NVIDIA Corporation: Unstoppable Force in the Tech World

June 10, 2023

🌧️Trending News

Nvidia Corporation ($NASDAQ:NVDA) is an unstoppable force in the tech world. The company creates graphics processing units (GPUs) as well as system on a chip (SoC) units for use in the consumer and professional markets. Nvidia’s products are used in gaming, virtual reality, self-driving cars and AI applications. Nvidia Corporation is a publicly traded company on the Nasdaq stock exchange.

Nvidia’s success can be attributed to its cutting-edge technology, dedicated customer service and strong partnerships with other technology companies. The company’s products have been widely praised for their performance and reliability, and they have continued to push the boundaries of gaming and AI technology. Nvidia’s dominance in the tech world is undeniable, and it doesn’t appear to be slowing down any time soon.

Share Price

Its stock opened at $377.2 and closed at $385.1, up by 2.8% from the previous closing price of $374.8. This performance has been consistently strong throughout the year, as the company continues to be a leader in the tech industry. NVIDIA is not only a powerhouse in the graphics processing world, but also has made significant strides in many other areas. Its products and services are used in everything from gaming and cloud computing, to artificial intelligence and self-driving cars. It has also made initiatives to increase its presence and capabilities in the virtual reality and augmented reality markets.

The strong performance of NVIDIA Corporation suggests that the company will continue to be a major power in the tech world for many years to come. The company’s commitment to innovation and ground-breaking technology will keep it ahead of the competition. With a bright future ahead, there is no doubt that NVIDIA Corporation will remain an unstoppable force in the tech world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nvidia Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 25.88k | 4.79k | 18.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nvidia Corporation. More…

| Operations | Investing | Financing |

| 6.82k | 3.92k | -9.55k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nvidia Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 44.46k | 19.94k | 8.94 |

Key Ratios Snapshot

Some of the financial key ratios for Nvidia Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.0% | 9.1% | 18.7% |

| FCF Margin | ROE | ROA |

| 19.7% | 13.7% | 6.8% |

Analysis

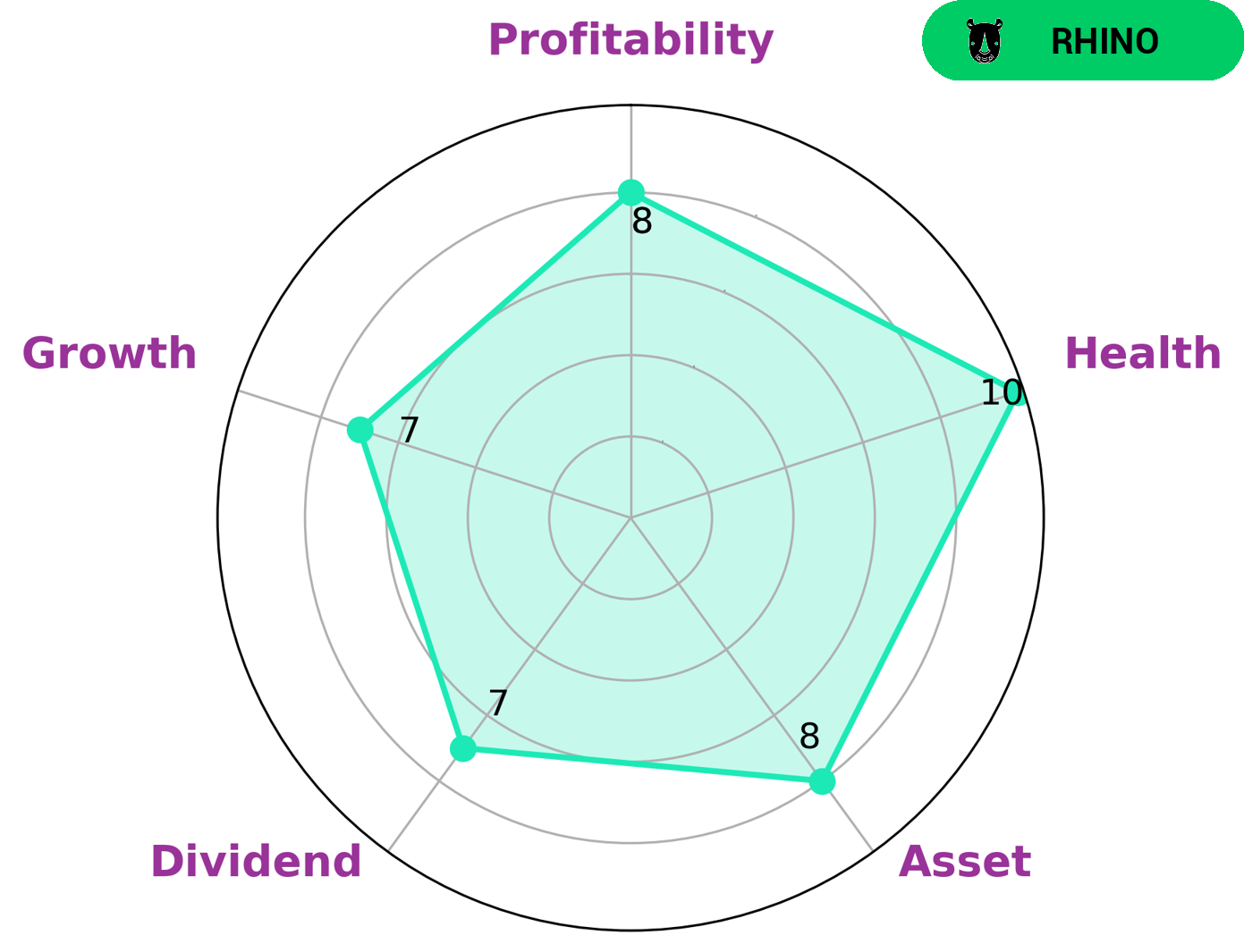

GoodWhale recently conducted an analysis of NVIDIA Corporation‘s health and the results are quite positive. After running a Star Chart assessment, we found that NVIDIA Corporation is strong in asset, dividend, growth, and profitability. We classified NVIDIA Corporation as ‘rhino’, which is a company that has achieved moderate revenue or earnings growth. Given NVIDIA Corporation’s high health score of 10/10 with regards to its cashflows and debt, it’s easy to see why investors may be attracted to this company. It’s capable of sustaining future operations in times of crisis. Furthermore, the dividend yield is quite high, making it a great choice for income-oriented investors. Growth-oriented investors may also be interested in NVIDIA Corporation, as it has the potential to achieve higher revenue and earnings growth in the future. Overall, GoodWhale believes NVIDIA Corporation is a strong buy for both income and growth-oriented investors. The combination of healthy cashflows and debt, high dividend yield, and potential for growth make it an attractive option for investors. More…

Peers

Nvidia Corporation is an American technology company headquartered in Santa Clara, California. It designs graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip units (SOCs) for the mobile computing and automotive market. Nvidia’s primary GPU product line, labeled “GeForce”, is in direct competition with Advanced Micro Devices’ (AMD) “Radeon” products.

– NeoPhotonics Corp ($SHSE:688521)

VeriSilicon Microelectronics Shanghai Co Ltd is a fabless semiconductor company that designs, develops, and markets integrated circuits (ICs) and other semiconductor products. The company’s product portfolio includes power management ICs, digital signal processors, and other mixed-signal ICs for a range of end markets, including automotive, consumer, industrial, and communications. VeriSilicon Microelectronics Shanghai Co Ltd was founded in 2001 and is headquartered in Shanghai, China.

– VeriSilicon Microelectronics Shanghai Co Ltd ($TPEX:4925)

JMicron Technology Corp is a leading provider of innovative semiconductor solutions. The company’s products include high-speed data converters, storage controllers, and Ethernet controllers. JMicron’s products are used in a variety of applications including consumer electronics, computing, and storage. The company has a market cap of 4.02B and a return on equity of 10.28%. JMicron is a publicly traded company on the Taiwan Stock Exchange.

Summary

Nvidia Corporation is a semiconductor company specializing in the development of graphics processing units (GPUs) and related technologies. With its cutting-edge products and strong presence in the gaming and professional markets, Nvidia has become a popular investment option for investors. The company’s strong financial performance in the past few years is driven by its ability to deliver high-end GPUs with superior performance, as well as its continued investments in research and development.

In addition, Nvidia has built a strong competitive advantage by leveraging its deep relationships with key partners in the industry. With the global demand for gaming hardware expected to rise in the near future, Nvidia’s success is likely to continue, making it an attractive investment opportunity for those interested in capitalizing on the company’s growth potential.

Recent Posts