FTC Closed Door Meetings May Affect Outcome of VMware/Broadcom Deal

April 22, 2023

Trending News 🌥️

VMWARE ($NYSE:VMW) is a multinational technology company that specializes in cloud computing and virtualization software and services. It is one of the world’s leading providers of virtualization and cloud infrastructure solutions, helping to redefine the way industries operate. Recently, news has emerged that the Federal Trade Commission (FTC) has been holding closed door meetings to discuss the VMware/Broadcom deal. This has caused the deal to become more wide-reaching than originally thought, as the FTC is now looking into how the acquisition would affect the competition landscape. The deal was expected to bring together two of the leading names in the technology industry and create a formidable force in the industry. It also posed a potential risk to other technology companies, as it could create an oligopoly in the tech sector. The FTC’s closed door meetings have raised many questions about the potential impact of the VMware/Broadcom deal.

It is unclear what measures the FTC will take to protect competition in the tech sector, though it is likely that some form of regulation will be imposed after the closed door meetings are concluded. If this happens, then it could significantly alter the outcome of the VMware/Broadcom deal. Given the current uncertainty surrounding the VMware/Broadcom deal, it is unclear what the final outcome will be. It is possible that the FTC’s closed door meetings will have a major impact on the future of the deal, though only time will tell. In any case, it is important for those involved in the deal to remain aware of the potential implications of this development as it could have a major impact on the final outcome.

Share Price

On Friday, news was released that the Federal Trade Commission (FTC) had held closed door meetings to discuss the potential merger between VMware and Broadcom. As a result of the news, VMWARE stock opened at $128.6 and closed at $126.1, representing a decrease of 1.7% over the previous closing price of 128.2. This news has created uncertainty about the outcome of the merger and its potential impact on VMWARE’s stock price. It is unclear whether the FTC meetings are indicative of an objection to the deal, or if the meetings are simply part of their due diligence process.

VMWARE has yet to release any statement about the FTC meetings, leaving investors to make their own assumptions about the potential outcome. As uncertainty surrounding the deal continues to grow, it is likely that VMWARE’s stock price will remain volatile until more information is released. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vmware. VMwareBroadcom_Deal”>More…

| Total Revenues | Net Income | Net Margin |

| 13.35k | 1.31k | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vmware. VMwareBroadcom_Deal”>More…

| Operations | Investing | Financing |

| 4.3k | -367 | -2.47k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vmware. VMwareBroadcom_Deal”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.24k | 29.7k | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Vmware are shown below. VMwareBroadcom_Deal”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | 10.1% | 15.7% |

| FCF Margin | ROE | ROA |

| 28.8% | 112.0% | 4.2% |

Analysis

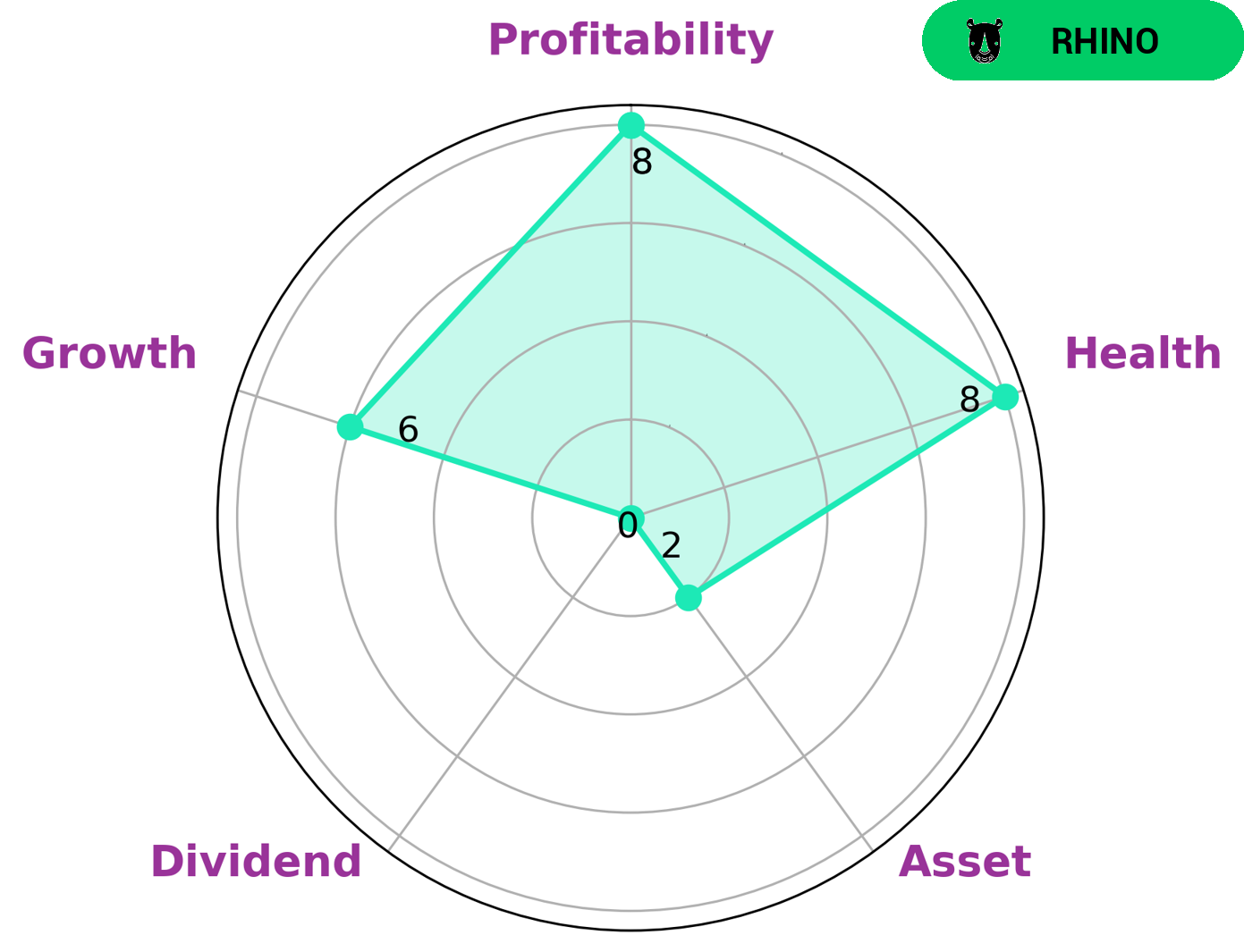

At GoodWhale, we examined VMWARE’s financials and found some interesting insights. According to our Star Chart, VMWARE is in good health with an 8/10 score when it comes to cashflows and debt, which means that it is capable of sustaining future operations in times of crisis. In terms of profitability, VMWARE is strong; however, its growth and dividend are only medium. Based on these findings, we classify VMWARE as a ‘rhino’ type of company; this means that it has achieved moderate revenue or earnings growth. Investors who focus on steady growth stocks may be interested in VMWARE’s profile. Those who prioritize consistent and strong returns while investing in established companies may find VMWARE an attractive option. Additionally, those who are looking for a diversified portfolio may also consider investing in VMWARE as its robust cashflow and debt score will provide some stability in times of uncertainty. VMwareBroadcom_Deal”>More…

Peers

VMware Inc is a leading provider of virtualization and cloud infrastructure solutions. Its competitors include GSS Infotech Ltd, Venzee Technologies Inc, ProStar Holdings Inc.

– GSS Infotech Ltd ($BSE:532951)

GSS Infotech Ltd. is a global provider of software and IT services. The company offers a range of services, including application development, enterprise resource planning, and infrastructure management. It also provides software solutions for the banking, financial services, and insurance industries. GSS Infotech has a market cap of 4.49 billion as of 2021 and a return on equity of 12.46%. The company was founded in 1997 and is headquartered in Hyderabad, India.

– Venzee Technologies Inc ($TSXV:VENZ)

Assuming you are writing as of 2022:

Venzee Technologies Inc has a market cap of 2.47M as of 2022. The company’s return on equity is 1422.25%. Venzee Technologies is a software company that provides a platform to streamline the exchange of product data between retailers and brands.

– ProStar Holdings Inc ($TSXV:MAPS)

ProStar Holdings Inc is a provider of geospatial data and related services for the energy industry. The company’s market cap is $22.79 million and its ROE is -67.74%. ProStar’s geospatial data and services are used by oil and gas companies, government agencies, and other organizations involved in the exploration, production, and transportation of energy.

Summary

VMWare has seen a rise in interest from investors with its recent announcement of a joint deal with Broadcom. The market reacted positively to the news initially, however stock prices have since dropped as rumors of closed-door meetings with the Federal Trade Commission came to light. Analysts are now unsure what the implications of the meetings are, leading to a widening of the spread and an increase in volatility. Investors should be aware of the potential risks involved with the deal and monitor developments in the situation.

Recent Posts