Now is a Great Time to Invest in Applied Materials – Stock Down 36% in the Last Year and PE Ratio Under 15

January 7, 2023

Trending News ☀️

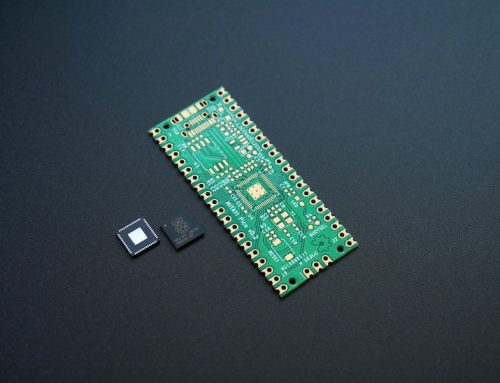

Applied Materials ($NASDAQ:AMAT) is one of the world’s leading providers of materials engineering solutions used to produce virtually every new chip and advanced display in the world. The company’s innovative products and services enable the manufacture of semiconductor chips, flat panel displays, solar photovoltaic cells, flexible electronics and other specialty materials. This presents an attractive opportunity for value investors who recognize that buying a stock at a low price can yield significant gains over time. The company is also focusing on innovating its products and services to maintain its competitive edge in the market.

The company has a solid long-term growth potential and can provide investors with a healthy return over time. Overall, Applied Materials presents a great opportunity for investors looking for long-term growth and an attractive dividend yield.

Price History

At the time of writing, media sentiment is mostly positive. On Friday, Applied Materials stock opened at $100.0 and closed at $104.3, representing a 6.5% increase from the previous closing price of 97.9. They provide advanced equipment, services, and software to enable the manufacture of chips, displays, and other electronic devices. Their technologies are used to make products such as smartphones, laptops, tablets, TVs, and much more. They offer a wide range of products and services that address the evolving needs of their customers.

For example, their products enable customers to meet their production goals faster, reduce cost and complexity, and improve reliability and quality. They also offer tools, software, and services that allow their customers to optimize their processes, improve yield, and accelerate time-to-market. Their low PE ratio means there is plenty of room for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Applied Materials. More…

| Total Revenues | Net Income | Net Margin |

| 25.79k | 6.53k | 25.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Applied Materials. More…

| Operations | Investing | Financing |

| 5.4k | -1.36k | -7.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Applied Materials. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.73k | 14.53k | 14.03 |

Key Ratios Snapshot

Some of the financial key ratios for Applied Materials are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.9% | 32.5% | 30.4% |

| FCF Margin | ROE | ROA |

| 17.9% | 40.5% | 18.3% |

VI Analysis

Company fundamentals are important for investors to identify a company’s long term potential. VI app makes it easy to analyze the fundamentals of a company in a simplified manner. This means that the company has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in such companies are often looking for long-term growth opportunities. Applied Materials also has a high health score of 10/10, which indicates that the company is capable of handling any crisis without the risk of bankruptcy due to its strong cashflows and low debt. This makes the company an attractive option for investors looking for a balance between stability and growth opportunities. More…

VI Peers

Applied Materials, Inc. and its competitors, Lam Research Corporation, KLA Corporation, and ASML Holding NV, compete in the semiconductor equipment industry. This industry is capital intensive, with high barriers to entry. The four companies have similar business models, but Applied Materials has a slight edge in terms of market share.

– Lam Research Corp ($NASDAQ:LRCX)

Lam Research Corporation is a company that manufactures semiconductor processing equipment. It is headquartered in Fremont, California, and has been in business since 1980. The company has a market capitalization of $51.81 billion as of 2022 and a return on equity of 54.63%. Lam Research Corporation is a leading supplier of wafer processing equipment to the semiconductor industry. The company’s products are used in the manufacturing of integrated circuits (ICs), which are the tiny electronic components that are found in everything from computers to cell phones. Lam Research Corporation’s products are used in all stages of IC production, from the initial deposition of materials on the wafer to the final etching of the completed circuits.

– KLA Corp ($NASDAQ:KLAC)

KLA Corp is a leader in process equipment and services for the semiconductor and nanoelectronics industries. The company has a market cap of $43.23 billion and a return on equity of 126.76%. KLA Corp provides products and services that enable the manufacturing of advanced semiconductor chips. The company’s products are used by customers in the fab process of making chips, including etching, metrology, and inspection. KLA Corp’s services enable customers to optimize their productivity and yield. The company has a strong history of innovation and is a trusted partner to the world’s leading chipmakers.

– ASML Holding NV ($NASDAQ:ASML)

ASML Holding NV is a technology company that manufactures semiconductor processing equipment, which is used in the production of integrated circuits (ICs). ASML’s products are used by customers in the computer, communications, and consumer electronics industries. The company has a market cap of 187.16B as of 2022 and a return on equity of 39.55%. ASML is headquartered in the Netherlands and has offices in Europe, the United States, Asia, and Japan.

Summary

Applied Materials is an attractive investment opportunity given its stock price has decreased 36% in the last year and its price-to-earnings ratio is under 15. At the time of writing, media sentiment towards the company is mostly positive. The stock price appears to have responded favorably to this news, showing an increase on the same day. Investors should consider whether the current stock price offers a good entry point into the company, and assess the potential risks and rewards associated with investing in Applied Materials.

Recent Posts