Huawei Hong Semiconductor Allocating $6.7 Billion to Construct Wafer Fab for Mature Chip Nodes

January 30, 2023

Trending News ☀️

Hua ($SEHK:01347)wei Hong Semiconductor, a company based in China, has announced plans to allocate US$6.7 billion to construct a wafer fab with the purpose of specializing in mature chip nodes. The wafer fab will be located in the city of Chengdu, China, and is expected to be completed by 2022. Huawei Hong Semiconductor is a publicly traded semiconductor company listed on the Shanghai Stock Exchange. The new wafer fab will be used to manufacture mature chip nodes, which are essential components found in electronic devices such as smartphones and tablets. Mature chip nodes are typically found in older generations of electronic products, and are often more cost-efficient to produce than newer chip nodes. This new investment is part of Huawei Hong Semiconductor’s strategy to expand their product portfolio and strengthen their presence in the semiconductor industry. This will allow them to better compete with larger companies such as Intel and Samsung, which have already established strong footholds in the mature chip node market.

In addition, this investment is expected to create thousands of jobs in the Chinese economy and will contribute to the country’s economic growth. This new wafer fab is expected to be completed by 2022 and will enable Huawei Hong Semiconductor to better compete with established competitors in the mature chip node market.

Share Price

The move has been welcomed by the media, with positive exposure at the time of writing. On Friday, HUA HONG SEMICONDUCTOR stock opened at HK$31.0 and closed at HK$31.2, up by 0.5% from last closing price of 31.0. This is seen as an indication of investor confidence in the company’s decision to invest in this area. Huawei’s move is seen as a way to expand its presence in the semiconductor market and reduce its reliance on foreign suppliers. The new fab will enable it to produce chips for its own products and also for other companies in the industry.

Huawei’s decision to invest in this area is also a sign of its commitment to developing the Chinese semiconductor industry and becoming a major player in the global market. The company has already invested heavily in research and development, and this new fab will further strengthen its capabilities. Overall, Huawei’s decision to invest $6.7 billion in a new wafer fab is being seen as a positive move for both the company and the Chinese semiconductor industry. It is likely to result in increased production capacity and job creation, as well as increased competition in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hua Hong Semiconductor. More…

| Total Revenues | Net Income | Net Margin |

| 2.2k | 371.21 | 16.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hua Hong Semiconductor. More…

| Operations | Investing | Financing |

| 766.36 | -787.87 | 799.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hua Hong Semiconductor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.24k | 2.61k | 2.22 |

Key Ratios Snapshot

Some of the financial key ratios for Hua Hong Semiconductor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.6% | 34.6% | 19.4% |

| FCF Margin | ROE | ROA |

| -4.8% | 9.2% | 4.3% |

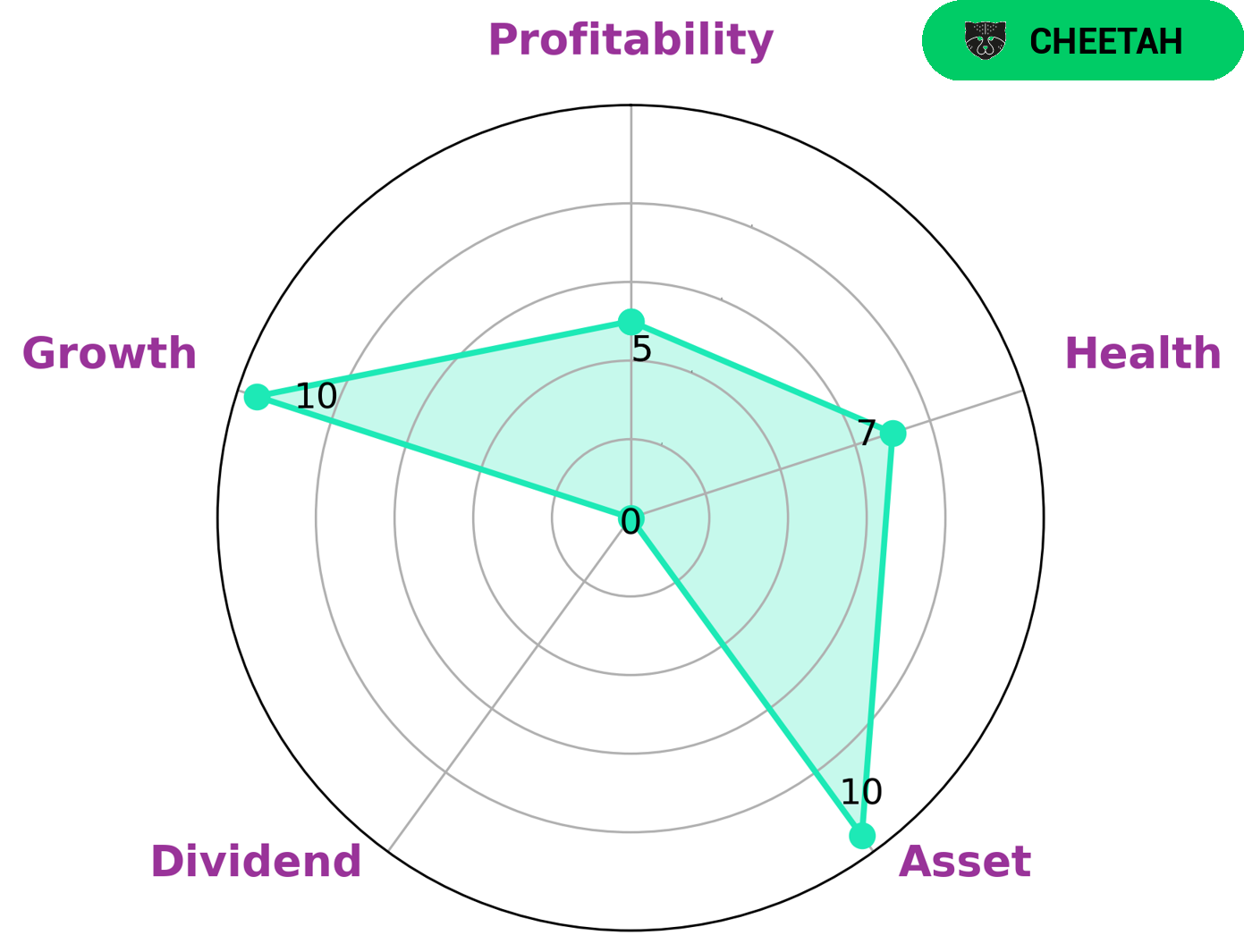

VI Analysis

Company fundamentals are essential for investors when assessing potential investments. HUA HONG SEMICONDUCTOR is a strong example of this, as its long-term potential has been clearly demonstrated by VI app’s review. The VI Star Chart gave HUA HONG SEMICONDUCTOR a health score of 7/10, indicating that its cashflows and debt are robust enough to survive in any crisis without the risk of bankruptcy. HUA HONG SEMICONDUCTOR was also found to be strong in assets and growth, while medium in profitability and weak in dividend. This categorizes the company as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors interested in HUA HONG SEMICONDUCTOR should be aware of the company’s strengths and weaknesses, as well as the risks associated with its lower profitability. However, those who are willing to take on some risk may find attractive opportunities in this company. With careful analysis and research, investors may be rewarded for their efforts. More…

VI Peers

The company operates in a highly competitive industry with players such as MACOM Technology Solutions Holdings Inc, Melexis NV, RS Technologies Co Ltd. The company has a strong market position and has been able to grow its market share despite intense competition.

– MACOM Technology Solutions Holdings Inc ($NASDAQ:MTSI)

Macom Technology Solutions Holdings Inc is a provider of semiconductor and technology solutions. The company has a market cap of 4.9B as of 2022 and a Return on Equity of 25.96%. Macom Technology Solutions Holdings Inc designs, manufactures and supplies a range of semiconductor products, including integrated circuits, chipsets, packaging, and modules. The company’s products are used in a variety of applications, including data center, cloud computing, enterprise, metro, and long-haul networking.

– Melexis NV ($OTCPK:MLXSF)

Melexis NV is a semiconductor company that designs, develops, and markets integrated circuits. The company has a market cap of 3.44B as of 2022 and a return on equity of 28.95%. Melexis NV designs and manufactures products for automotive, medical, consumer, and industrial applications. The company’s products include sensors, microcontrollers, and integrated circuits.

– RS Technologies Co Ltd ($TSE:3445)

As of 2022, Huawei Technologies Co Ltd has a market cap of 115.7B and ROE of 25.27%. The company is a leading global provider of information and communications technology (ICT) infrastructure and smart devices.

Summary

Huawei Hong Semiconductor recently announced an investment of $6.7 billion into the construction of a new wafer fab for mature chip nodes. This investment is widely seen as a positive move, as it will help Huawei expand its presence in the semiconductor market and increase its production capacity. The wafer fab is likely to be used for the manufacturing of mature chip nodes, which are essential components of today’s electronic devices. Huawei’s investment in this area is expected to help it remain competitive in the semiconductor market and increase its profits.

Furthermore, the construction of the wafer fab is likely to provide a boost to the local economy, as it will create additional jobs and stimulate economic growth in the area. Overall, Huawei’s investment in the wafer fab is generally seen as a positive move for both the company and the local economy.

Recent Posts