Renren to Rebrand and Change Name to Moatable,

June 12, 2023

🌥️Trending News

Renren Inc ($NYSE:RENN). is undergoing a rebranding process and will be changing its name to Moatable, Inc. The company was formerly known as Renren, a Chinese social networking company. In the past, Renren has been referred to as the “Facebook of China” due to its similarities with the popular social media platform.

However, the company has since shifted its focus from social networking to developing online services ranging from gaming to virtual reality technology. It also runs a venture capital arm that invests in startups in sectors such as artificial intelligence, blockchain, and e-commerce. Renren’s rebranding to Moatable, Inc. is intended to showcase its shift in focus and expansion of services. By changing its name, the company hopes to create a new identity that better reflects its range of services and current position as a forerunner in the tech industry.

Market Price

On Thursday, RENREN INC made an announcement on its stock opening at $1.3 and closing at $1.4, marking a 7.1% rise from the last closing price of 1.3. The news also revealed that the company would be rebranding itself and changing its name to Moatable, Inc. This is a major move for RENREN, showing the company’s commitment to evolve with the rapidly changing market trends. The new name reflects the company’s mission to improve customer experience through innovative technologies and strategic partnerships. The rebranding signals a new direction for the company and its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Renren Inc. More…

| Total Revenues | Net Income | Net Margin |

| 47.64 | -65.96 | -42.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Renren Inc. More…

| Operations | Investing | Financing |

| -4.83 | -31 | 0.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Renren Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 100.61 | 28.92 | 3.4 |

Key Ratios Snapshot

Some of the financial key ratios for Renren Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -49.2% | – | -138.5% |

| FCF Margin | ROE | ROA |

| -18.3% | -49.8% | -41.0% |

Analysis

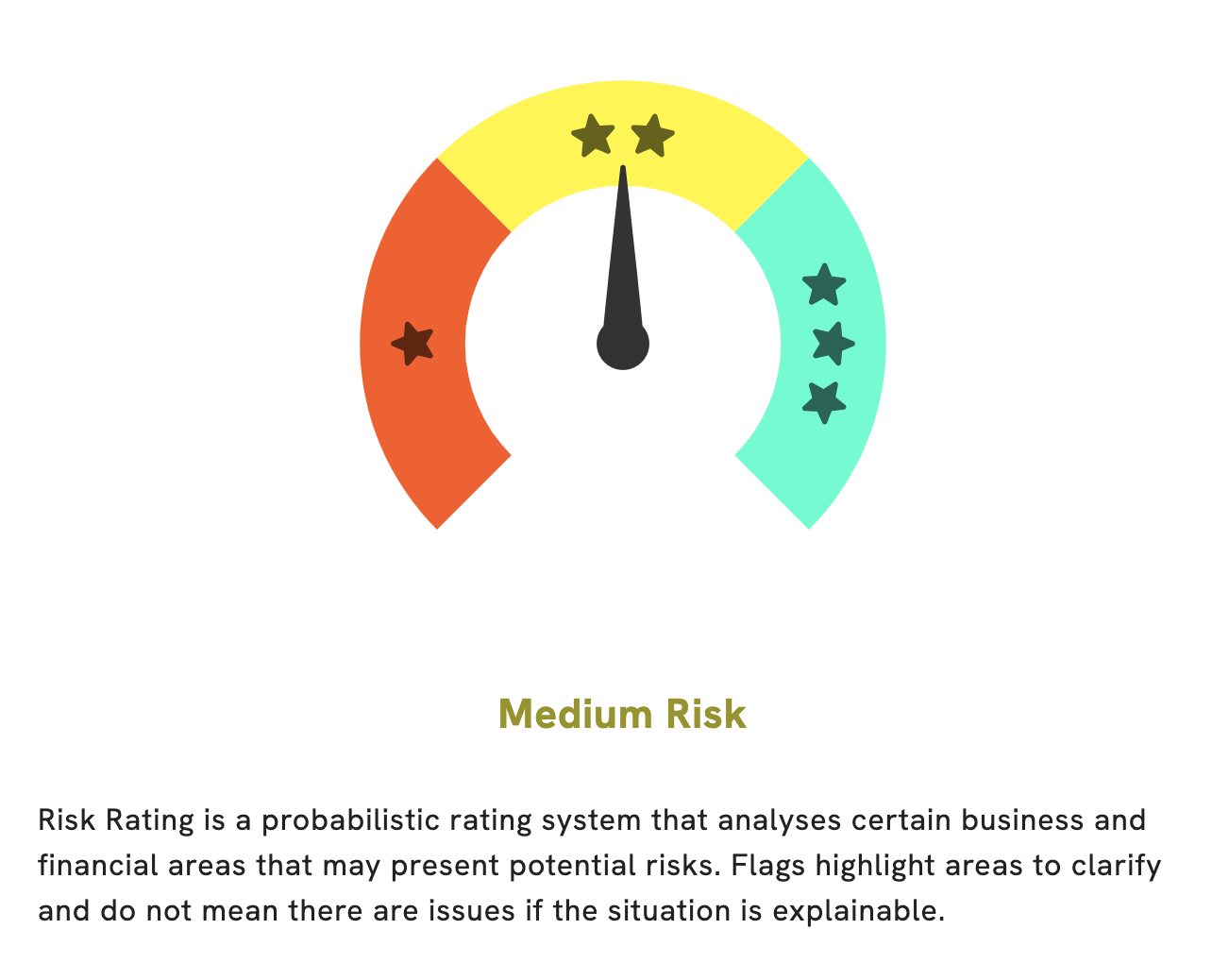

As a part of our analysis of RENREN INC, GoodWhale has given it a Risk Rating of “medium”. This rating is based on various financial and business aspects of the company, such as its income sheet and financial journal. We have identified two risk warnings in these documents that could potentially affect the company’s future performance. If you would like to know more about these risks, make sure to register on goodwhale.com. We offer detailed financial information that can help you make informed decisions about your investments. More…

Peers

It has been competing with a number of other firms, including GainClients Inc, Unity Software Inc, and Livechat Software SA, in the market for providing online solutions to businesses and individuals. Through its innovative products and services, Renren Inc has managed to carve out a strong presence and gain a significant share of the market.

– GainClients Inc ($OTCPK:GCLT)

Unity Software Inc is a San Francisco-based software development company that provides a 3D game engine and other related tools for game development. As of 2022, Unity Software Inc has a market cap of 10.69B, which is an indication of its strong financial position and the potential of its products. Additionally, the company has a Return on Equity of -20.99%, which is an indication of its ability to generate profits from its investments. This suggests that the company is well-positioned to capitalize on future opportunities and remain competitive in the industry. In conclusion, Unity Software Inc appears to be in a strong financial position with a strong market cap and return on equity.

– Unity Software Inc ($NYSE:U)

Chatbot Software SA is a leading company in the customer service technology market. It specializes in developing artificial intelligence-driven chatbots that help businesses better engage with their customers. The company has a market capitalization of 2.77B as of 2022, making it one of the most valuable companies in the industry. Its strong financial performance has resulted in an impressive return on equity of 65.76%, which is well above the industry average. The company’s success can be attributed to its focus on innovation and customer-centric services. Chatbot Software SA is dedicated to providing businesses with the latest chatbot technology to ensure customer satisfaction and maximize profits.

Summary

Renren Inc is a Chinese social networking company, and has recently announced their rebranding efforts, changing its name to Moatable, Inc. The company has gained much attention from investors in response to the news, as the stock price rose on the same day. Moving forward, investors should consider whether the rebranding could translate into increased revenue and improved financial performance for Renren. Analysts should also consider the potential impact of continuing competition in the social networking sector, as well as the company’s ability to adjust to the rapidly changing industry landscape.

In addition, it is important to assess Renren’s current financial standing, and to be aware of any new developments that could affect future earnings. Ultimately, Renren’s potential for success and profitability will determine investor returns.

Recent Posts