Compass Outpaces Peers in 2023 Comparison

March 16, 2023

Trending News 🌥️

Compass ($NYSE:COMP) Inc. has significantly outperformed its peers in the 2023 comparison. The company has seen an impressive growth, which has placed it well ahead of its competitors. This is evidenced by several key metrics, including overall revenue, market capitalization and share price performance. This is largely attributed to the company’s development of innovative products and services that have been embraced by customers. Moreover, the company has made strong investments in research and development, which has enabled them to maintain an edge in the market.

This is a testament to both the company’s success and investor confidence in the company’s future prospects. Overall, Compass Inc. has clearly outpaced its peers in 2023, as evidenced by its revenue growth, market capitalization and share price performance. The company’s success is clearly a result of strong investments in innovation and research, as well as a savvy approach to staying ahead of the competition.

Price History

On Wednesday, COMPASS stock opened at $2.8 and closed at $3.0, marking a 2.8% increase from its prior closing price of $2.9. The strong showing by COMPASS indicates that investors are confident in the company’s future prospects and ability to navigate the tumultuous economic climate. In addition, COMPASS has managed to keep its operating costs under control, allowing for increased profits and higher stock prices. With investors already looking ahead to 2023, it seems likely that COMPASS will continue to outperform its competitors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Compass. More…

| Total Revenues | Net Income | Net Margin |

| 6.02k | -601.5 | -9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Compass. More…

| Operations | Investing | Financing |

| -291.7 | -100.1 | 135.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Compass. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.53k | 1.01k | 1.18 |

Key Ratios Snapshot

Some of the financial key ratios for Compass are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.1% | – | -9.7% |

| FCF Margin | ROE | ROA |

| -6.0% | -63.5% | -23.9% |

Analysis

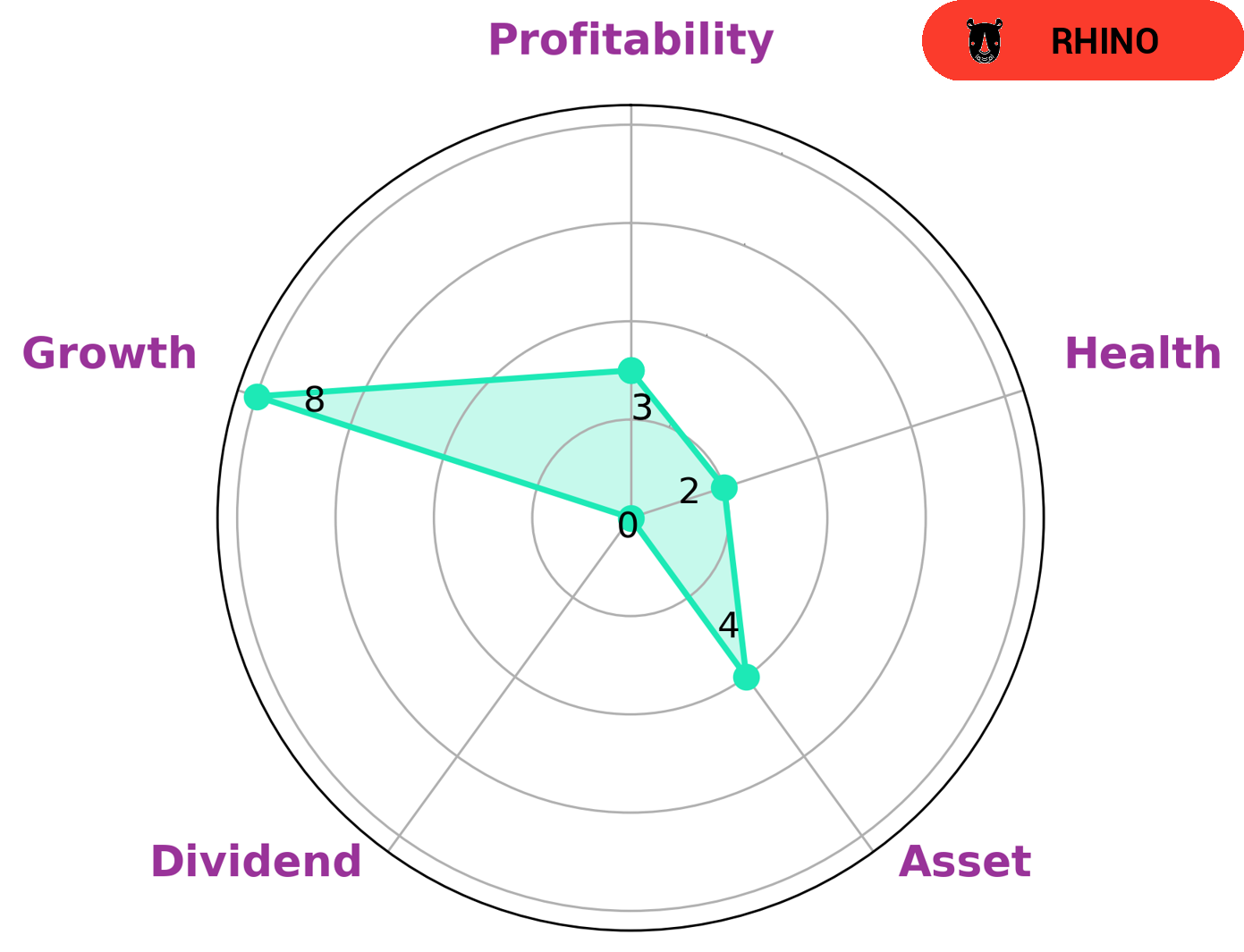

At GoodWhale, we analyzed COMPASS‘s financials to understand what type of company it is. We used our Star Chart to classify COMPASS as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who are interested in such companies should take note of COMPASS’s strengths and weaknesses. COMPASS is strong in growth, medium in asset and weak in dividend and profitability. It has a low health score of 2/10 considering its cashflows and debt, making it less likely to safely ride out any crisis without the risk of bankruptcy. Therefore, investors who are interested in COMPASS need to consider its financial risks carefully. More…

Peers

In the business world, there is always competition. One example of this is the competition between Compass Inc and its competitors: GainClients Inc, Alarm.com Holdings Inc, and ChannelAdvisor Corp. All of these companies are vying for the same thing: market share. Market share is the percentage of the total market that a company controls. In order to increase their market share, each company must find ways to differentiate themselves from their competitors. Compass Inc, for example, has differentiated itself by offering a unique product that its competitors do not offer. GainClients Inc has differentiated itself by offering a lower price than its competitors. Alarm.com Holdings Inc has differentiated itself by offering a superior customer service experience. ChannelAdvisor Corp has differentiated itself by offering a more comprehensive suite of products. By finding ways to differentiate themselves from their competitors, each company is able to increase its market share.

– GainClients Inc ($OTCPK:GCLT)

Alarm.com Holdings Inc is a leading technology provider of interactive security, video monitoring, and energy management solutions for residential and commercial customers. Alarm.com’s award-winning platform is revolutionizing how people interact with their homes and businesses. Every day, millions of people rely on Alarm.com’s technology to manage and protect their property from anywhere. Alarm.com’s products and services are available through a nationwide network of professional dealers and service providers.

– Alarm.com Holdings Inc ($NASDAQ:ALRM)

ChannelAdvisor Corp is a technology company that provides software to help businesses sell their products online. The company has a market cap of 732.88M as of 2022 and a return on equity of 5.5%. ChannelAdvisor’s software helps businesses list their products on multiple online marketplaces, track inventory, and fulfill orders. The company also offers consulting and other services to help businesses grow their online sales.

Summary

Compass is an investment analysis company which has been performing well and is projected to continue to outperform its peers in the years to come. Analyses conducted by Compass have shown that their strategies yield higher returns compared to their competitors and that the company’s success is likely to continue. The company has been focused on delivering better results for investors, while staying ahead of the competition, and this commitment to excellence has been paying off.

Additionally, Compass has established a track record of successful investments, delivering excellent returns to their clients. As a result, Compass is seen as a reliable and trustworthy partner for investors, making it a great choice for those looking to maximize their returns on investments.

Recent Posts