BlackLine, Short Interest Update Analyzed by Defense World

June 2, 2023

☀️Trending News

BLACKLINE ($NASDAQ:BL): Defense World has recently released a Short Interest Update for BlackLine, Inc., a leading provider of cloud-based solutions for finance and accounting teams. BlackLine offers a variety of products and services to help finance and accounting teams manage critical processes, such as reconciliation, financial close, period-end close, and performance reporting. The company’s innovative platform is designed to save organizations time and money while increasing accuracy and efficiency. The Short Interest Update from Defense World provides investors with a detailed look at BlackLine, Inc.’s short interest over the past month. It tracks the number of shares sold short, the percentage of the company’s total shares outstanding that are sold short, and the number of days to cover. With this information, investors can accurately assess their risk level and draw informed conclusions about the current market sentiment towards BlackLine. Defense World’s Short Interest Update not only provides an in-depth analysis of BlackLine’s short interest, but it also provides valuable insight into the stock’s overall performance. Investors can use this data to make informed decisions when investing in BlackLine.

Additionally, the report also includes a comprehensive overview of BlackLine’s current financial situation, as well as commentary from market experts. With this data, investors can make more educated decisions about how to approach their investments.

Stock Price

On Tuesday, BLACKLINE, Inc. stock opened at $52.2 and closed at $50.0, representing a 2.3% decrease from its previous closing price of $51.2. This decrease in short interest could indicate that investors are becoming less bearish on BLACKLINE stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Blackline. More…

| Total Revenues | Net Income | Net Margin |

| 541.69 | -31.39 | -4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Blackline. More…

| Operations | Investing | Financing |

| 78.7 | -215.39 | -5.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Blackline. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.93k | 1.79k | 1.93 |

Key Ratios Snapshot

Some of the financial key ratios for Blackline are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.8% | – | -3.9% |

| FCF Margin | ROE | ROA |

| 8.5% | -11.7% | -0.7% |

Analysis

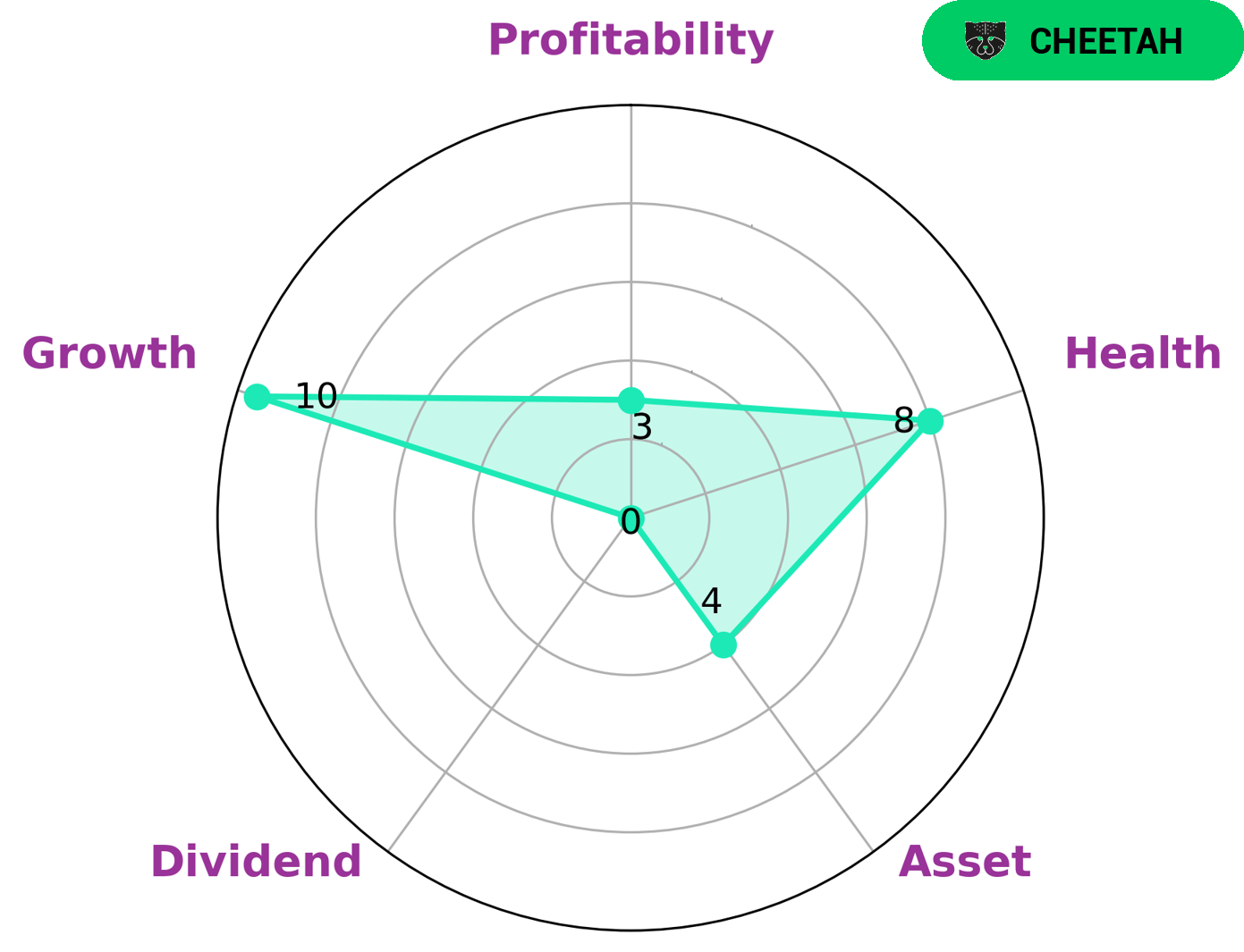

GoodWhale has conducted an in-depth analysis of BLACKLINE‘s financials and based on the Star Chart, we conclude that BLACKLINE is strong in growth, medium in asset and weak in dividend, profitability. Based on this, we have classified BLACKLINE as ‘cheetah’, which is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe investors interested in such a company are those who seek higher growth investments and are willing to accept the accompanying higher risk. Though BLACKLINE has a high growth rate, its health score of 8/10 with regard to its cashflows and debt suggest that it is capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company offers a suite of solutions that automate and streamline accounting processes, including the financial close, account reconciliation, journal entry, and intercompany accounting. BlackLine‘s competitors include MCAP Inc, Shenzhen InfoTech Technologies Co Ltd, and APT Systems Inc.

– MCAP Inc ($OTCPK:MCAP)

MCAP Inc is a holding company that operates in the real estate industry. The company has a market capitalization of 112.86 thousand as of 2022 and a return on equity of -106.38%. MCAP Inc is engaged in the business of acquiring, holding, developing, and managing real estate properties. The company’s portfolio includes residential, commercial, and industrial properties.

– Shenzhen InfoTech Technologies Co Ltd ($SZSE:300085)

Shenzhen InfoTech Technologies Co Ltd is a Chinese technology company that specializes in the development and manufacturing of mobile phones and other electronic devices. The company has a market cap of 6.66B as of 2022 and a Return on Equity of -19.32%. Shenzhen InfoTech Technologies Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

– APT Systems Inc ($OTCPK:APTY)

APT Systems Inc is a publicly traded company with a market capitalization of 1.75 million as of 2022. The company has a return on equity of 50.12%. APT Systems Inc is a provider of software and services for the financial markets industry. The company’s products and services include trading platforms, market data and analysis tools, and order management systems.

Summary

BlackLine, Inc., a leading provider of cloud-based financial and accounting automation solutions, has seen its short interest steadily increase in the past few months. This indicates that more investors are betting against Blackline stock. However, analysts believe that BlackLine’s fundamentals remain strong and that the stock has potential for long-term growth. Investors should cautiously monitor the stock’s price movements over the next few weeks and consider investing in the company at attractive prices.

Recent Posts