Analysts Weigh In on the Performance of Compass (NYSE: COMP)

April 1, 2023

Trending News 🌥️

Analysts have been weighing in on the performance of Compass ($NYSE:COMP) Inc. (NYSE: COMP) lately, and the results are mixed. COMP is a diversified holding company, operating in the banking and financial services industry. It has a wide range of subsidiaries, including a bank, a mortgage company, an insurance agency, and an investment advisor. Many analysts are still skeptical of the long-term potential of COMP, citing the uncertain global economy and the cyclical nature of the banking industry. They point to recent declines in COMP’s stock prices and ongoing concerns over its ability to manage risk as two potential areas of concern.

On the other hand, analysts who are more optimistic about COMP’s prospects argue that its diversified portfolio and disciplined approach to risk management have positioned it well to weather any economic downturns. While opinions on Compass Inc.’s performance may vary, it is clear that investors continue to watch with keen interest. With its strong financials and diversified portfolio, it is likely that the company will continue to attract attention from analysts and investors alike in the coming months.

Share Price

This represented a drop of 3.6% from the prior day’s closing price, marking a short-term decline for the company’s stock. It is not yet clear what factors are driving the decline in Compass Inc.’s stock price, but analysts remain cautious about the company’s long-term outlook. Many analysts have noted that despite the short-term drop in stock price, the company has been performing well in terms of fundamentals and could be a good long-term investment opportunity.

Overall, analysts believe that Compass Inc. stock is still worth consideration by investors, and that there could be potential for growth in the future. The company’s financial performance and stability makes it an attractive option for investors looking to build a diversified portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Compass. More…

| Total Revenues | Net Income | Net Margin |

| 6.02k | -601.5 | -9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Compass. More…

| Operations | Investing | Financing |

| -291.7 | -100.1 | 135.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Compass. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.53k | 1.01k | 1.18 |

Key Ratios Snapshot

Some of the financial key ratios for Compass are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.1% | – | -9.7% |

| FCF Margin | ROE | ROA |

| -6.0% | -63.5% | -23.9% |

Analysis

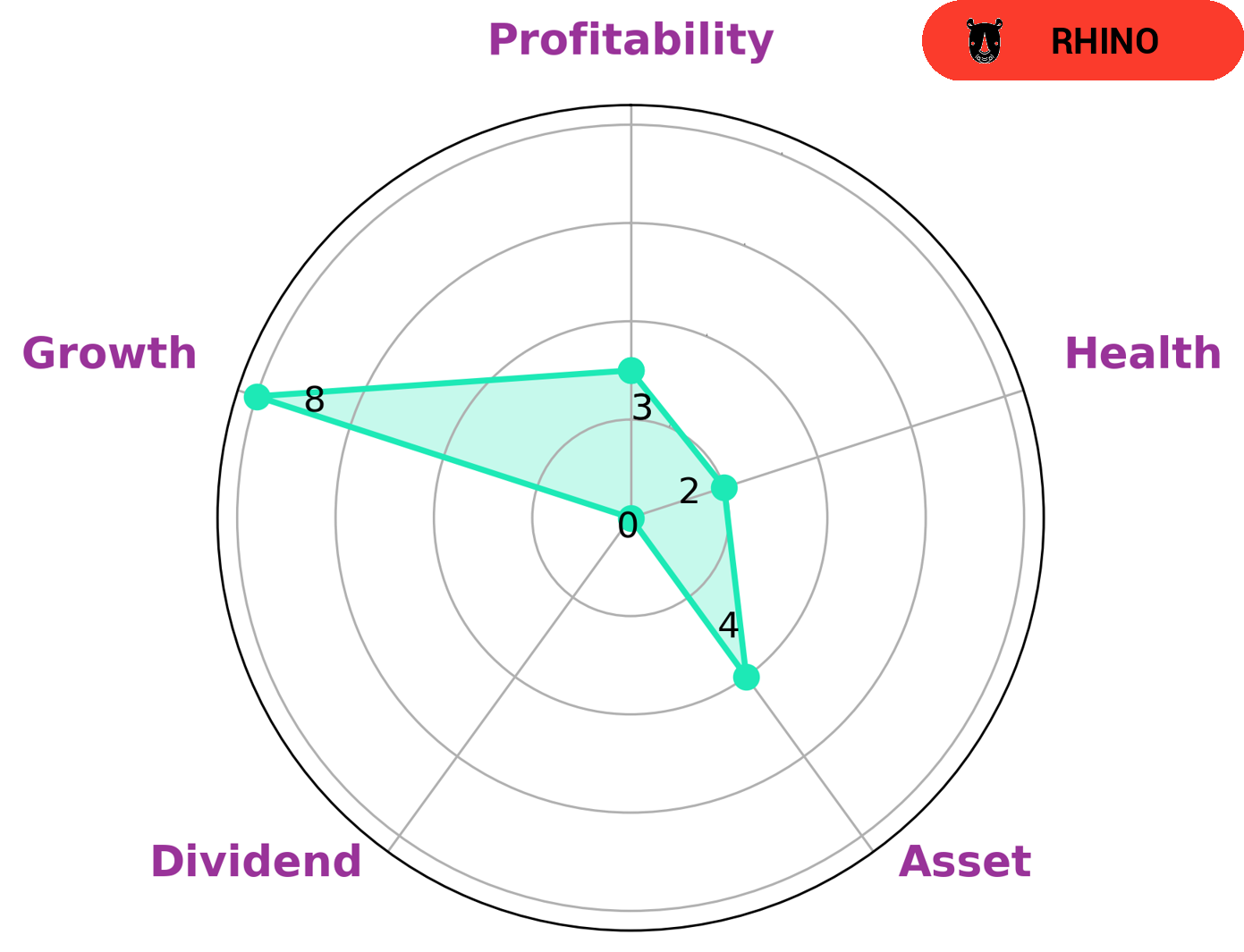

At GoodWhale, we recently conducted an analysis of COMPASS‘s fundamentals. Based on our Star Chart classification, COMPASS is a ‘rhino’, which we define as a company that has achieved moderate revenue or earnings growth. From our analysis, we conclude that COMPASS is particularly strong in terms of growth, while being only of medium strength in terms of assets and weak in terms of dividends and profitability. Furthermore, COMPASS has a low health score of 2/10 with regard to its cashflows and debt, meaning it is less likely to safely ride out any crisis without the risk of bankruptcy. Given these factors, investors who focus on long-term growth and are comfortable with taking on higher levels of risk may be interested in investing in COMPASS. Companies that require a more conservative approach to investing, however, may not find value in COMPASS. More…

Peers

In the business world, there is always competition. One example of this is the competition between Compass Inc and its competitors: GainClients Inc, Alarm.com Holdings Inc, and ChannelAdvisor Corp. All of these companies are vying for the same thing: market share. Market share is the percentage of the total market that a company controls. In order to increase their market share, each company must find ways to differentiate themselves from their competitors. Compass Inc, for example, has differentiated itself by offering a unique product that its competitors do not offer. GainClients Inc has differentiated itself by offering a lower price than its competitors. Alarm.com Holdings Inc has differentiated itself by offering a superior customer service experience. ChannelAdvisor Corp has differentiated itself by offering a more comprehensive suite of products. By finding ways to differentiate themselves from their competitors, each company is able to increase its market share.

– GainClients Inc ($OTCPK:GCLT)

Alarm.com Holdings Inc is a leading technology provider of interactive security, video monitoring, and energy management solutions for residential and commercial customers. Alarm.com’s award-winning platform is revolutionizing how people interact with their homes and businesses. Every day, millions of people rely on Alarm.com’s technology to manage and protect their property from anywhere. Alarm.com’s products and services are available through a nationwide network of professional dealers and service providers.

– Alarm.com Holdings Inc ($NASDAQ:ALRM)

ChannelAdvisor Corp is a technology company that provides software to help businesses sell their products online. The company has a market cap of 732.88M as of 2022 and a return on equity of 5.5%. ChannelAdvisor’s software helps businesses list their products on multiple online marketplaces, track inventory, and fulfill orders. The company also offers consulting and other services to help businesses grow their online sales.

Summary

Compass Inc. (NYSE: COMP) is a technology and services company that recently released its second-quarter earnings report. Despite these positive results, the stock price moved down the same day, likely due to investor concerns about the company’s outlook. Analysts have expressed concerns that Compass may struggle going forward due to increased competition in its market and potential macroeconomic headwinds. The company has been making strides towards positioning itself for the long-term, such as focusing on expanding its cloud-based services business and investing in new products and services.

However, it remains to be seen if these efforts will be enough to meet analysts’ expectations and convince them of the stock’s long-term potential.

Recent Posts