J e f f e r i e s G i v e s P a y o n e e r G l o b a l a B u y R a t i n g , S h a r e s U p 5 . 3 % i n M o r n i n g T r a d e

February 28, 2023

Trending News ☀️

Jefferies cited several advantages which have allowed Payoneer Global ($NASDAQ:PAYO) to stand out in a crowded, competitive environment. These include the company’s early entry into the market, its worldwide presence, and its products and services. Payoneer Global’s early entry into the market has allowed it to work with established partners, such as Apple, Amazon and Airbnb, and develop reliable products and services that meet their needs. The products and services Payoneer offers are another key factor in why Jefferies decided to give them a Buy rating.

These include online payments, cross-border remittance, digital banking and merchant payment solutions. The confidence shown in Payee Global by Jefferies is an indicator that this company is well-positioned to capitalize on the booming e-commerce industry. With its presence being extended worldwide and its comprehensive products and services offering, Payoneer Global is a great choice for businesses looking for an innovative provider of payment solutions.

Share Price

Investment banking firm, Jefferies, recently gave PAYONEER GLOBAL a ‘Buy’ rating, providing a lift to the company’s stock in Monday trading. Media coverage of PAYONEER GLOBAL have been mainly positive leading up to the rating, and the stock opened at $5.8 and closed the session at the same price, representing an increase of 1.8% from the previous closing price of $5.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Payoneer Global. More…

| Total Revenues | Net Income | Net Margin |

| 583.28 | 12.91 | -5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Payoneer Global. More…

| Operations | Investing | Financing |

| 53.55 | 0.75 | 1.37k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Payoneer Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.76k | 5.23k | 1.52 |

Key Ratios Snapshot

Some of the financial key ratios for Payoneer Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.1% | – | -3.1% |

| FCF Margin | ROE | ROA |

| 4.9% | -2.1% | -0.2% |

Analysis

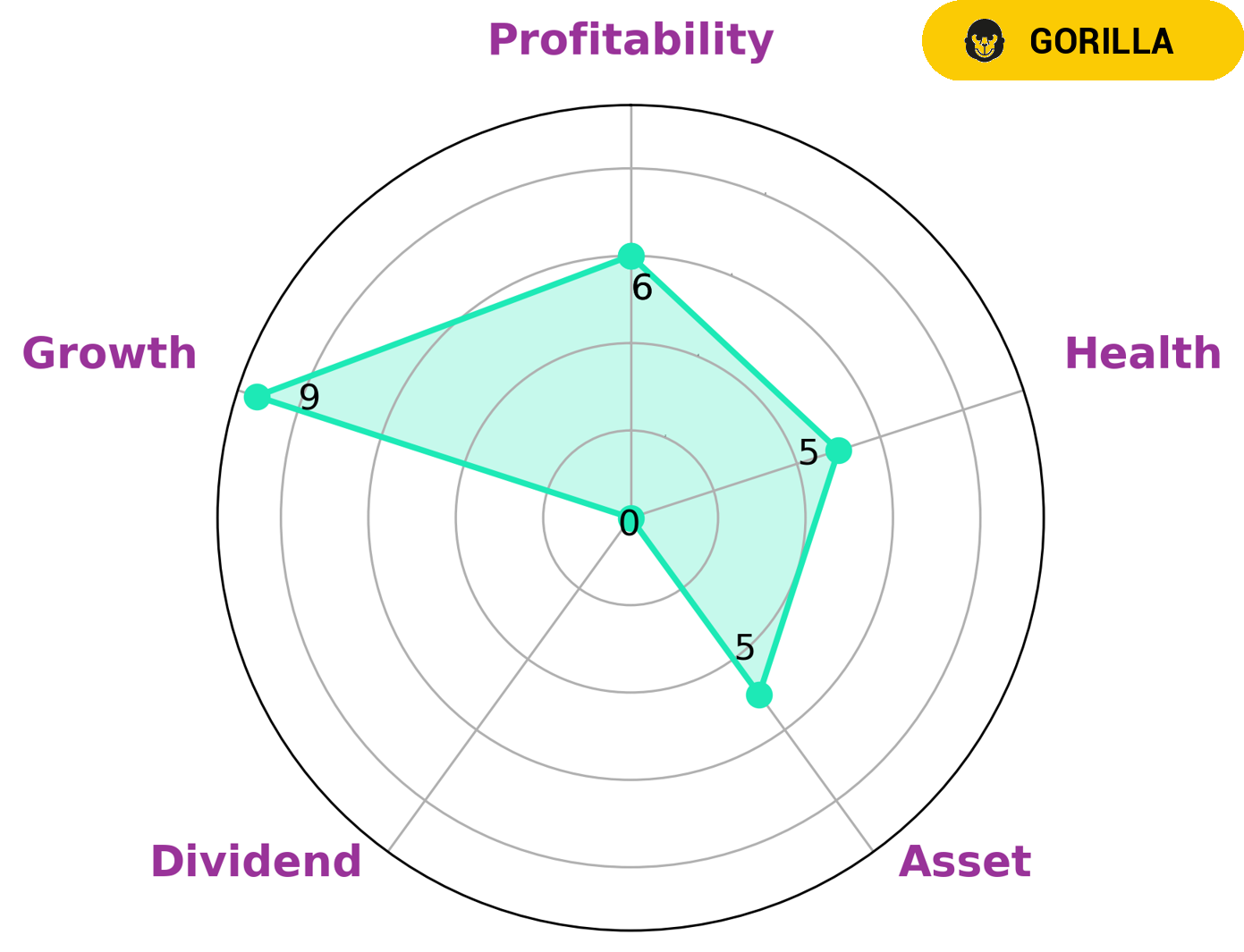

As a financial analyst at GoodWhale, it is my duty to analyze the financials of PAYONEER GLOBAL. Using GoodWhale’s Star Chart, I have classified PAYONEER GLOBAL as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. From a fiscal perspective, PAYONEER GLOBAL is strong in growth, medium in asset, profitability and weak in dividend. Furthermore, considering its cashflows and debt, PAYONEER GLOBAL has an intermediate health score of 5/10. This implies that while PAYONEER GLOBAL may not be an ideal choice for dividend investors, it is likely to pay off its debt and fund future operations. Overall, PAYONEER GLOBAL is an interesting choice for growth investors who are looking to make a long-term investment. More…

Peers

The company offers a suite of products and services that enable businesses to send and receive payments in over 200 countries and territories. Payoneer also provides consumers with a prepaid debit card that can be used to make purchases online and in-store. Payoneer’s main competitors are Fintech Select Ltd, NextPlat Corp, and Appliqate Inc. All three companies offer similar products and services, but each has a different focus. Fintech Select Ltd is a leading provider of online payment solutions for businesses and consumers. NextPlat Corp is a global provider of cross-border payment solutions, connecting businesses and consumers around the world. Appliqate Inc is a leading provider of mobile payment solutions, connecting businesses and consumers around the world.

– Fintech Select Ltd ($TSXV:FTEC)

Fintech Select Ltd is a provider of technology solutions for the financial services industry. The company has a market cap of 1.6M as of 2022 and a Return on Equity of -195.24%. The company’s products and services include point-of-sale solutions, mobile payments, and fraud prevention and detection solutions. The company serves clients in the United States, Canada, Europe, and Asia.

– NextPlat Corp ($NASDAQ:NXPL)

NextPlat Corp is a publicly traded company with a market capitalization of 15.21 million as of 2022. The company has a return on equity of -22.46%. NextPlat Corp is engaged in the business of developing and marketing software products and services. The company’s products and services include software development tools, application development tools, web development tools, and database management tools. NextPlat Corp’s customers include businesses of all sizes, from small businesses to large enterprises.

Summary

P a y o n e e r G l o b a l i s a p a y m e n t t e c h n o l o g y c o m p a n y t h a t e n a b l e s b u s i n e s s e s , p r o f e s s i o n a l s , a n d o n l i n e m a r k e t p l a c e s t o p a y a n d g e t p a i d g l o b a l l y .

Recent Posts