded expectations and investors may find it attractive as an investment option. It is important to note, however, that past performance is not always indicative of future results, and potential investors should conduct their own due diligence before making any investments.

Recent Posts