Globalfoundries Inc Intrinsic Stock Value – GLOBALFOUNDRIES Shines with Q4 Non-GAAP EPS of $1.44 in 2023, Beating Expectations by $0.12

February 16, 2023

Trending News 🌧️

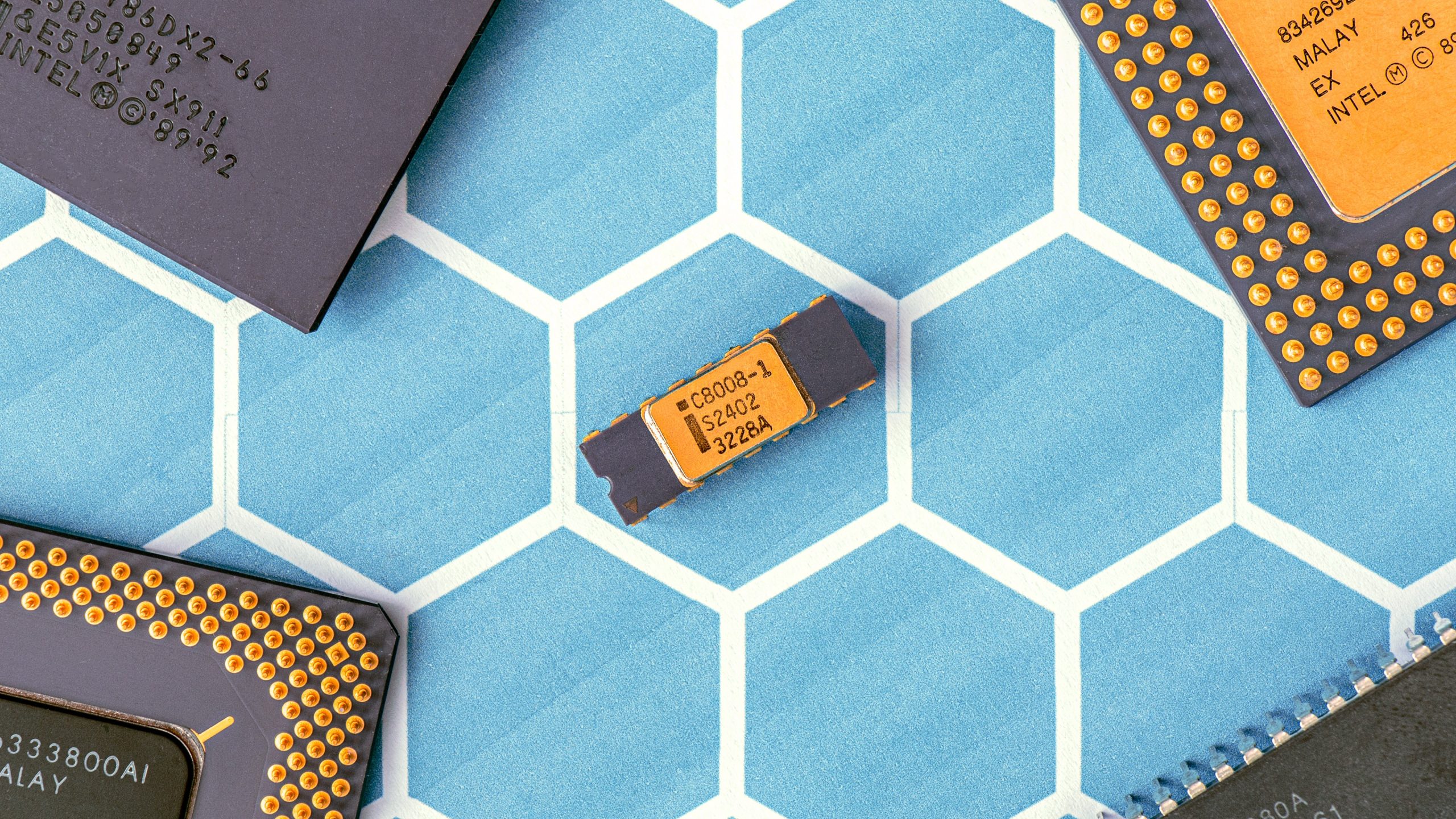

Globalfoundries Inc Intrinsic Stock Value – GLOBALFOUNDRIES ($NASDAQ:GFS) Inc. is a semiconductor firm based in Santa Clara, California. The company designs and manufactures integrated circuits for a variety of consumer, industrial, and automotive applications. GLOBALFOUNDRIES recently reported Non-GAAP EPS of $1.44 for the fourth quarter of 2023, beating analyst expectations by $0.12. This quarterly result is a testament to the company’s strong performance and its ability to drive growth and profitability. This was primarily driven by strong demand for the company’s products in the automotive, consumer, and industrial markets. In addition to its financial performance, GLOBALFOUNDRIES also made important technological advances during the fourth quarter.

GLOBALFOUNDRIES also announced that the company is looking to expand its presence in China and other Asian markets with its new GlobalFoundries China Joint Venture. The joint venture will enable the company to better serve customers in the region by providing them with access to GLOBALFOUNDRIES’ advanced technology and product offerings. Overall, GLOBALFOUNDRIES emerged as a leader in the semiconductor industry in 2023. The company’s impressive fourth quarter results are a testament to its strong performance and its ability to stay ahead of the competition. With its focus on innovation and expanding its presence in key markets, GLOBALFOUNDRIES is well-positioned to continue its success in the years ahead.

Market Price

On Tuesday, GLOBALFOUNDRIES Inc. (GF) posted its fourth quarter non-GAAP earnings per share (EPS) of $1.44, beating expectations by $0.12. The stock opened the day at $68.0 and closed at $71.7, representing a rise of 8.4% from its previous closing price of 66.2. GF, one of the leading semiconductor companies in the world, manufactures advanced semiconductor chipsets for a variety of consumer and industrial applications. This increase was driven by higher selling prices, improved cost controls and product mix.

This increase was mainly due to higher customer demand and increased production capacity. Overall, GF’s performance in the fourth quarter exceeded expectations due to its focus on innovation and cost control. The company’s long-term potential looks promising given its strong position in the industry and its commitment to delivering quality products and services to customers. With its strong financial outlook, GF is well positioned to continue to expand its market share and capitalize on growth opportunities in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Globalfoundries Inc. More…

| Total Revenues | Net Income | Net Margin |

| 8.11k | 1.45k | 14.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Globalfoundries Inc. More…

| Operations | Investing | Financing |

| 2.62k | -4.06k | 842 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Globalfoundries Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.84k | 7.88k | 16.58 |

Key Ratios Snapshot

Some of the financial key ratios for Globalfoundries Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | – | 19.6% |

| FCF Margin | ROE | ROA |

| -5.4% | 10.5% | 5.6% |

Analysis – Globalfoundries Inc Intrinsic Stock Value

GoodWhale has identified that the intrinsic value of GLOBALFOUNDRIES INC share is around $59.1, based on its proprietary Valuation Line. Currently, GLOBALFOUNDRIES INC stock is traded at a higher price of $71.7, making it overvalued by 21.4%. GoodWhale can provide detailed insights into GLOBALFOUNDRIES INC’s fundamentals and financial metrics such as revenue growth, earnings per share, operating cash flow, and dividend yield to help investors in making an informed decision. Additionally, GoodWhale allows investors to compare the performance of GLOBALFOUNDRIES INC with its peers in the industry, enabling them to get an overview of the company’s competitive positioning. With GoodWhale, users can also receive alerts and notifications on GLOBALFOUNDRIES INC’s stock price movements, news and analyst ratings to stay up-to-date on the company’s performance. More…

Peers

With the technological advances in the semiconductor industry, the competition between foundries has become increasingly fierce. GLOBALFOUNDRIES Inc, a leading foundry company, has been locked in a battle with its competitors, Advanced Micro Devices Inc, Taiwan Semiconductor Manufacturing Co Ltd, and Intel Corp. In order to maintain its competitive edge, GLOBALFOUNDRIES has made significant investments in cutting-edge manufacturing technologies and has been aggressively expanding its production capacity.

– Advanced Micro Devices Inc ($NASDAQ:AMD)

Advanced Micro Devices, Inc. (AMD) is an American multinational semiconductor company based in Santa Clara, California, that develops computer processors and related technologies for business and consumer markets. AMD’s main products include microprocessors, motherboard chipsets, embedded processors and graphics processors for servers, workstations and personal computers, and embedded systems applications.

As of 2022, AMD has a market cap of $93.57 billion and a return on equity (ROE) of 4.13%. The company’s products are used in a variety of electronic devices, including personal computers, game consoles, and servers. AMD is a leading supplier of microprocessor technology for the PC market.

– Taiwan Semiconductor Manufacturing Co Ltd ($TWSE:2330)

Taiwan Semiconductor Manufacturing Co Ltd is a semiconductor foundry. The company has a market cap of 10.29T as of 2022 and a Return on Equity of 22.34%. Taiwan Semiconductor Manufacturing Co Ltd is the world’s largest dedicated semiconductor foundry and one of the largest fabless semiconductor companies. The company offers a comprehensive set of IC design enablement tools, libraries, IPs, design services, advanced packaging, test and yield optimization solutions to help customers accelerate time-to-market.

– Intel Corp ($NASDAQ:INTC)

Intel Corp. is an American multinational corporation and technology company headquartered in Santa Clara, California, in the Silicon Valley. It is the world’s largest and highest valued semiconductor chip manufacturer based on revenue and is the inventor of the x86 series of microprocessors, the processors found in most personal computers (PCs). Intel supplies processors for computer system manufacturers such as Apple, Lenovo, HP, and Dell. Intel also manufactures motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors and other devices related to communications and computing.

The company’s market cap is $108.48B as of 2022 and has a return on equity of 19.16%. Intel Corp is a technology company that designs and manufactures computer processors and other components. The company is headquartered in Santa Clara, California, in the Silicon Valley.

Summary

Investors who have GLOBALFOUNDRIES INC in their portfolios have reason to be very pleased. This pushed the stock price up the same day, a sign of investor confidence and a positive indication of the company’s financial health. Long-term investors should be especially encouraged by the quarterly report, as it highlights GLOBALFOUNDRIES INC’s ability to create positive financial outcomes despite adverse market conditions. With a strong balance sheet, sizable cash reserves, and a focus on delivering exceptional products, GLOBALFOUNDRIES INC appears to be a sound investment opportunity and is one to watch going forward.

Recent Posts