Smartsheet to Announce Q1 Earnings with Estimated EPS of $0.08 on June 7th

June 7, 2023

🌥️Trending News

Smartsheet Inc ($NYSE:SMAR). is a cloud-based software company based out of Bellevue, Washington. They specialize in providing business solutions that support collaboration and productivity through their enterprise work management platform. On Wednesday, June 7th, the company will be releasing its Q1 earnings results following the closing of the market. Market analysts have estimated that the company’s earnings per share (EPS) for Q1 will be $0.08. The anticipation and speculation surrounding the report has caused a spike in trading volume and share price in recent weeks.

Investors will be eager to see if Smartsheet can meet or exceed their $0.08 EPS Estimate and continue to make a positive impact on their bottom line. As with all financial reports, investors and market analysts will be paying close attention to the details of the Q1 report from Smartsheet. It could be a catalyst for further growth or an indicator of future problems. Regardless, the eyes of Wall Street will be on Smartsheet as they announce their Q1 earnings on Wednesday, June 7th.

Earnings

In their latest earning report of FY2023 Q4 as of January 31 2021, the company earned a total revenue of 109.87M USD, but lost 28.66M USD in net income. Compared to the previous year, there was a 30.2% decrease in total revenue. Despite this, SMARTSHEET INC has seen a significant increase in total revenue over the past three years, reaching 212.34M USD. Investors will be watching closely as the company announces their Q1 earnings to see if they can continue to grow year over year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Smartsheet Inc. More…

| Total Revenues | Net Income | Net Margin |

| 766.91 | -215.64 | -28.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Smartsheet Inc. More…

| Operations | Investing | Financing |

| 23.59 | -263.9 | 14.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Smartsheet Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.11k | 624.55 | 3.68 |

Key Ratios Snapshot

Some of the financial key ratios for Smartsheet Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 41.5% | – | -28.9% |

| FCF Margin | ROE | ROA |

| 1.3% | -28.9% | -12.5% |

Share Price

Smartsheet Inc, a leading cloud-based project management and work automation platform, is set to announce its quarterly earnings on June 7th. Analysts are expecting the company to report an estimated earnings per share (EPS) of $0.08 for the first quarter of 2021. The news has been well-received by investors, as the company’s shares opened at $49.2 and closed at $51.7 on Tuesday, representing a 4.8% increase from the prior closing price of $49.3. This marks a positive start to the quarter for Smartsheet Inc, and investors remain optimistic about the company’s prospects for the rest of the year. Live Quote…

Analysis

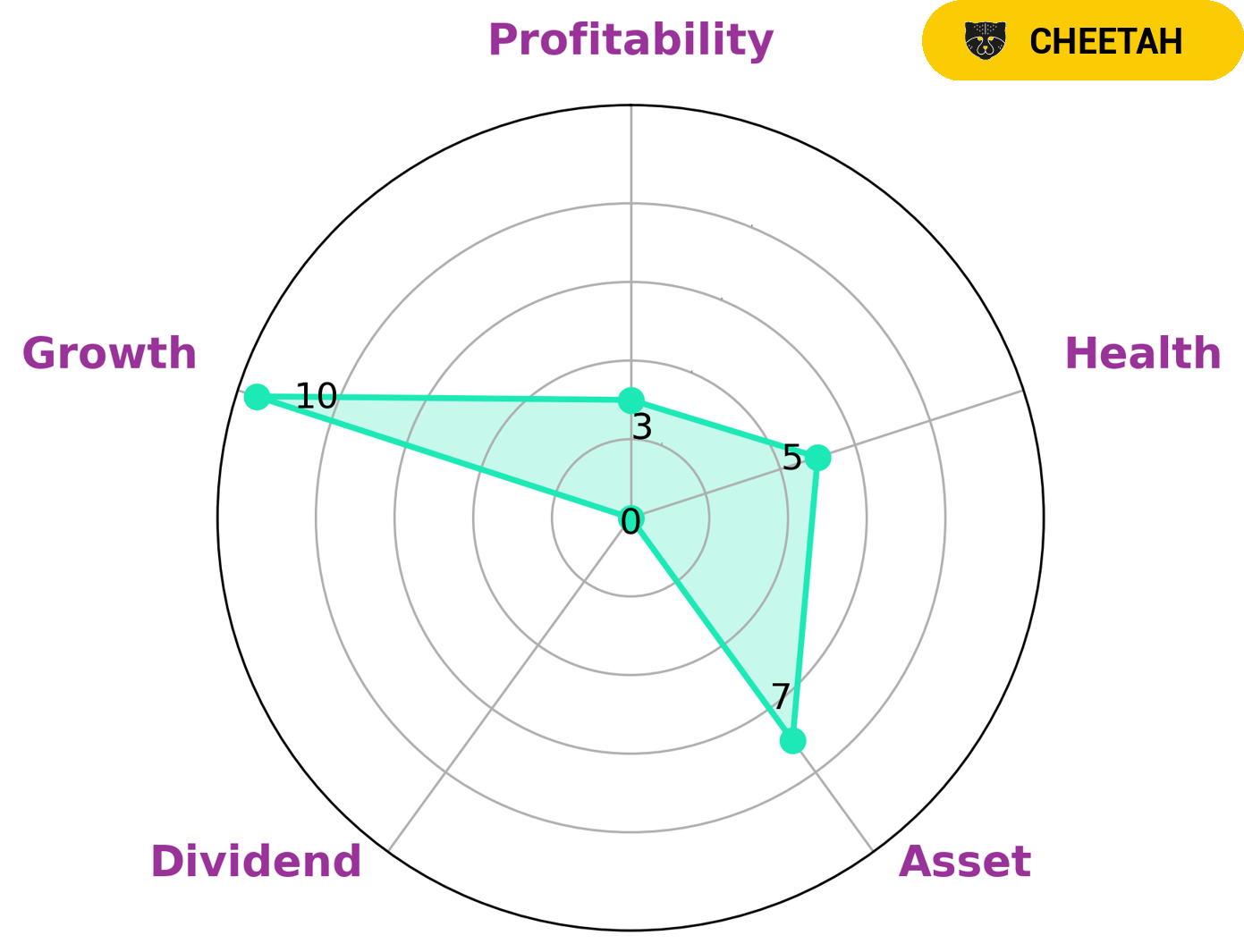

At GoodWhale, we have conducted an analysis of the fundamentals of SMARTSHEET INC. Based on our Star Chart, it is clear that this company is strong in assets and growth, but weak in dividend and profitability. This has allowed us to classify SMARTSHEET INC as a ‘cheetah’ – a company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. In terms of what type of investors may be interested in such a company, it could be investors who are looking for fast growth opportunities, or those who are seeking higher returns with a certain amount of risk. The intermediate health score of SMARTSHEET INC – 5/10 – indicates that the company might be able to sustain future operations in times of crisis, taking into account its cashflows and debt. More…

Peers

There is fierce competition among Smartsheet Inc, Asana Inc, Monday.Com Ltd, and Microsoft Corp in the productivity software market. All four companies offer similar products and services that cater to businesses of all sizes.

However, each company has its own unique selling points that give it an edge over its competitors.

– Asana Inc ($NYSE:ASAN)

Asana is a work management platform that helps teams organize, track, and manage their work. It has a market cap of 3.98B as of 2022 and a Return on Equity of -184.09%. Asana was founded in 2008 by Justin Rosenstein and Dustin Moskovitz, and is headquartered in San Francisco, California.

– Monday.Com Ltd ($NASDAQ:MNDY)

Monday.com Ltd has a market cap of $4.38B as of 2022. The company has a Return on Equity of -16.76%. Monday.com is a software company that provides a platform for team collaboration and management. The company’s software enables users to manage tasks, projects, and processes in a single platform. Monday.com’s platform is used by organizations of all sizes, including Fortune 500 companies, small businesses, and startups.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is an American multinational technology company with a market capitalization of $1.76 trillion as of April 2022 and a return on equity of 45.3%. The company develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and services. Its best known software products are the Microsoft Windows line of operating systems, the Microsoft Office suite, and the Internet Explorer and Edge web browsers.

Summary

Investors should pay close attention to SmartSheet Inc. as the company is scheduled to announce its Q1 earnings results on June 7th. Analysts anticipate earnings per share (EPS) of $0.08, which could cause the stock price to move up after market close. It is important for potential investors to consider the company’s fundamentals and financial history before considering an investment. Analysts and investors should also consider the company’s competitive landscape, growth opportunities, and current and future cash flows when evaluating the potential return on the stock.

Additionally, looking at trends in industry peers, and macroeconomic conditions can help to inform a more informed investing decision. Overall, SmartSheet Inc. is worth keeping an eye on as it releases its earnings report in June.

Recent Posts