Victory Capital Management Invests $356000 in Avid Technology,

February 15, 2023

Trending News ☀️

Victory Capital Management Inc. recently invested $356000 in Avid Technology ($NASDAQ:AVID), Inc., a publicly traded software company specializing in digital media creation, management, and delivery. From audio and video editing to asset management and delivery, Avid Technology provides a comprehensive suite of products and services. Avid Technology’s products are used in virtually every aspect of content creation, from film and television production to video game development. Its software and hardware offerings simplify workflow and makes it easier for users to manage their media. Its flagship products include Avid Media Composer, Pro Tools and Sibelius, which are all used in the production of audio and video content. It also offers a wide range of products aimed at the consumer market such as its Airspeed video editing and recording devices.

Avid Technology has an established presence in the world of digital media production. Its products are used by professionals in major broadcasting networks, Hollywood studios and independent producers. The company is also well known for its support of independent filmmakers, offering free educational materials and access to its software to help them create quality content. The investment from Victory Capital Management is a significant boost for Avid Technology, as it will enable it to expand its reach into new markets and better serve its existing customers. With the investment, Avid Technology is expected to continue its growth in the digital media industry with innovative solutions and services that will further revolutionize the way content is created and delivered.

Share Price

On Monday, Victory Capital Management Inc. made the decision to invest $356000 in Avid Technology, Inc. This investment comes as the media exposure of Avid Technology has been largely positive. On the same day, AVID TECHNOLOGY stock opened at $29.9 and closed at $30.6, a 2.6% increase from the previous closing price of $29.8. The company designs high-end audio and video technology for the media, entertainment and creative industries, including professional recording studios, broadcast and post-production facilities, independent filmmakers, and corporate video production departments. The company has a wide range of products that range from digital audio and video editing software to audio interfaces and mixing consoles. The company also offers technical training and certification programs for professionals in the industry. The company is expected to continue to expand its reach and develop innovative products and services for its customers.

Additionally, AVID TECHNOLOGY’s customer service reputation is sure to remain strong and reliable, as it has in the past. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avid Technology. More…

| Total Revenues | Net Income | Net Margin |

| 420.38 | 45.2 | 10.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avid Technology. More…

| Operations | Investing | Financing |

| 52.63 | -13.14 | -56.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avid Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 237.53 | 378.94 | -3.22 |

Key Ratios Snapshot

Some of the financial key ratios for Avid Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.0% | 21.5% | 13.1% |

| FCF Margin | ROE | ROA |

| 9.4% | -24.7% | 14.4% |

Analysis

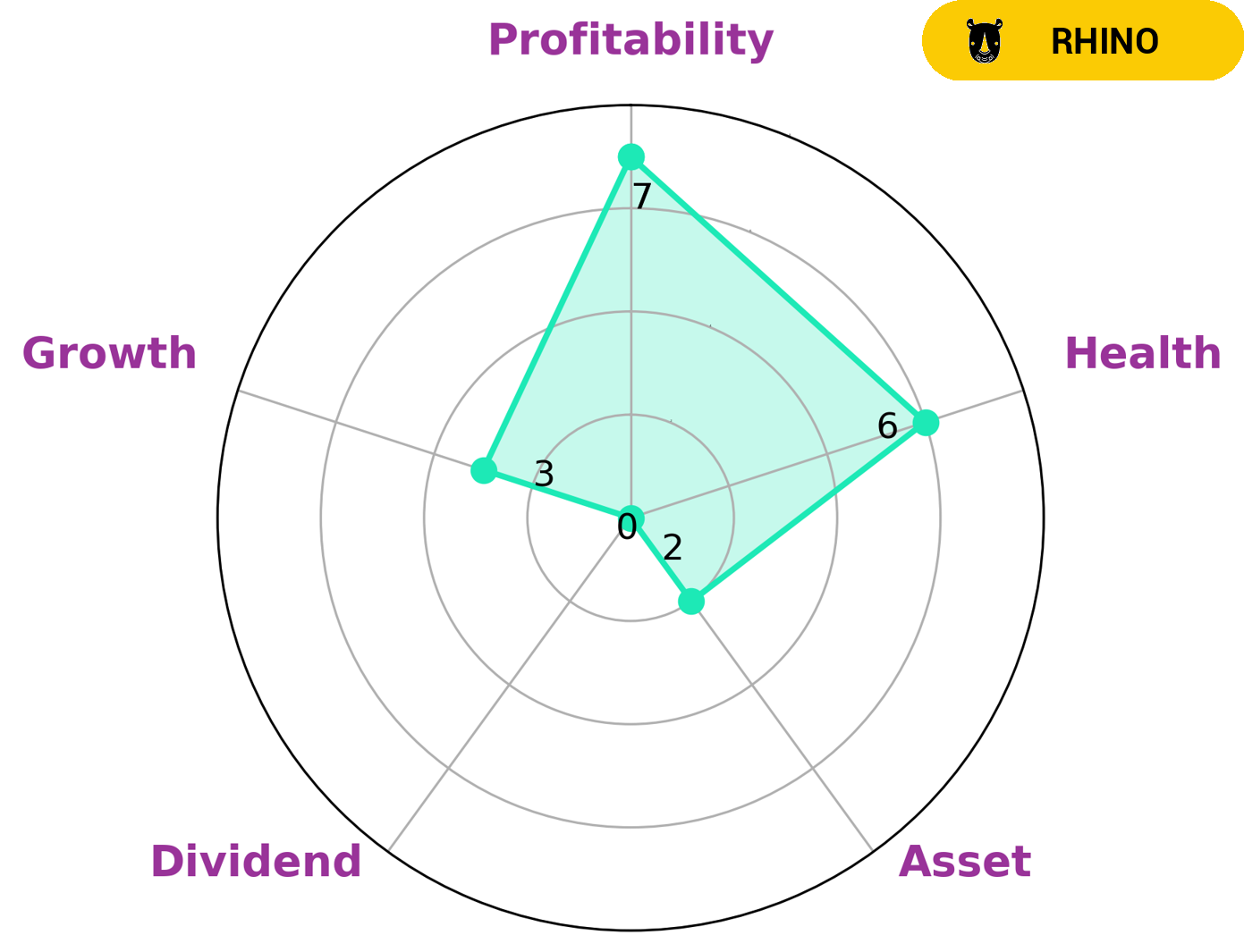

GoodWhale’s analysis of AVID TECHNOLOGY reveals that the company is strong in terms of profitability and weak in terms of asset, dividend, and growth. It is classified as a “rhino” type of company, which has achieved moderate revenue or earnings growth. This would appeal to investors who are looking for a stable investment with good cash flow. AVID TECHNOLOGY has an intermediate health score of 6/10, which means it may be able to pay off its debt and fund future operations. Investors seeking a medium-term return on their investment may find AVID TECHNOLOGY to be an appealing option, as it is likely to continue generating steady revenue with moderate growth. When evaluating the company, investors should also consider the risks associated with the company’s weak asset, dividend, and growth performance. These could be a sign that the company may struggle to diversify its sources of revenue or expand its operations in the future. It is important for investors to understand these risks when assessing AVID TECHNOLOGY as an investment opportunity. Overall, AVID TECHNOLOGY may be an attractive option for investors seeking a safe and manageable investment with a moderate return. The company’s intermediate health score demonstrates that it is likely to generate steady cash flow and achieve moderate growth. However, investors should also be aware of the potential risks associated with the company’s weak performance in asset, dividend and growth areas. More…

Peers

The company’s competitors include 7digital Group PLC, NanoTech Entertainment Inc, and Shutterstock Inc.

– 7digital Group PLC ($LSE:7DIG)

7digital Group PLC is a digital media company that provides music, radio, and other entertainment services. The company has a market cap of 7.49M as of 2022 and a Return on Equity of 20.43%. 7digital Group PLC offers a variety of music-related services, including online music stores, radio stations, and other entertainment services. The company also provides digital media content and services to a variety of clients, including mobile phone operators, retailers, and media companies.

– NanoTech Entertainment Inc ($OTCPK:NTEK)

NanoTech Entertainment Inc is a media and entertainment company that creates and distributes digital content and services. The company has a market cap of 1.19M as of 2022. NanoTech’s products and services include video games, music, movies, and TV shows. The company’s mission is to provide high-quality entertainment experiences to consumers around the world.

– Shutterstock Inc ($NYSE:SSTK)

Shutterstock Inc is a publicly traded company that provides digital content and services. Its market cap as of 2022 is 1.7 billion dollars and its return on equity is 14.64%. The company was founded in 2003 and is headquartered in New York City. Shutterstock Inc provides digital content and services to businesses and individuals around the world. Its products and services include royalty-free images, video clips, and music. Shutterstock Inc also offers a variety of tools and services to help businesses and individuals create and manage their digital content.

Summary

Analysts suggest that Avid Technology has potential to be a lucrative investment due to its innovative products and solutions. Additionally, Avid Technology regularly posts profits and has experienced a steady increase in their stock price over the past few years. Analysts also point to their strong financials and management team as good signs for potential investors. With their strong balance sheet and a strong position in the industry, Avid Technology is highly recommended for investors looking for a reliable and profitable investment opportunity.

Recent Posts