Rockefeller Capital Management L.P. Boosts Stake in BlackLine, by 1671 Shares.

February 1, 2023

Trending News ☀️

BLACKLINE ($NASDAQ:BL): Rockefeller Capital Management L.P. recently increased its stake in BlackLine, Inc. by 1671 shares. BlackLine, Inc. is a leading provider of cloud-based solutions for finance and accounting departments. The company’s flagship product, BlackLine, provides cloud-based accounting software that automates and streamlines business processes such as account reconciliations, journal entries, and cash flow management. In addition to this, the company has been expanding its market reach, introducing new features and services to meet customer needs. Rockefeller Capital Management L.P.’s purchase of 1671 shares is indicative of their faith in the company’s future prospects.

As one of the most successful software companies in the world and a leading provider of cloud-based solutions for finance and accounting departments, BlackLine, Inc. is well-positioned to continue its impressive growth in the coming years. This move is also expected to attract further investments from other institutional investors. With its innovative products and services, combined with the confidence of institutional investors, BlackLine, Inc. is poised to continue its impressive growth in the future.

Price History

This news has been welcomed by the mainstream media, which has mostly provided positive coverage of BlackLine, Inc. On Tuesday, the stock opened at $70.8 and closed at $71.8, up by 1.8% from prior closing price of 70.5. This is an encouraging change for the company and shows that investors are increasingly showing faith in the company’s future prospects. This news is a sign of confidence in the company’s future prospects and could be an indication of further growth in the near future. It is likely that this news will attract more investors to BlackLine, Inc. and will be beneficial for the company in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Blackline. More…

| Total Revenues | Net Income | Net Margin |

| 498.31 | -77.7 | -15.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Blackline. More…

| Operations | Investing | Financing |

| 52.38 | -245.29 | 5.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Blackline. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.88k | 1.78k | 1.33 |

Key Ratios Snapshot

Some of the financial key ratios for Blackline are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.5% | – | -13.8% |

| FCF Margin | ROE | ROA |

| 4.2% | -54.7% | -2.3% |

VI Analysis

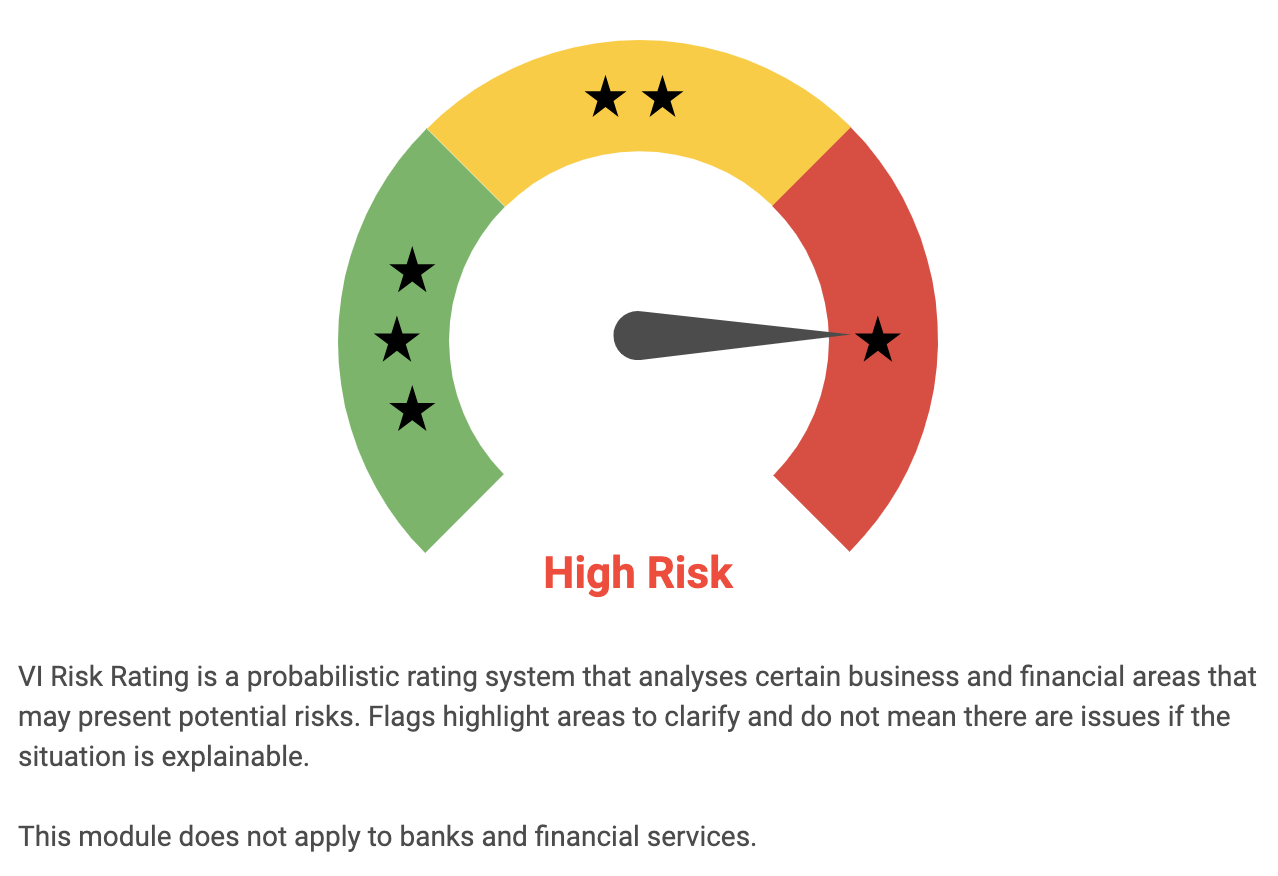

The VI App helps investors analyze BLACKLINE’s long-term potential and make informed investment decisions by providing an overview of the company’s fundamentals. The app’s VI Risk Rating places BLACKLINE as a high risk investment in terms of financial and business aspects. To further assess the company’s financial health, the app has detected two risk warnings in its cashflow statement, non financial. These warnings are based on the company’s ability to generate cash from its operations, capital structure, and use of credit. Investors are advised to register on vi.app for more detailed analysis of BLACKLINE’s financials. The app also provides analysis of the company’s financial statement and balance sheet, income statement, and other non-financial metrics. This helps investors better understand the company’s current performance and potential future risks. In addition, the app provides a comprehensive view of BLACKLINE’s competitive position in the industry and its competitive advantages. Investors can also use the app to track the company’s stock performance and identify market trends that may impact its future growth. Overall, the VI App offers a comprehensive picture of BLACKLINE’s current state and future potential. This helps investors make informed decisions when considering investing in the company’s long-term prospects. More…

VI Peers

The company offers a suite of solutions that automate and streamline accounting processes, including the financial close, account reconciliation, journal entry, and intercompany accounting. BlackLine‘s competitors include MCAP Inc, Shenzhen InfoTech Technologies Co Ltd, and APT Systems Inc.

– MCAP Inc ($OTCPK:MCAP)

MCAP Inc is a holding company that operates in the real estate industry. The company has a market capitalization of 112.86 thousand as of 2022 and a return on equity of -106.38%. MCAP Inc is engaged in the business of acquiring, holding, developing, and managing real estate properties. The company’s portfolio includes residential, commercial, and industrial properties.

– Shenzhen InfoTech Technologies Co Ltd ($SZSE:300085)

Shenzhen InfoTech Technologies Co Ltd is a Chinese technology company that specializes in the development and manufacturing of mobile phones and other electronic devices. The company has a market cap of 6.66B as of 2022 and a Return on Equity of -19.32%. Shenzhen InfoTech Technologies Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

– APT Systems Inc ($OTCPK:APTY)

APT Systems Inc is a publicly traded company with a market capitalization of 1.75 million as of 2022. The company has a return on equity of 50.12%. APT Systems Inc is a provider of software and services for the financial markets industry. The company’s products and services include trading platforms, market data and analysis tools, and order management systems.

Summary

Media coverage surrounding the stock has been mostly positive. Analysts are optimistic about BlackLine‘s future prospects, pointing to its innovative software solutions for accounting and finance departments. They believe that its user-friendly solutions and cost-effective pricing model can help streamline processes for many businesses. Additionally, the company has a strong management team with experience in the industry, making it an attractive investment option for many.

Recent Posts