Piper Sandler Cautions Investors about Near-Term Challenges for Datadog

April 19, 2023

Trending News ☀️

Piper Sandler has identified potential near-term obstacles that could impede the upside potential of Datadog ($NASDAQ:DDOG), a cloud-based monitoring and analytics platform. According to their initial assessment, the company faces a number of short-term challenges, including possible pressure from the competition and lower customer acquisition.

Additionally, the potential for changes in customer preferences and regulations could affect the company’s long-term growth prospects. The risks associated with investing in Datadog are further amplified by its relatively high price-to-sales ratio and a lack of diversification in its product offerings. Despite these challenges, Piper Sandler believes that Datadog has significant potential to continue to grow its market share in the cloud-based monitoring and analytics space. They recommend that investors take into account these near-term risks before investing in the company.

Price History

On Tuesday, Piper Sandler released a statement cautioning investors about near-term challenges for DATADOG. Despite this, the stock opened at $70.8 and closed at $70.0, representing a slight 0.2% increase from its previous closing price of 69.8. It is unclear how these near-term challenges will affect the stock price of DATADOG in the future, however Piper Sandler suggested that investors should be aware of the risks. Datadog“>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Datadog. More…

| Total Revenues | Net Income | Net Margin |

| 1.68k | -50.16 | -3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Datadog. More…

| Operations | Investing | Financing |

| 418.41 | -384.67 | 36.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Datadog. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3k | 1.59k | 4.42 |

Key Ratios Snapshot

Some of the financial key ratios for Datadog are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 66.5% | – | -1.3% |

| FCF Margin | ROE | ROA |

| 21.1% | -1.0% | -0.4% |

Analysis

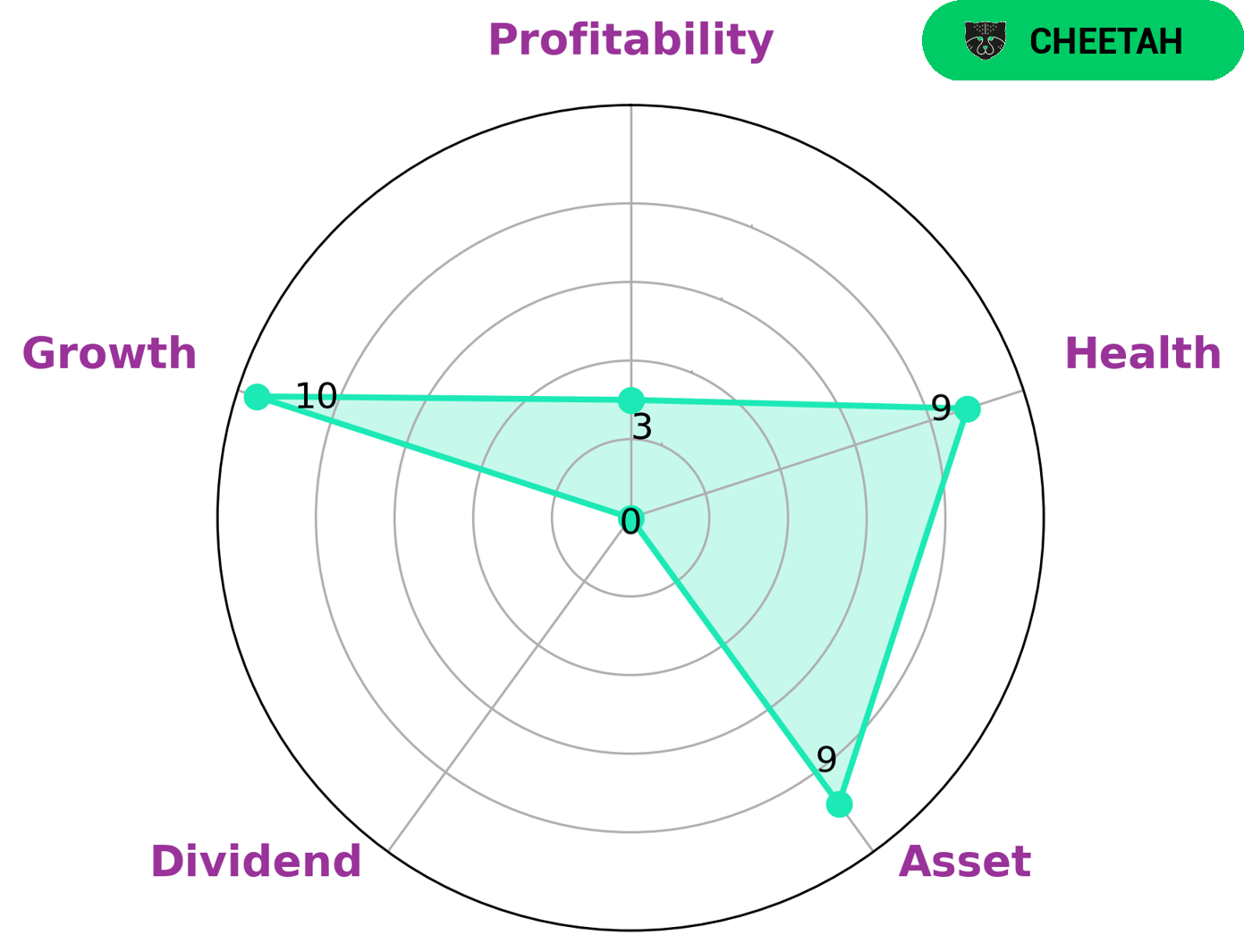

As GoodWhale, we have examined the financials of DATADOG. According to our Star Chart evaluation, DATADOG has a high health score of 9/10 with regard to its cashflows and debt, which is impressive and demonstrates they are capable enough to sustain future operations in times of crisis. Moreover, DATADOG is strong in asset and growth, but weak in dividend and profitability. Based on this assessment, we classify DATADOG as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Therefore, investors who are interested in a company like DATADOG should be more focused on the growth potential, as opposed to pursuing a more stable investment. These could include venture capitalists, private equity firms, angel investors, and other individuals looking for a higher risk/higher return opportunity. Datadog“>More…

Peers

Datadog Inc is a cloud-based monitoring and analytics platform for IT, Operations and Development teams who write and run applications at scale, and is used by organizations of all sizes. Founded in 2010, Datadog is headquartered in New York City with offices in France, Germany, and the United Kingdom.

Datadog’s primary competitors are Dynatrace Inc, Elastic NV, and New Relic Inc. These companies are also cloud-based monitoring and analytics platforms that provide similar services to Datadog.

– Dynatrace Inc ($NYSE:DT)

Dynatrace Inc is a publicly traded American software intelligence company based in Waltham, Massachusetts with a market cap of $9.67B as of 2022. The company offers various application performance management (APM) products. Its products are used by companies to monitor the performance of software applications and services.

Dynatrace’s ROE of 3.59% is lower than the average of its competitors, which is around 7%. This indicates that the company is not generating as much profit from its equity as its competitors. One reason for this could be that Dynatrace is reinvesting its profits back into the business in order to grow. Another reason could be that the company has higher operating expenses than its competitors.

– Elastic NV ($NYSE:ESTC)

Elastic N.V. is a Netherlands-based company engaged in the provision of software solutions. The Company’s products include Elastic Stack, X-Pack, and Elastic Cloud. The Elastic Stack is a set of software products that combine data from any source with any format and search, analyze, and visualize it in real time. X-Pack is a set of software products that provides security, alerting, monitoring, reporting, machine learning, and graph capabilities for Elastic Stack. Elastic Cloud is a cloud service that offers hosted versions of the Elastic Stack.

– New Relic Inc ($NYSE:NEWR)

New Relic Inc is a publicly traded American software analytics company based in San Francisco, California. The company’s market cap as of 2022 was 3.84 billion dollars, and its ROE was -41.23%. New Relic was founded in 2008, and it provides software analytics products that help developers monitor the performance of their applications.

Summary

Investing analysis of Datadog (DATADOG) has been started by Piper Sandler with a Neutral rating. The near-term headwinds are expected to impact the stock’s upside potential. Datadog is a cloud-monitoring platform that provides full-stack visibility and delivers operational insights for customers. It enables customers to quickly gain visibility across their applications, detect and diagnose performance issues, and optimize the user experience.

Through its platform, Datadog helps customers to improve application performance, increase operational efficiency, and better understand customer usage. Investors should assess Datadog’s business model, competitive landscape, financials, and competitive positioning before deciding to invest in the stock.

Recent Posts